IQST - iQSTEL Announces 108% Q1 Revenue Growth To $51.4 Million

Rhea-AI Summary

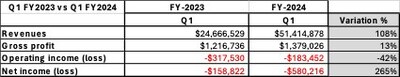

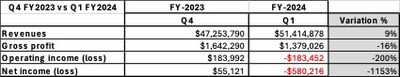

iQSTEL announced a 108% revenue increase in Q1 FY-2024 to $51.4 million compared to Q1 FY-2023. This growth is fully organic and does not include contributions from recent acquisitions QXTEL and LYNK.

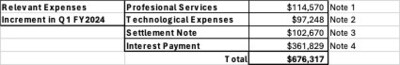

However, the company reported a net loss of $580,216 primarily due to increased expenses related to acquisition transactions and Nasdaq up-listing initiatives. Professional and technological services expenses also rose due to Smartbiz's migration to the VAMP platform.

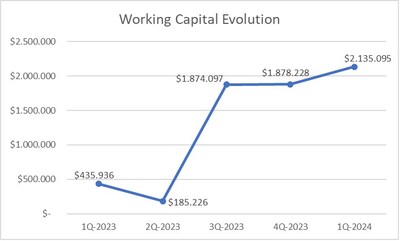

The Telecom Division, a key revenue generator, posted a positive operating income of $484,624 for Q1 FY-2024. The company's working capital improved to $2,135,095 as of March 31, 2024. Management expects continued growth and plans to hit a quarter-billion-dollar revenue in FY-2024.

Positive

- 108% revenue growth to $51.4 million in Q1 FY-2024.

- Telecom Division generated a positive operating income of $484,624.

- Working capital increased to $2,135,095 by March 31, 2024.

- Anticipated contribution from QXTEL and LYNK acquisitions in future quarters.

- Management expects to achieve or surpass $250 million in revenue for FY-2024.

Negative

- Reported net loss of $580,216 in Q1 FY-2024.

- Increased expenses from acquisition-related activities and Nasdaq up-listing initiatives.

- Higher professional and technological services expenses due to Smartbiz's migration.

News Market Reaction – IQST

On the day this news was published, IQST declined 4.69%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

As a result of increased expenses coming primarily from non-operating payments associated with recent acquisition transactions and an ongoing Nasdaq up-listing initiative, the company reported a net loss

Notes:

- The company increased its professional services expense in connection with funding its recent M&A activity, and in conjunction with its Nasdaq up-listing initiative.

- The increased technological services expense results from the migration of Smartbiz into our Voice Proprietary Platform (VAMP). Etelix and SwissLink are already on VAMP and the Smartbiz migration will improve synergies, and reduce the cost per minute, as well as providing Smartbiz the state of the art features available in our proprietary VAMP telecommunications platform.

- In January 2024, the company settled a promissory note with M2B as a prerequisite to the funding for the acquisition of QXTEL.

- The increased interest expense is due in part to a non-cash expense associated with the issuance of "kicker shares" to M2B and in part to a cash interest payment made to M2B. Both the cash and non-cash expenses result from the QXTEL acquisition and were specifically orchestrated to minimize dilution in our IQST stock in Q1 FY-2024.

Additional Financial Performance Highlights and Further Analysis

- Telecom Division stand-alone performance (stronger than ever)

iQSTEL's overall business strategy is built on the foundation of our Telecom Division. We are growing a robust telecom business and building complimentary high margin potential technology businesses at the same time. It is our Telecom Division that is currently generating revenue with a positive operating Income. The Telecom Division generated

Telecom Division | ||||

Revenues | $ | 51,414,878 | ||

Cost of revenues | 50,035,852 | |||

Gross profit | 1,379,026 | |||

Operating expenses | ||||

General and administration | 894,402 | |||

Total operating expenses | 894,402 | |||

Operating income/(loss) | $ | 484,624 | ||

- Increase in Consolidated Working Capital

As of March 31, 2024, we had total current assets of

The increase in working capital is a positive indication that the company's capital resources have the potential to meet operating costs and finance organic growth. Management expects this positive trend to continue throughout FY-2024.

- Shareholder value creation through accretive acquisitions and organic growth

iQSTEL 's high growth strategy is to combined organic growth with strategic acquisitions. To fund growth the Company has raised funds through various debt and equity instruments. The issuance of stock to acquire new operations and raise funds has been accretive and ultimately added shareholder value. The graph below illustrates the quarterly increases in net shareholder equity, current assets, total assets, and net shareholder's equity per issued share.

Summary

Q1 FY-2024 financial results represent a transitional period with non-operating expenses associated with the acquisitions of QXTEL and LYNK without the revenue and bottom line benefit of QXTEL and LYNK. With the ongoing revenue and bottom line contributions of QXTEL and LYNK going forward, management anticipates positive operating and net income results in subsequent 2024 quarterly financial reports.

Without any benefit from the recent QXTEL and LYNK acquisitions, the Q1 FY-2024 financial results demonstrate the success of iQSTEL's ability to acquire and integrate new telecom operations and rapidly achieve synergistic organic growth.

Our balanced organic growth and ongoing acquisition campaign is proving to be accretive and continuing to consistently add shareholder value.

Management is committed to making this FY-2024 the best ever. We plan to achieve or surpass the quarter billion dollar revenue mark this year. We also expect to achieve 7-digit positive operating income.

On behalf of our Independent Board of Directors we want to thank our partners, customers, shareholders, investors, management, and our employees for all the loyal support throughout our journey to become a one billion revenue company.

All the Best,

Leandro Iglesias

CEO and Chairman iQSTEL

About IQSTEL:

iQSTEL Inc. (OTC-QX: IQST) (www.iQSTEL.com) is a US-based, multinational publicly listed company preparing for a Nasdaq up-listing with an FY2023

- The Enhanced Telecommunications Services Division (Communications) includes VoIP, SMS, International Fiber-Optic, Proprietary Internet of Things (IoT), and a Proprietary Mobile Portability Blockchain Platform.

- The Fintech Division (Financial Freedom) includes remittances services, top up services, Master Card Debit Card, a US Bank Account (No SSN required), and a Mobile App.

- The Electric Vehicles (EV) Division (Mobility) offers Electric Motorcycles and plans to launch a Mid Speed Car.

- The Artificial Intelligence (AI)-Enhanced Metaverse Division (information and content) includes an enriched and immersive white label proprietary AI-Enhanced Metaverse platform to access products, services, content, entertainment, information, customer support, and more in a virtual 3D interface.

The company continues to grow and expand its suite of products and services both organically and through mergers and acquisitions. iQSTEL has completed 10 acquisitions since June 2018 and continues to develop an active pipeline of potential future acquisitions.

Safe Harbor Statement: Statements in this news release may be "forward-looking statements." Forward-looking statements include, but are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions, or any other information relating to our future activities or other future events or conditions. These statements are based on current expectations, estimates, and projections about our business based partly on assumptions made by management. These statements are not guarantees of future performance and involve risks, uncertainties, and assumptions that are difficult to predict. Therefore, actual outcomes and results may and are likely to differ materially from what is expressed or forecasted in forward-looking statements due to numerous factors. Any forward-looking statements speak only as of the date of this news release, and iQSTEL Inc. undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date of this news release. This press release does not constitute a public offer of any securities for sale. Any securities offered privately will not be or have not been registered under the Act and may not be offered or sold in

iQSTEL Inc.

IR US Phone: 646-740-0907

IR Email: investors@iqstel.com

Contact Details

iQSTEL Inc.

+1 646-740-0907

investors@iqstel.com

Company Website

www.iqstel.com

Photo - https://mma.prnewswire.com/media/2413592/iQSTEL_Inc.jpg

Photo - https://mma.prnewswire.com/media/2413594/iQSTEL_Inc_2.jpg

Photo - https://mma.prnewswire.com/media/2413593/iQSTEL_Inc_3.jpg

Photo - https://mma.prnewswire.com/media/2413596/iQSTEL_Inc_4.jpg

Photo - https://mma.prnewswire.com/media/2413595/iQSTEL_Inc_5.jpg

Logo: https://mma.prnewswire.com/media/1308745/iQSTEL_Logo.jpg

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/iqst--iqstel-announces-108-q1-revenue-growth-to-51-4-million-302146375.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/iqst--iqstel-announces-108-q1-revenue-growth-to-51-4-million-302146375.html

SOURCE iQSTEL Inc.