Sharc Energy Announces Q3 2025 Financial Results

Rhea-AI Summary

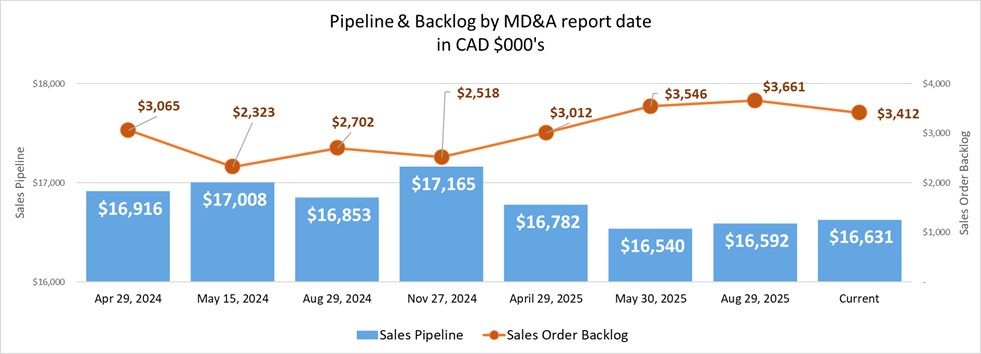

SHARC Energy (OTCQB: INTWF) reported results for Q3 and nine months ended Sept 30, 2025. YTD 2025 revenue was $2.69M, up 15% vs YTD 2024 and equal to 124% of full‑year 2024 revenue. Q3 2025 revenue was $0.83M, up 6% year‑over‑year. The Company reports a $16.6M sales pipeline and a $3.4M sales order backlog (estimated conversion ~12 months).

Q3 loss was $0.74M (Adjusted EBITDA loss $0.5M), with YTD loss $2.47M (Adjusted EBITDA loss $1.53M). Gross margin expanded to 39% in Q3. Subsequent events include granted US and EU patents and a $1.57M unsecured convertible debenture closing.

Positive

- YTD revenue +15% to $2.69M

- Sales pipeline of $16.6M

- Sales order backlog $3.4M (est. conversion ~12 months)

- Q3 gross margin improved to 39%

- Closed financing $1.57M unsecured convertible debenture

- Patents granted in US and EU (protection to 2042/2043)

Negative

- YTD net loss widened 7% to $2.47M

- YTD Adjusted EBITDA still negative at $1.53M

- Sales order backlog down ~7% since Aug 29, 2025

- Q3 net loss of $0.74M (Adjusted EBITDA loss $0.5M)

News Market Reaction

On the day this news was published, INTWF declined NaN%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Peers in Industrials/Pollution & Treatment Controls showed mixed, generally modest moves, with DOCKF up 4.35% and TMGEF up 0.48%, while others were flat. No clear sector-wide move aligns with INTWF’s flat price.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 01 | Q3 2025 earnings | Positive | +0.0% | Q3 and YTD 2025 revenue growth with higher gross margins and backlog. |

| Oct 23 | Project milestone | Positive | +0.0% | Completion of False Creek NEU expansion, largest WET project in North America. |

| Sep 23 | Patent grants | Positive | +1.1% | US and European patents extending protection into the 2040s. |

| Sep 17 | Climate award news | Positive | +14.6% | Selection as finalist in New York Climate Exchange sustainability challenge. |

| Aug 29 | Q2 2025 earnings | Positive | -15.2% | Strong Q2 revenue growth and backlog, but shares fell after the release. |

News has generally seen aligned or modestly positive reactions, with one notable negative move on a prior earnings release.

Over the last several months, SHARC Energy has reported rising revenues and expanding gross margins, alongside persistent losses. Earnings updates in Q1, Q2, and now Q3 2025 highlighted a growing Sales Pipeline and Sales Order Backlog. Operational milestones included expansion of the False Creek NEU, major district energy projects, and key US/EU patent grants. A $1.57M unsecured convertible debenture added financing flexibility. The current Q3 2025 results continue this theme of revenue growth and backlog visibility amid ongoing losses.

Market Pulse Summary

This announcement details Q3 2025 and year-to-date performance, with YTD revenue reaching $2.69M, Q3 gross margin at 39%, and a Sales Order Backlog of $3.4M expected to convert within about a year. Losses, including a Q3 net loss of $0.74M and Adjusted EBITDA loss of $0.5M, remain a key risk. Investors may watch future earnings for backlog conversion, margin stability, project execution, and financing developments such as the $1.57M convertible debenture.

Key Terms

IFRS regulatory

Adjusted EBITDA financial

Sales Pipeline financial

Sales Order Backlog financial

convertible debentures financial

AI-generated analysis. Not financial advice.

VANCOUVER, British Columbia, Dec. 01, 2025 (GLOBE NEWSWIRE) -- SHARC International Systems Inc. (CSE: SHRC) (FSE: IWIA) (OTCQB: INTWF) ("SHARC Energy" or the “Company”) is pleased to announce it has filed financial results for the three and nine months ended September 30, 2025. All figures are in Canadian Dollars and in accordance with IFRS unless otherwise stated.

Third Quarter and Year to Date (YTD) Financial Highlights:

- Revenue for the nine months ended September 30, 2025 (“YTD 2025”) is

$2.69 million (M), representing124% of the full year revenue in 2024 and a15% increase over the$2.34M of revenue reported in the nine months ended September 30, 2024 (“YTD 2024”). Revenue increased6% to$0.83M for the three months ended September 30, 2025 (“Q3 2025”) compared to$0.79M reported for the three months ended September 30, 2024 (“Q3 2024”). - As of December 1, 2025, the Company has a Sales Pipeline1 of 16.6M and Sales Order Backlog2 of

$3.4M . This represents a ~$0.25M decrease or7% decrease in Sales Order Backlog since August 29, 2025 disclosure. Sales Pipeline saw a nominal increase since August 29, 2025 disclosure reflecting the deliberate efforts by the Company to refill the pipeline once projects convert to the order book. The combined pipeline showed a nominal decrease of1% or$0.2M from the previous disclosure on August 29, 2025. The$3.4M Sales Order Backlog, which is estimated to be converted to revenue within an average of 12 months from disclosure, represents a58% improvement compared to the year ended December 31, 2024 revenue of$2.17M . The Company continues to observe the maturity of its Sales Pipeline leading to improved revenue consistency and reduced volatility, providing a strong platform to scale and grow. - During Q3 2025, the Company reported a loss of

$0.74M and an Adjusted EBITDA3 loss of$0.5M . This compares to a loss of$0.83M and an Adjusted EBITDA loss of$0.64M in the comparative quarter representing a12% reduction and22% improvement, respectively. - During YTD 2025, the Company reported a loss of

$2.47M and an Adjusted EBITDA loss of$1.53M . This contrasts to a loss of$2.31M and an Adjusted EBITDA loss of$1.65M in the comparative period representing a7% increase and7% improvement, respectively. - Gross margins for Q3 2025 and YTD 2025 were

39% and38% , respectively, compared to32% and37% reported in Q3 2024 and YTD 2024, respectively. Management remains optimistic that this margin range aligns with our expectations for the coming quarters but the margin percentage varies dependent on sales mix and stage of completion of each project.

Michael Albertson, Chief Executive Officer and President of SHARC Energy, said, “2025 marks a turning point for SHARC Energy. With

“Reaching

Mr. Albertson continued, “Our Sales Order Backlog continues to evolve in both volume and project diversity. The large-scale district energy projects we are currently in final negotiation on represent an entirely new tier of opportunity for SHARC Energy—projects that individually exceed or rival our existing backlog alone. We expect these wins to meaningfully reshape our growth profile in 2026 and beyond.”

“We are currently entering several new market sectors, ranging from wastewater treatment plants and universities to utilities, correctional facilities, and data centers, with our evolving product portfolio. These sectors represent meaningful diversification opportunities for our backlog and future revenues, and many offer fewer regulatory barriers and faster sales cycles. We expect to close new business in these areas by the next reporting date. We are very excited for the continuous growth of the Company.”

YTD 2025 Key Highlights and Subsequent Events

- SHARC System Powers Groundbreaking Sen̓áḵw District Energy System. The SHARC WET system will be the core component of the Sen̓áḵw Energy System, the largest real estate development in Canadian First Nations history. The SHARC WET system was shipped to the project in Q2 2025.

- SHARC Systems Shipped to US Government-Affiliated Project. The Company announced the shipment of two SHARC 880 WET Systems to a U.S. government-affiliated project. Further information about the project will be released at a later stage.

- SHARC System Featured in Ottawa’s Lebreton Flats District Energy Project. The Company announced that two SHARC 880 Wastewater Energy Transfer (“WET”) systems will be used to power a district energy system in Canada’s capital city. SHARC Energy anticipates commencing submittals for the SHARC WET Systems in 2025 with equipment build and delivery expected during 2026

- False Creek Neighbourhood Energy Utility (“NEU”) Expansion. The Company continued work on the supply and maintenance agreement with the City of Vancouver for the provision and maintenance of five SHARC systems for the False Creek NEU Expansion. During the three months ended March 31, 2025, the Company completed all remaining milestones of the agreement.

- SHARC System U.S. and European Patents. SHARC Energy has been granted key patents for it SHARC wastewater heat exchange system in the United States and Europe. The newly granted patents provide protection until February 14, 2043 and July 2, 2042, respectively. Additional filings are pending in Canada, Australia, the United Kingdom, Mexico, United Arab Emirates, Saudi Arabia, India and South Korea, with additional European “Unitary Patent” validations planned in multiple EU member states.

- Closing of

$1.57 Million Unsecured Convertible Debenture. SHARC Energy has closed a non-brokered private placement of unsecured convertible debentures of the Company for a principal amount of$1,570,000. - Fred Andriano appointed as Chairman of the Board of Directors. On May 5, 2025, the Company announced significant changes to its Board of Directors, appointing Fred Andriano as Chairman of the Board and Executive Officer, replacing Lynn Mueller, who will now serve as Vice Chairman and Executive Officer. Furthermore, the Company accepted the retirement and resignation of Eleanor Chiu as Director.

For complete financial information for the three and nine months ended September 30, 2025, please see the Condensed Consolidated Interim Financial Statements and Management Discussion and Analysis (“MD&A”) filed on SEDAR at www.sedar.com.

About SHARC Energy

SHARC International Systems Inc. is a world leader in energy transfer with the wastewater we send down the drain every day. SHARC Energy's systems exchange thermal energy with wastewater, generating one of the most energy-efficient and economical systems for heating, cooling & hot water production for commercial, residential and industrial buildings along with thermal energy networks, commonly referred to as “District Energy”.

SHARC Energy is publicly traded in Canada (CSE: SHRC), the United States (OTCQB: INTWF) and Germany (Frankfurt: IWIA) and you can find out more on our SEDAR profile.

Learn more about SHARC Energy: Website | Customers | LinkedIn | YouTube | PIRANHA | SHARC

ON BEHALF OF THE BOARD

Fred Andriano

Chairman

For investor inquiries, please contact:

Hanspaul Pannu

Chief Financial & Operating Officer

SHARC Energy

Telephone: (604) 475-7710 ext. 4

Email: hanspaul.pannu@sharcenergy.com

For media inquiries, please contact:

John Louis Fahie

Marketing

SHARC Energy

Telephone: 604.475.7710 Ext.109

Email: johnlouis.fahie@sharcenergy.com

The Canadian Securities Exchange does not accept responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Certain statements contained in this news release may constitute forward-looking information. Forward-looking information is often, but not always, identified using words such as “anticipate”, “plan”, “estimate”, “expect”, “may”, “will”, “intend”, “should”, and similar expressions. Forward-looking information involves known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking information. SHARC Energy’s actual results could differ materially from those anticipated in this forward-looking information because of regulatory decisions, competitive factors in the industries in which the Company operates, prevailing economic conditions, and other factors, many of which are beyond the control of the Company. SHARC Energy believes that the expectations reflected in the forward-looking information are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward-looking information should not be unduly relied upon. Any forward-looking information contained in this news release represents the Company’s expectations as of the date hereof and is subject to change after such date. The Company disclaims any intention or obligation to update or revise any forward-looking information whether because of new information, future events or otherwise, except as required by applicable securities legislation.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/d66a199f-d126-4a8f-ad99-9afc97bb4375

https://www.globenewswire.com/NewsRoom/AttachmentNg/ecf9757b-65f1-4178-bdf9-c6605081448b

1 Sales Pipeline is a non-IFRS measure. Please see discussion of Alternative Performance Measures and Non-IFRS Measures in the Q3 2025 MD&A.

2 Sales Order Backlog is a non-IFRS measure. Please see discussion of Alternative Performance Measures and Non-IFRS Measures in the Q3 2025 MD&A.

3 Adjusted EBITDA is a non-IFRS measure. Please see discussion of Alternative Performance Measures and Non-IFRS Measures in the Q3 2025 MD&A.