Foremost Clean Energy Exercises Low-Cost Option to Acquire 100% Ownership of Jean Lake Lithium-Gold Property

Rhea-AI Summary

Foremost Clean Energy (NASDAQ: FMST) has exercised its option to acquire 100% ownership of the 2,476-acre Jean Lake Lithium-Gold Project in Manitoba's Snow Lake District. The company completed the acquisition by making a final cash payment of $75,000 and issuing $75,000 worth of common shares to Mount Morgan Resources, bringing the total purchase to $250,000 cash plus shares.

The property has demonstrated significant potential with drill results showing high-grade gold intercepts of 7.50 g/t Au over 7.66m (including 102.0 g/t Au over 0.48m) and lithium mineralization of 1.26% Li₂O over 3.35m. The company plans to conduct a 15-hole, 2,500-metre diamond drill program before year-end, targeting both lithium and gold mineralization.

The strategic asset is located near established infrastructure and in proximity to Hudbay Minerals' operations, which have produced over 1 million ounces of gold at its Lalor Mine. Current operations are temporarily affected by regional wildfires and evacuation orders in the Snow Lake area.

Positive

- High-grade gold intercepts confirmed with 7.50 g/t Au over 7.66m, including 102.0 g/t Au over 0.48m

- Significant lithium mineralization discovered with 1.26% Li₂O over 3.35m

- Strategic location with access to power, highway, rail, and airstrip infrastructure

- Low-cost acquisition at $250,000 cash plus shares for 100% ownership

- Property located in proven mining jurisdiction with historical production of 5.5M oz gold

Negative

- Operations temporarily suspended due to regional wildfires and evacuation orders

- Mount Morgan retains 2% Net Smelter Royalty on the property

- Company has shifted focus to uranium exploration, potentially reducing resources for this project

News Market Reaction 8 Alerts

On the day this news was published, FMST gained 4.03%, reflecting a moderate positive market reaction. Argus tracked a trough of -12.8% from its starting point during tracking. Our momentum scanner triggered 8 alerts that day, indicating moderate trading interest and price volatility. This price movement added approximately $1M to the company's valuation, bringing the market cap to $32M at that time.

Data tracked by StockTitan Argus on the day of publication.

By completing this option agreement first entered into in July 2021, Foremost has acquired

VANCOUVER, British Columbia, July 16, 2025 (GLOBE NEWSWIRE) -- Foremost Clean Energy Ltd. (NASDAQ: FMST) (CSE: FAT) ("Foremost" or the "Company"), is pleased to announce it has exercised a low-cost option to acquire a

Key Highlights

- Foremost Safeguards Value With Established Potential: Jean Lake is a prospective Gold and Lithium exploration property where Foremost’s initial drill program intercepted 7.50 g/t Au over 7.66m (including 102.0 g/t Au over 0.48 metres) in drill hole FM23-8 and

1.26% Li₂O over 3.35m in drill hole FM23-04A.

- Strategic Infrastructure: The property is within close proximity to power access, highway, rail, airstrip and mines, making it ideally situated for future advancement as a gold and/or lithium development project.

- Proven Jurisdiction: Located in proximity to Hudbay Minerals’ core operating area, which has produced more than 1 million+ ounces of gold at its Lalor Mine1.

Foremost’s President and CEO, Jason Barnard comments, “Prior to Foremost’s pivot to focus on uranium exploration in the prolific Athabasca Basin region of northern Saskatchewan, Foremost invested successfully in lithium and gold exploration in Manitoba – generating positive results and confirming the prospectivity of the Company’s Manitoba project portfolio. With gold achieving historic price highs, our Jean Lake property provides exceptional leverage and optionality with its demonstrated high-grade gold mineralization and confirmation of lithium mineralization. With a modest final investment in the property, Foremost has successfully secured this prospective asset.”

Mr. Barnard continues, “Amidst our operational update, our deepest solidarity remains with the people of the Snow Lake region during this devastating wildfire season. The mandatory evacuation orders impacting families, First Nations partners, and our dedicated local workforce underscore the profound human dimension of this crisis. We recognize the resilience shown by this community, one that has supported Manitoba’s mining legacy for generations, and extend our unwavering commitment to their safety and recovery, and recognize the efforts of emergency responders to protect those impacted by the wildfires.”

Foremost’s 2022/2023 Drill Campaign

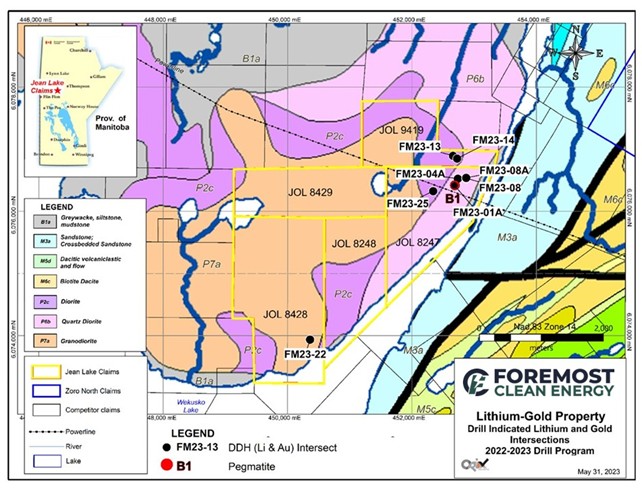

The Company completed a 3,002 metre initial diamond drill program, designed to test targets based on integrated prospecting, UAV-borne magnetic survey results, MMI soil geochemical surveys and outcrop rock chip analyses (Foremost news release June 6, 2023). The program intersected numerous gold mineralized intervals at vertical depths up to 110 m below surface as well lithium at the B1 spodumene bearing pegmatite. The locations of drill holes that intersected gold mineralized intervals are illustrated in Figure 1, in addition to the B1 drill hole location. Details of the lithium and gold intersections are provided in Table 1 below.

Highlights include:

GOLD

- In drill hole FM23-8: 7.50 g/t Au over 7.66 metres from 94.35 - 102.01 m (including 102.0 g/t Au over 0.48 metres from 94.77 - 95.25 m)

- In drill hole FM23-04A: 11.27 g/t Au over 2.75 metres from 73.75 - 76.50 m (including 91.8 g/t Au over 0.32 metres from 74.74 - 75.06 m)

- In drill hole FM23-01A: 2.46 g/t Au over 3.70 metres from 41.30 - 45.00m

LITHIUM

1.26% Li2O over 3.35 metres in drill hole FM23-01A

Figure 1. Lithium and Gold Intersections Drill Holes

Table 1 - 2022 – 2023 Program Lithium and Gold Intersections in Drill Holes

| Hole ID | Easting | Northing | Strike | Dip | Depth | Intercept in Metres | |||||||||||

| FM23-01A | 452688 | 6076420 | 205 | -66 | 62m | ||||||||||||

| FM23-01A | 452688 | 6076420 | 205 | -66 | 62 | 2.46 g/t Au over 3.70m from 41.30m-45m | |||||||||||

| FM23-04A | 452743 | 6076529 | 90 | -45 | 80 | 11.27 g/t Au over 2.75m from 73.75m-76.5m including 91.8 g/t Au over 0.32mfrom 74.74 - 75.06m | |||||||||||

| FM23-08 | 452877 | 6076534 | 245 | -45 | 134 | 1.44 g/t Au for 0.32m from 11.33m-11.65m and 7.50 g/t Au for 7.66m from 94.35m-102.01m including 29.95 g/t Au for 1.77m from 94.35m-96.12m and 1.28 g/t Au for 0.3m from 107.6m-107.9m | |||||||||||

| FM23-08A | 452878 | 6076543 | 110 | -45 | 173 | 1.51 g/t Au for 0.52m from 95.18m-95.7m | |||||||||||

| FM23-13 | 452667 | 6076898 | 270 | -45 | 125 | 0.94 g/t Au for 1.23m from 121.30m-122.53m | |||||||||||

| FM23-14 | 452732 | 6076854 | 270 | -45 | 158 | 1.23 g/t Au for 2.85m from 151.24m-154.09m | |||||||||||

| FM23-22 | 450367 | 6073940 | 314 | -45 | 125 | 3.04 g/t Au for 0.68m from 102.92m-103.6m | |||||||||||

| FM23-25 | 452347 | 6076330 | 120 | -45 | 114 | 2.07 g/t Au for 3.49m from 25.3m-28.79m including 6.86 g/t Au for 0.54m from 25.30m-25.84m and 1.27 g/t Au for 2.4m from 69.6m-72m | |||||||||||

2025 Jean Lake Planned Drill Program

Foremost plans to conduct a 15-hole, 2,500-metre diamond drill program at Jean Lake before the end of this year to satisfy the Company’s commitments. Targets include the B-1 spodumene bearing pegmatite dyke along strike towards the B-2 and B-3 pegmatites extending the mineralization laterally.

Potential for additional gold mineralization at depth will be targeted based on encouraging results from previous completed drill program. Of interest is the occurrence of 2.46 g/t Au over 3.70m from 41.30m-45m in DHFM23-01A. This intersection occurs in a shear zone at or near the base of the B1 pegmatite in fine grained gabbro. Gold is associated with quartz veins and arsenopyrite.

Gold

Previous drill testing in 2023 of integrated geological and geochemical targets elsewhere on the Jean Lake intersected numerous gold mineralized intervals at vertical depths of up to 110 metres below surface. Highlights from this program included 7.50 g/t Au over 7.66 metres from 94.35 - 102.01 metres (including 102.0 g/t Au over 0.48 metres from 94.77 - 95.25 metres). Further investigation and drilling will assess the potential for additional gold mineralization at depth as well as create a geological framework to aid in delineating gold intersected during the 2022-23 drill program.

History of Gold in the Jean Lake Property Area

Historically, 5.5 million ounces of gold has been produced as a by-product of base metal copper-zinc massive sulphide type deposit production, in addition to major gold deposits such as the New Britannia, Puffy Lake, and Tartan deposits with cumulative production of more than 1.5 million ounces of gold, in the Flin Flon-Snow Lake greenstone belt2. In 1940, two bulk samples from the Jean Lake Property (then known as the Sparky Gold Property), weighing 22.7 and 22.2 kg. respectively, were sent to the Canada Department of Mines and Resources in Ottawa for testing3. The first bulk sample contained 16.46 g/t gold and 2.39 g/t silver, and the second bulk sample contained 241.71 g/t gold and 12.34 g/t silver. Gold exploration continued unabated in the area with high-grade gold mineralization documented from numerous past producing gold mines and properties hosting significant gold mineralization.

Lithium

It is the Company’s goal to develop a better understanding of the spodumene-bearing pegmatite emplacement mechanisms at Jean Lake. Foremost’s drill program, combined with field observations, have indicated that B-1 and B-2 could be one spodumene-bearing pegmatite with a minimum length of 325 metres. Previous drilling, just north of the B1 pegmatite outcrop, intersected a 3.35 metre zone of spodumene mineralization between surface and 3.35 metres, assaying

Figure 2. Map of Jean Lake’s B1, B2 and B3 Spodumene Bearing Pegmatites

Wildfire Impact and Mitigation

Active wildfires in northern Manitoba prompted evacuation orders in Snow Lake, temporarily suspending regional mining operations.4 Hudbay Minerals Inc., a major operator in Snow Lake, re-opened the Lalor Mine in 2022, has secured its facilities and expects minimal impact on its 2025 gold production guidance of 190,000+ ounces5. Foremost will advance further planning in preparation for its 15-hole 2,500 metre diamond hole drill program to commence once authorities declare safe conditions.

Qualified Person

Technical information in this news release has been reviewed and approved by Lindsay Bottomer, P.Geo., who is a Qualified Person as defined by Canadian National Instrument 43-101-Standards of Disclosure for Mineral Projects.

About Foremost

Foremost Clean Energy Ltd. (NASDAQ: FMST) (CSE: FAT) (WKN: A3DCC8) is a rapidly growing North American uranium and lithium exploration company. The Company holds an option to earn up to a

Foremost also has a portfolio of lithium projects at varying stages of development, which are located across 55,000+ acres in Manitoba and Quebec. For further information, please visit the Company’s website at www.foremostcleanenergy.com.

Contact and Information

Company

Jason Barnard, President and CEO

+1 (604) 330-8067

info@foremostcleanenergy.com

Follow us or contact us on social media:

X: @fmstcleanenergy

LinkedIn: https://www.linkedin.com/company/foremostcleanenergy

Facebook: https://www.facebook.com/ForemostCleanEnergy

Forward-Looking Statements

Except for the statements of historical fact contained herein, the information presented in this news release and oral statements made from time to time by representatives of the Company are or may constitute “forward-looking statements” as such term is used in applicable United States and Canadian laws and including, without limitation, within the meaning of the Private Securities Litigation Reform Act of 1995, for which the Company claims the protection of the safe harbor for forward-looking statements. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Any other statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect,” “is expected,” “anticipates” or “does not anticipate,” “plans,” “estimates” or “intends,” or stating that certain actions, events or results “may,” “could,” “would,” “might” or “will” be taken, occur or be achieved) are not statements of historical fact and should be viewed as forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such risks and other factors include, among others, the availability of capital to fund programs and the resulting dilution caused by the raising of capital through the sale of shares, continuity of agreements with third parties and satisfaction of the conditions to the option agreement with Denison, risks and uncertainties associated with the environment, delays in obtaining governmental approvals, permits or financing. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be achieved. Forward-looking information is subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected. Many of these factors are beyond the Company’s ability to control or predict. Important factors that may cause actual results to differ materially and that could impact the Company and the statements contained in this news release can be found in the Company’s filings with the Securities and Exchange Commission. The Company assumes no obligation to update or supplement any forward-looking statements whether as a result of new information, future events or otherwise. Accordingly, readers should not place undue reliance on forward-looking statements contained in this news release and in any document referred to in this news release. This news release shall not constitute an offer to sell or the solicitation of an offer to buy securities. and information. Please refer to the Company’s most recent filings under its profile at on Sedar+ at www.sedarplus.ca and on Edgar at www.sec.gov for further information respecting the risks affecting the Company and its business.

The CSE has neither approved nor disapproved the contents of this news release and accepts no responsibility for the adequacy or accuracy hereof.

_____________________________________

1 https://hudbayminerals.com/investors/press-releases/press-release-details/2025/Hudbay-Celebrates-Major-Milestone-with-Millionth-Ounce-of-Gold-Recovered-from-Lalor-Mine/default.aspx

2 Richardson, D.J. and Ostry, G. 1996: Gold Deposits of Manitoba, Manitoba Energy and Mines Economic Geology Report ER86-1, 114 pages

3 Fedikow, M.A.F., Athayde, P and Galley, A.G. 1993: Mineral deposits and occurrences in the Wekusko Lake area, NTS 63J/13; Manitoba Energy and Mines, Geological Services, Mineral Deposit Series No.14, 459pages

4 https://www.bloomberg.com/news/articles/2025-06-04/wildfires-prompt-hudbay-and-alamos-gold-to-evacuate-canada-mines

5 https://www.hudbayminerals.com/investors/press-releases/press-release-details/2025/Hudbay-Provides-Annual-Reserve-and-Resource-Update-Three-Year-Production-Outlook-and-Positive-Snow-Lake-Exploration-Results/default.aspx

Infographics accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/f334b769-f845-4685-a81e-4efe1b75ec83

https://www.globenewswire.com/NewsRoom/AttachmentNg/6f0e9737-66e2-45af-908a-1b4029bc184a