Gray Media Agrees to Purchase Block Communications’ Television Stations

Rhea-AI Summary

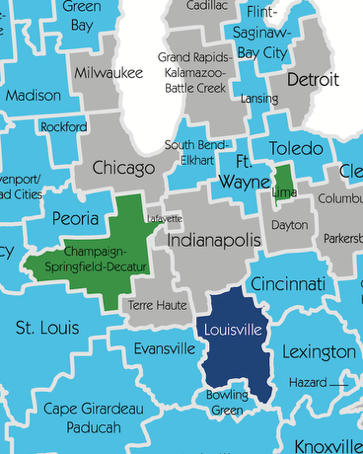

Gray Media (NYSE: GTN) has announced an agreement to acquire Block Communications' television stations for $80 million. The acquisition includes FOX affiliate WDRB and CW affiliate WBKI in Louisville, Kentucky (DMA 49), NBC affiliate WAND in Springfield-Champaign-Decatur, Illinois (DMA 92), and NBC affiliate WLIO in Lima, Ohio (DMA 190).

The transaction will create a new Big Four duopoly in Louisville, where Gray already owns NBC affiliate WAVE3. Both WAND and WLIO achieved the highest all-day ratings in their respective markets during 2024. Gray expects to close the transaction in Q4 2025, subject to regulatory approvals including FCC ownership rule waivers.

Positive

- Acquisition creates new Big Four duopoly in Louisville market

- Adds top-ranked local news stations in two Midwest markets

- WAND and WLIO both achieved highest all-day ratings in their markets in 2024

- Strategic expansion strengthens Gray's Midwest presence

- Acquired stations complement Gray's existing operations in adjacent markets

Negative

- Transaction requires FCC ownership rule waivers for completion

- Significant capital expenditure of $80 million required for acquisition

News Market Reaction

On the day this news was published, GTN declined 1.11%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

ATLANTA, Aug. 01, 2025 (GLOBE NEWSWIRE) -- Gray Media, Inc. (“Gray”) has reached an agreement with Block Communications, Inc. (“BCI”) to acquire its television stations for

The transaction includes WDRB and WBKI, the FOX and CW affiliates for the Louisville, Kentucky, market (DMA 49), where Gray owns and operates NBC affiliate WAVE3. The transaction also includes WAND, the NBC affiliate for the Springfield-Champaign-Decatur, Illinois, market (DMA 92), and WLIO, the NBC affiliate for the Lima, Ohio, market (DMA 190) as well as WLIO’s associated low power television stations. WAND and WLIO each had the highest all-day ratings among television households in their markets during 2024, according to Comscore.

Gray anticipates closing these transactions in the fourth quarter of this year following receipt of regulatory approval, including certain waivers of the FCC’s current ownership rules, and other customary closing conditions.

Forward-Looking Statements:

This press release contains certain forward-looking statements that are based largely on Gray’s current expectations and reflect various estimates and assumptions by Gray. These statements are statements other than those of historical fact and may be identified by words such as “estimates,” “expect,” “anticipate,” “will,” “implied,” “assume” and similar expressions. Forward-looking statements are subject to certain risks, trends and uncertainties that could cause actual results and achievements to differ materially from those expressed in such forward-looking statements. Such risks, trends and uncertainties, which in some instances are beyond Gray’s control, include the inability to complete the proposed transaction within the expected timeframe, or at all, and other future events. Gray is subject to additional risks and uncertainties described in its quarterly and annual reports filed with the Securities and Exchange Commission from time to time, including in the “Risk Factors,” and management’s discussion and analysis of financial condition and results of operations sections contained therein, which reports are made publicly available via www.sec.gov. Any forward-looking statements in this communication should be evaluated in light of these important risk factors. This press release reflects management’s views as of the date hereof. Except to the extent required by applicable law, Gray undertakes no obligation to update or revise any information contained in this communication beyond the date hereof, whether as a result of new information, future events or otherwise.

About Gray Media:

Gray Media, Inc. (NYSE: GTN) is a multimedia company headquartered in Atlanta, Georgia. The company is the nation’s largest owner of top-rated local television stations and digital assets serving 113 television markets that collectively reach approximately 37 percent of US television households. The portfolio includes 78 markets with the top-rated television station and 99 markets with the first and/or second highest rated television station during 2024, as well as the largest Telemundo Affiliate group with 44 markets. The company also owns Gray Digital Media, a full-service digital agency offering national and local clients digital marketing strategies with the most advanced digital products and services. Gray’s additional media properties include video production companies Raycom Sports, Tupelo Media Group, and PowerNation Studios, and studio production facilities Assembly Atlanta and Third Rail Studios. For more information, please visit www.graymedia.com.

Gray Contact:

Kevin P. Latek, Executive Vice President, Chief Legal and Development Officer, 404-266-8333

# # #