Grande Portage Initiates Preliminary Economic Assessment and Receives Gold Payability Terms of Up to 87%

Rhea-AI Summary

Grande Portage (OTCQB:GPTRF) announced initiation of an NI 43-101 Preliminary Economic Assessment (PEA) for the New Amalga Gold Project in Southeast Alaska.

The project hosts a high-grade mineral resource of 1.4 million ounces indicated and 0.5 million ounces inferred gold and is open to expansion. The company received indicative offtake terms showing gold payability of 72%–87% depending on grade, with typical expected payabilities of 80%–85% using sensor-based ore sorting. Treatment and refining charges are quoted as copper benchmark TC plus $95/tonne and $10 per contained gold ounce refining charge.

An initial draft PEA is anticipated in early to mid-January 2026 with final completion targeted for mid-to-late February 2026. The company plans small-footprint underground mining with third-party offsite processing to avoid an onsite mill or tailings facility.

Positive

- Indicated resource of 1.4 million ounces gold

- Inferred resource of 0.5 million ounces gold

- Gold payability confirmed at 72%–87% (typical 80%–85%)

- PEA schedule with draft in early–mid January 2026 and final by mid–late February 2026

Negative

- None.

News Market Reaction 1 Alert

On the day this news was published, GPTRF gained 5.58%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

VANCOUVER, BC / ACCESS Newswire / October 20, 2025 / Grande Portage Resources Ltd. (TSXV:GPG)(OTCQB:GPTRF)(FSE:GPB) ("Grande Portage" or the "Company") is pleased to report two major advancements at its New Amalga Gold Project in Southeast Alaska.

The project hosts a high-grade mineral resource of 1.4 million ounces of gold (indicated) and 0.5 million ounces (inferred) and remains open to expansion in multiple directions. The current development concept envisions a small-footprint underground mining operation with third-party offsite processing, eliminating the need for an onsite mill or tailings storage facility.

Strong Indicative Offtake Terms Confirm Marketability

Grande Portage has received indicative ore offtake terms from a leading global concentrate trading firm, showing gold payability of

The offtake study confirms that New Amalga ore is readily marketable to Asian base metal smelters, custom concentrates facilities, roasting operations, and leach plants. Applicable treatment and refining charges (TC/RCs) are quoted at the copper benchmark treatment charge plus

Preliminary Economic Assessment Initiated

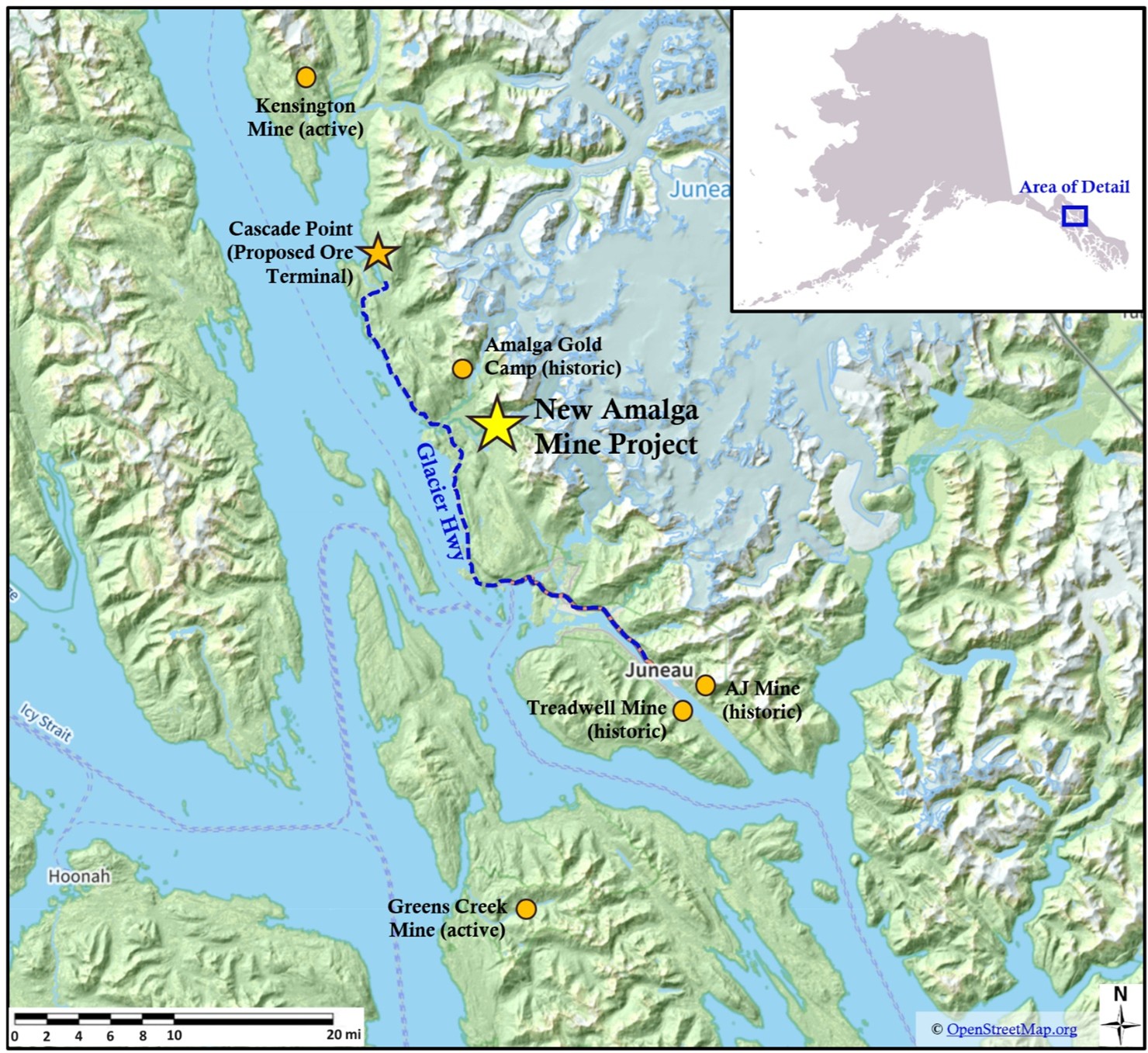

Following this positive market feedback, Grande Portage has initiated an NI 43-101 Preliminary Economic Assessment (PEA). The Company has contracted all required Qualified Persons (QPs) and technical specialists, many of whom have direct project experience in Alaska, including at Pogo, Kensington, and Greens Creek, as well as within the Alaska DNR Office of Project Management and Permitting.

An initial draft PEA is anticipated in early to mid-January, with final completion targeted for mid-to-late February 2026.

PEA Consultant Team:

Core Geoscience LLC - Environmental, Permitting, Social & Community Impacts

DRW Geological Consultants Ltd. - Geological Setting & Mineralization, Resource Estimates

Mine Development Associates (RESPEC Inc.) - Capital & Operating Costs

OreLogic LLC - Mining Methods, Recovery, Infrastructure, Market Studies, Economic Analysis

SRK Consulting Inc. - Geotechnical & Hydrogeological Studies

Ian Klassen, Grande Portage President and CEO comments: "The excellent gold payabilities in this indicative term sheet attest to the marketability of the New Amalga ore as a highly desirable feedstock for third-party processing facilities. This validates our strategy for developing the deposit as a DSO direct-ship operation, which will greatly reduce capital costs by avoiding the need to construct a processing plant at the site, while de-risking the regulatory approval process by eliminating the requirement for a tailings storage facility. We look forward to defining further technical and economic details as part of our upcoming PEA."

Fig. 1: Location of the New Amalga Gold Project

Kyle Mehalek, P.E.., is the QP within the meaning of NI 43-101 and has reviewed and approved the technical disclosure in this release. Mr. Mehalek is independent of Grande Portage within the meaning of NI 43-101.

About Grande Portage:

Grande Portage Resources Ltd. is a publicly traded mineral exploration company focused on advancing the New Amalga Mine project, the outgrowth of the Herbert Gold discovery situated approximately 25 km north of Juneau, Alaska. The Company holds a

The Company's updated NI#43-101 Mineral Resource Estimate (MRE) reported at a base case mineral resources cut-off grade of 2.5 grams per tonne gold (g/t Au) and consists of: an Indicated Resource of 1,438,500 ounces of gold at an average grade of 9.47 g/t Au (4,726,000 tonnes); and an Inferred Resource of 515,700 ounces of gold at an average grade of 8.85 g/t Au (1,813,000 tonnes), as well as an Indicated Resource of 891,600 ounces of silver at an average grade of 5.86 g/t Ag (4,726,000 tonnes); and an Inferred Resource of 390,600 ounces of silver at an average grade of 7.33 g/t silver (1,813,000 tonnes). The MRE was prepared by Dr. David R. Webb, Ph.D., P.Geol., P.Eng. (DRW Geological Consultants Ltd.) with an effective date of July 17, 2024.

ON BEHALF OF THE BOARD

"Ian Klassen"

Ian M. Klassen

President & Chief Executive Officer

Tel: (604) 899-0106

Email: Ian@grandeportage.com

Cautionary Statement Regarding Forward-Looking Information

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties as described in the Company's filings with Canadian securities regulators. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Please note that under National Instrument 43-101, the Company is required to disclose that it has not based any production decision on NI 43-101-compliant reserve estimates, preliminary economic assessments, or feasibility studies, and historically production decisions made without such reports have increased uncertainty and higher technical and economic risks of failure. These risks include, among others, areas that are analyzed in more detail in a feasibility study or preliminary economic assessment, such as the application of economic analysis to mineral resources, more detailed metallurgical and other specialized studies in areas such as mining and recovery methods, market analysis, and environmental, social, and community impacts. Any decision to place the New Amalga Mine into operation at levels intended by management, expand a mine, make other production-related decisions, or otherwise carry out mining and processing operations would be largely based on internal non-public Company data, and on reports based on exploration and mining work by the Company and by geologists and engineers engaged by the Company.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICE PROVIDER (AS THAT TERM IS DEFINED UNDER THE POLICIES OF THE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS RELEASE

SOURCE: Grande Portage Resources Ltd.

View the original press release on ACCESS Newswire