Kinross reports 2025 first-quarter results

Rhea-AI Summary

Positive

- Margins increased 67% to $1,814 per Au eq. oz, outpacing gold price gains

- Attributable free cash flow more than doubled to $370.8 million

- Net earnings tripled to $368.0 million ($0.30 per share)

- Strong balance sheet with $694.6 million cash and $2.3 billion total liquidity

- Moody's upgraded outlook to positive, affirming investment grade rating

- Targeting $500 million minimum in share buybacks for 2025

Negative

- Production slightly decreased to 512,088 Au eq. oz from 527,399 Au eq. oz year-over-year

- Production costs increased to $1,043 per Au eq. oz from $982 in Q1 2024

- All-in sustaining costs rose to $1,355 per Au eq. oz from $1,310 year-over-year

News Market Reaction

On the day this news was published, KGC gained 2.70%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Free cash flow more than doubled year-over-year driven by strong operating performance

Targeting

TORONTO, May 06, 2025 (GLOBE NEWSWIRE) -- Kinross Gold Corporation (TSX: K, NYSE: KGC) (“Kinross” or the “Company”) today announced its results for the first quarter ended March 31, 2025.

This news release contains forward-looking information about expected future events and financial and operating performance of the Company. We refer to the risks and assumptions set out in our Cautionary Statement on Forward-Looking Information located on pages 25 and 26 of this release. All dollar amounts are expressed in U.S. dollars, unless otherwise noted.

2025 first-quarter highlights:

- Production1 of 512,088 gold equivalent ounces (Au eq. oz.).

- Production cost of sales2 of

$1,043 per Au eq. oz. sold and attributable production cost of sales1 of$1,038 per Au eq. oz. sold. - Attributable all-in sustaining cost1 of

$1,355 per Au eq. oz. sold. - Operating cash flow3 of

$597.1 million . - Attributable free cash flow1 of

$370.8 million . - Margins4 increased by

67% to$1,814 per Au eq. oz. sold, outpacing the rise in the average realized gold price. - Reported earnings5 of

$368.0 million , or$0.30 per share, with adjusted net earnings6, 7 of$364.0 million , or$0.30 per share. - On track to meet annual guidance: On an attributable basis1, Kinross expects to produce 2.0 million Au eq. oz. (+/-

5% ) at a production cost of sales per Au eq. oz.1 of$1,120 (+/-5% ) and all-in sustaining cost1 of$1,500 (+/-5% ) per ounce sold for 2025. Total attributable capital expenditures1 are forecast to be$1,150 million (+/-5% ). - Balance sheet strength: Kinross has improved its debt metrics, repaying the remaining

$200.0 million of its term loan, while strengthening its balance sheet. Cash and cash equivalents increased to$694.6 million , and the Company has total liquidity8 of approximately$2.3 billion at March 31, 2025. - On March 27, 2025, Moody’s Investors Service (“Moody’s”) announced that it upgraded Kinross’ outlook to positive from stable and affirmed the Company’s investment grade rating of Baa3.

Return of capital to shareholders:

- Kinross’ Board of Directors declared a quarterly dividend of

$0.03 per common share payable on June 12, 2025, to shareholders of record at the close of business on May 29, 2025. - Kinross has reactivated a share buyback program and re-purchased

$60 million in shares to date in 2025. Full-year share repurchases are targeted to be a minimum of$500 million assuming recent gold prices are sustained and operations continue to deliver on plan.

____________________

1 Unless otherwise stated, production figures in this news release are on an attributable basis. “Attributable” includes Kinross’

2 “Production cost of sales per equivalent ounce sold” is defined as production cost of sales, as reported on the interim condensed consolidated statements of operations, divided by total gold equivalent ounces sold.

3 Operating cash flow figures in this release represent “Net cash flow provided from operating activities,” as reported on the interim condensed consolidated statements of cash flows.

4 “Margins” per equivalent ounce sold is defined as average realized gold price per ounce less production cost of sales per equivalent ounce sold.

5 Earnings, net earnings, and reported net earnings figures in this news release represent “Net earnings attributable to common shareholders,” as reported on the interim condensed consolidated statements of operations.

6 These figures are non-GAAP financial measures and ratios, as applicable, and are defined and reconciled on pages 16 to 22 of this news release. Non-GAAP financial measures and ratios have no standardized meaning under International Financial Reporting Standards (“IFRS”) and therefore, may not be comparable to similar measures presented by other issuers.

7 Adjusted net earnings figures in this news release represent “Adjusted net earnings attributable to common shareholders.”

8 “Total liquidity” is defined as the sum of cash and cash equivalents, as reported on the interim condensed consolidated balance sheets, and available credit under the Company’s credit facilities (as calculated in Section 6 Liquidity and Capital Resources of Kinross’ MD&A for the three months ended March 31, 2025).

Operations:

- Paracatu had a solid quarter driven by strong grades and improved recoveries, delivering high margin production. Kinross implemented additional gravity circuit infrastructure contributing to the improved recoveries.

- Tasiast performed well during the quarter driven by strong grades and recoveries following a number of optimization initiatives to the mill.

- Kinross has re-started the mill at Tasiast. The Company does not expect the fire to affect Tasiast’s annual guidance.

- Fort Knox increased production and lowered costs quarter-over-quarter, generating significant free cash flow.

Development and exploration projects:

- Kinross’ pipeline of development projects continues to advance.

- Great Bear’s Advanced Exploration (AEX) program is progressing, with construction and earthworks underway, and detailed engineering near completion.

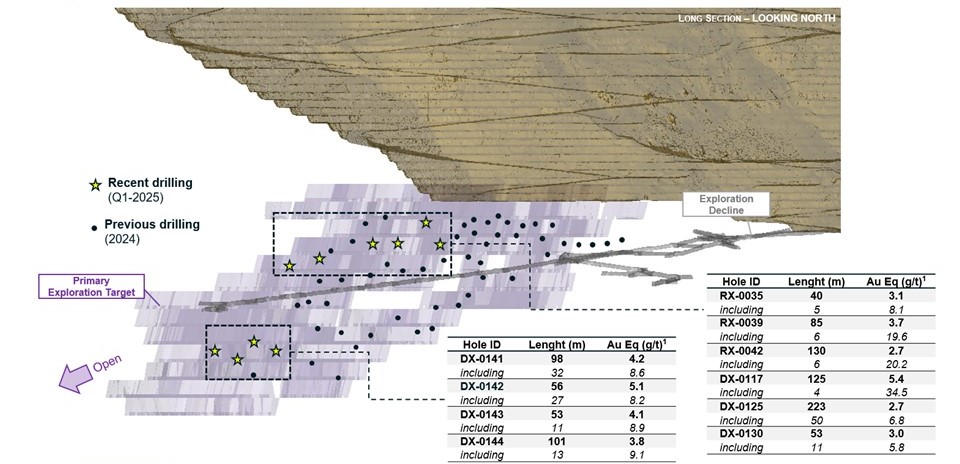

- At Round Mountain Phase X, the exploration decline is advancing well, with over 3,900 metres developed to date. Infill drilling continues to confirm strong grades and widths in the primary target zones.

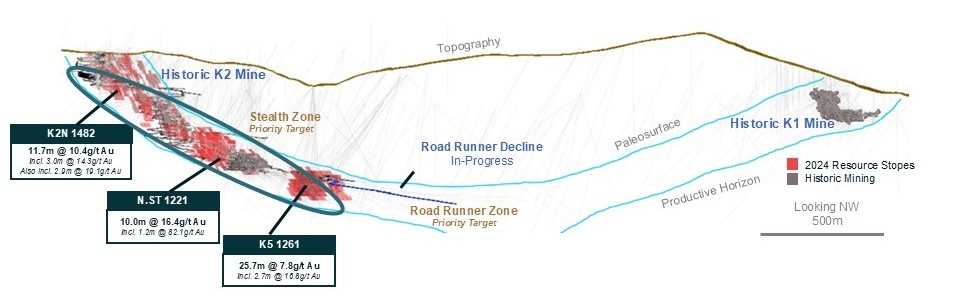

- At Curlew, drill results continue to demonstrate increased grades and widths that could support high-margin production.

- At Lobo-Marte, the dedicated project team is progressing baseline studies to support permitting.

Sustainability:

- Kinross expects to publish its 2024 Sustainability Report later this month, marking its 17th edition, providing a comprehensive summary of its performance over the past year.

CEO commentary:

J. Paul Rollinson, CEO, made the following comments in relation to 2025 first-quarter results:

"We had an excellent start to the year built on our continued strong operational performance and disciplined cost management, and are well positioned to meet our annual guidance. The Company delivered a

“Our culture of technical excellence and financial discipline, complemented by our consistent operating performance, continues to drive strong margins and cash flow, all of which underpin our capital allocation strategy. In addition to our dividend, we’ve reactivated our share buyback program and, given the current gold environment as well as the strength of our operations, we are aiming to repurchase a minimum of

“We continue to advance our pipeline of high-quality development projects and exploration opportunities across our broader portfolio with a focus on driving value for our shareholders through this decade and beyond. The Great Bear AEX program is progressing, Redbird at Bald Mountain is advancing on schedule, we continue to deliver strong drill results at Round Mountain Phase X and Curlew, and baseline studies at Lobo-Marte are progressing well.”

Summary of financial and operating results

| Three months ended | ||||

| March 31, | ||||

| (in millions of U.S. dollars, except ounces, per share amounts, and per ounce amounts) | 2025 | 2024 | ||

| Operating Highlights(a) | ||||

| Total gold equivalent ounces(b) | ||||

| Produced | 529,861 | 527,399 | ||

| Sold | 524,089 | 522,400 | ||

| Attributable gold equivalent ounces(b) | ||||

| Produced | 512,088 | 527,399 | ||

| Sold | 506,564 | 522,400 | ||

| Gold ounces - sold | 516,268 | 503,604 | ||

| Silver ounces - sold (000's) | 701 | 1,667 | ||

| Earnings(a) | ||||

| Metal sales | $ | 1,497.5 | $ | 1,081.5 |

| Production cost of sales | $ | 546.7 | $ | 512.9 |

| Depreciation, depletion and amortization | $ | 288.4 | $ | 270.7 |

| Operating earnings | $ | 570.4 | $ | 193.2 |

| Net earnings attributable to common shareholders | $ | 368.0 | $ | 107.0 |

| Net earnings per share attributable to common shareholders (basic and diluted) | $ | 0.30 | $ | 0.09 |

| Adjusted net earnings attributable to common shareholders(c) | $ | 364.0 | $ | 124.9 |

| Adjusted net earnings per share(c) | $ | 0.30 | $ | 0.10 |

| Cash Flow(a) | ||||

| Net cash flow provided from operating activities | $ | 597.1 | $ | 374.4 |

| Attributable adjusted operating cash flow(c) | $ | 676.2 | $ | 425.7 |

| Capital expenditures(d) | $ | 207.7 | $ | 241.9 |

| Attributable capital expenditures(c) | $ | 204.1 | $ | 232.1 |

| Attributable free cash flow(c) | $ | 370.8 | $ | 145.3 |

| Per Ounce Metrics(a) | ||||

| Average realized gold price per ounce(e) | $ | 2,857 | $ | 2,070 |

| Attributable average realized gold price per ounce(c) | $ | 2,856 | $ | 2,070 |

| Production cost of sales per equivalent ounce(b) sold(f) | $ | 1,043 | $ | 982 |

| Attributable production cost of sales per equivalent ounce(b) sold(c) | $ | 1,038 | $ | 982 |

| Attributable production cost of sales per ounce sold on a by-product basis(c) | $ | 1,010 | $ | 941 |

| Attributable all-in sustaining cost per equivalent ounce(b) sold(c) | $ | 1,355 | $ | 1,310 |

| Attributable all-in sustaining cost per ounce sold on a by-product basis(c) | $ | 1,331 | $ | 1,281 |

| Attributable all-in cost per equivalent ounce(b) sold(c) | $ | 1,678 | $ | 1,630 |

| Attributable all-in cost per ounce sold on a by-product basis(c) | $ | 1,660 | $ | 1,613 |

| (a) | All measures and ratios include |

| (b) | “Gold equivalent ounces” include silver ounces produced and sold converted to a gold equivalent based on a ratio of the average spot market prices for the commodities for each period. The ratio for the first quarter of 2025 was 89.69:1 (first quarter of 2024 – 88.70:1). |

| (c) | The definition and reconciliation of these non-GAAP financial measures and ratios is included on pages 16 to 22 of this news release. Non-GAAP financial measures and ratios have no standardized meaning under International Financial Reporting Standards (“IFRS”) and therefore, may not be comparable to similar measures presented by other issuers. |

| (d) | “Capital expenditures” is “Additions to property, plant and equipment” on the interim condensed consolidated statements of cash flows. |

| (e) | “Average realized gold price per ounce” is defined as gold revenue divided by total gold ounces sold. |

| (f) | “Production cost of sales per equivalent ounce sold” is defined as production cost of sales divided by total gold equivalent ounces sold. |

The following operating and financial results are based on first-quarter gold equivalent production:

Production: Kinross produced 512,088 Au eq. oz. in Q1 2025, compared with 527,399 Au eq. oz. in Q1 2024. Higher production from Fort Knox, with the commencement of Manh Choh in the second half of 2024, was offset by lower planned production at Round Mountain and Tasiast.

Average realized gold price9: The average realized gold price in Q1 2025 was

Revenue: During the first quarter, revenue increased to

Production cost of sales: Production cost of sales per Au eq. oz. sold2 increased to

Attributable production cost of sales per Au oz. sold on a by-product basis1 was

Margins4: Kinross’ margin per Au eq. oz. sold increased by

Attributable all-in sustaining cost1: Attributable all-in sustaining cost per Au eq. oz. sold was

In Q1 2025, attributable all-in sustaining cost per Au oz. sold on a by-product basis was

Operating cash flow3: Operating cash flow was

Attributable adjusted operating cash flow1 for Q1 2025 was

Attributable free cash flow1: Attributable free cash flow more than doubled to

Reported earnings5: Reported net earnings more than tripled to

Adjusted net earnings6, 7 more than doubled to

Attributable capital expenditures1: Attributable capital expenditures decreased to

____________________

9 “Average realized gold price per ounce” is defined as gold revenue divided by total gold ounces sold.

Balance sheet

During the quarter, the Company repaid the remaining

After the repayments, Kinross had cash and cash equivalents of

The Company had additional available credit11 of

On March 27, 2025, Moody’s announced that it upgraded Kinross’ outlook to positive from stable and affirmed the Company’s investment grade rating of Baa3. Moody’s noted Kinross’ debt reduction, good scale, low leverage and conservative financial policies as key factors driving the improved outlook.

Return of capital to shareholders

Kinross is committed to enhancing shareholder value through return of capital programs such as a share buyback and its quarterly dividend, which are underpinned by the Company’s investment grade balance sheet, strong free cash flow and stable production profile from its global portfolio.

On March 19, 2025, Kinross received approval from the Toronto Stock Exchange to renew its normal course issuer bid (“NCIB”) program. Under the NCIB program, the Company is authorized to purchase up to 110,350,160 of its common shares (out of the 1,229,635,757 common shares outstanding as at February 28, 2025) representing up to

Kinross has reactivated its share buyback program and has re-purchased approximately

The Company believes that Kinross’ shares offer exceptional value, and that the buyback offers an attractive use of excess cash in this gold price environment. Kinross will continue to strengthen its balance sheet while retaining its capacity to continue investing in its business.

As part of its continuing quarterly dividend program, the Company declared a dividend of

Operating results

Mine-by-mine summaries for 2025 first-quarter operating results may be found on pages 10 and 14 of this news release. Highlights include the following:

At Tasiast, production decreased slightly quarter-over-quarter due to lower throughput, partially offset by timing of ounces processed through the mill. Production was lower year-over-year due to lower grades, consistent with mine plan sequencing, partially offset by an increase in recoveries due to a number of optimization initiatives to the mill. Cost of sales per ounce sold increased quarter-over-quarter mainly due to lower planned throughput, and increased year-over-year mainly due to the decrease in production.

Kinross has re-started milling operations at Tasiast following the fire on April 14, 2025. The Company does not expect the fire to affect Tasiast’s annual guidance.

At Paracatu, production increased quarter-over-quarter due to higher grades and improved recoveries as well as timing of ounces processed through the mill. Production increased year-over-year primarily due to higher grades and improved recoveries, partially offset by lower throughput. Cost of sales per ounce sold decreased in both comparable periods mainly due to the increase in ounces produced.

At La Coipa, production decreased quarter-over-quarter mainly due to timing of ounces processed through the mill and planned lower mill throughput, partially offset by higher-grades from the Puren deposit. Year-over-year production decreased mainly due to the timing of ounces processed through the mill and a decrease in silver grades, partially offset by an increase in throughput. Cost of sales per ounce sold was lower quarter-over-quarter mainly due to lower maintenance costs, partially offset by the decrease in production. Year-over-year cost of sales per ounce sold was higher due to the decrease in ounces produced, higher royalty costs and higher processing costs. Permitting work for mine life extensions continued.

Fort Knox continued its strong performance with higher production quarter-over-quarter mainly due to the contribution from a longer campaign of processing Manh Choh’s higher-grade, higher-recovery ore, and increased year-over as Manh Choh came online in the second half of 2024. The higher production in both comparable periods contributed to the decreases in cost of sales per ounce sold.

At Round Mountain, production was lower quarter-over-quarter, as planned, mainly due to lower grades, partially offset by higher mill throughput. Compared with the previous quarter, cost of sales per ounce sold decreased due to lower reagent, fuel and milling supply costs, partially offset by the recovery of higher-cost ounces produced from the heap leach pads. Year-over-year production was lower due to a decrease in mill grades and fewer ounces recovered from the heap leach pads. Compared with Q1 2024, cost of sales per ounce sold increased mainly due to the decrease in production.

At Bald Mountain, production was in line quarter-over-quarter, and decreased year-over-year due to lower grades. Cost of sales per ounce sold was lower quarter-over-quarter due to a higher proportion of mining activities related to capital development, and in line with Q1 2024.

____________________

10 Net debt is calculated as long-term debt (current and long-term portion) of

11 “Available credit” is defined as available credit under the Company’s credit facilities and is calculated in Section 6 Liquidity and Capital Resources of Kinross’ MD&A for the three months ended March 31, 2025.

Development and exploration projects

Great Bear

At Great Bear, Kinross continues to progress its AEX program and overall permitting.

For the AEX program, detailed engineering is near completion and procurement continues to advance in-line with construction schedule requirements. AEX construction commenced in Q4 2024 and earthworks activities are underway.

For the Main Project, Kinross has initiated detailed engineering on the mill and key site infrastructure. Procurement for major process equipment will be initiated in late 2025.

The Company continues to work with the Impact Assessment Agency of Canada on advancing its Impact Statement. Consultation continues with designated Indigenous communities, including discussions to finalize related agreements.

Given Kinross has already drilled out a significant inventory in the Preliminary Economic Assessment providing an initial 12-year mine life, demonstrated continuation of mineralization beyond that, and the high cost of drilling at depth from surface, Kinross has shifted its focus from drilling the LP zone to regional exploration work.

Kinross commenced regional exploration drilling in Q1 2025 targeting both near-surface and underground targets delineated by lithostratigraphic models and geophysical surveys. The program is ongoing with more than 50,000 metres anticipated to be drilled by year-end.

Round Mountain Phase X

Decline development at Round Mountain Phase X is advancing well, with over 3,900 metres developed to date. Extensive infill drilling has been completed in the upper zone and is now largely focused in the lower zone.

Q1 drilling results from the lower zone continued to intercept strong widths and grades, supporting the thesis of the potential for bulk mining at Phase X, with average grades of 3-4 grams per tonne. Highlights include:

- DX-0141 – 98m @ 4.2 g/t Au

- Including 32m @ 8.6 g/t Au

- DX-0142 – 56m @ 5.1 g/t Au

- Including 27m @ 8.2 g/t Au

- DX-0143 – 53m @ 4.1 g/t Au

- Including 11m @ 8.9 g/t Au

- DX-0144 – 101m @ 3.8 g/t Au

- Including 13m @ 9.1 g/t Au

- Including 13m @ 9.1 g/t Au

Engineering work and technical studies are continuing to support project execution at Phase X. Kinross plans to provide a project and resource update at year-end.

See Appendix A for a Round Mountain Phase X long section.

Curlew Basin exploration

Curlew’s underground drill program is focused both on resource upgrade and near mine extensions at Stealth where results continue to be encouraging. Underground development was also re-initiated in Q1 to drive the decline deeper and provide access to drill off potential extensions to the Stealth zone and Roadrunner zone mineralization. Technical studies and detailed engineering are also progressing well.

Assay results received in Q1 continue to highlight zones of mineralization that are wider and higher-grade than the current resource, supporting the potential for high-margin production and further improving the quality of the project. Highlights include:

- K5-1261 – 25.7m @ 7.8 g/t Au

- Including 2.7m @ 16.8 g/t Au

- N.ST-1221 – 10.0m @ 16.4 g/t Au

- Including 1.2m @ 82.1 g/t Au

- K2N-1482 – 11.7m @ 10.4 g/t Au

- Including 2.9m @ 19.1 g/t Au

See Appendix A for a Curlew cross section.

Bald Mountain Redbird

At Redbird, mining is advancing on schedule. Studies and detailed engineering related to the potential Phase 2 extension of Redbird are progressing well, including engineering related to the heap leach pad expansion, technical studies and mine plan optimization work.

Lobo-Marte

Kinross is progressing baseline studies to support the Environmental Impact Assessment (EIA) for the Lobo-Marte project. Lobo-Marte continues to be a potential large, low-cost mine and Kinross is committed to progressing next steps to advance the project.

Sustainability

As part of its commitment to improved well-being in host communities, during the first quarter Kinross and the Municipality of Paracatu in Brazil completed the second phase of the municipal hospital renovation. The modern, renovated facility now has double the number of beds in the intensive care unit, in addition to rooms for medical isolation, which will increase the quality of public healthcare for the population of Paracatu and the region.

In Ontario, Kinross formalized its partnership with Lakehead University for research on geology, mining and environment. The five-year agreement will support a Research Chair on mineral exploration and critical minerals processing research. Specifically, the research focus will include supporting exploration efforts at Great Bear and include input from Indigenous communities.

Later this month, Kinross plans to publish its 2024 Sustainability Report providing a transparent account of its sustainability performance and outlining priorities in the year ahead and beyond.

Conference call details

In connection with this news release, Kinross will hold a conference call and audio webcast on Wednesday, May 7, 2025, at 7:45 a.m. EDT to discuss the results, followed by a question-and-answer session. To access the call, please dial:

Canada & US toll-free – 1 (888) 596-4144; Passcode: 9425112

Outside of Canada & US – 1 (646) 968-2525; Passcode: 9425112

Replay (available up to 14 days after the call):

Canada & US toll-free – 1 (800) 770-2030; Passcode: 9425112

Outside of Canada & US – 1 (609) 800-9909; Passcode: 9425112

You may also access the conference call on a listen-only basis via webcast at our website www.kinross.com. The audio webcast will be archived on www.kinross.com.

Virtual Annual Meeting of Shareholders

Kinross’ virtual Annual Meeting of Shareholders will be held on Wednesday, May 7, 2025, at 10:00 a.m. EDT.

The virtual meeting will be accessible online at: https://meetings.400.lumiconnect.com/r/participant/live-meeting/400-211-583-597 . The link to the virtual meeting will also be accessible at www.kinross.com and will be archived for later use.

Voting and participation instructions for eligible shareholders are provided in the Company’s Notice of Annual Meeting of Shareholders and Management Information Circular.

This release should be read in conjunction with Kinross’ 2025 first-quarter unaudited Financial Statements and Management’s Discussion and Analysis report at www.kinross.com. Kinross’ 2025 first-quarter Financial Statements and Management’s Discussion and Analysis have been filed with Canadian securities regulators (available at www.sedarplus.ca) and furnished with the U.S. Securities and Exchange Commission (available at www.sec.gov). Kinross shareholders may obtain a copy of the financial statements free of charge upon request to the Company.

About Kinross Gold Corporation

Kinross is a Canadian-based global senior gold mining company with operations and projects in the United States, Brazil, Mauritania, Chile and Canada. Our focus is on delivering value based on the core principles of responsible mining, operational excellence, disciplined growth, and balance sheet strength. Kinross maintains listings on the Toronto Stock Exchange (symbol: K) and the New York Stock Exchange (symbol: KGC).

Media Contact

Victoria Barrington

Senior Director, Corporate Communications

phone: 647-788-4153

victoria.barrington@kinross.com

Investor Relations Contact

David Shaver

Senior Vice-President, Investor Relations & Communications

phone: 416-365-2854

InvestorRelations@Kinross.com

Review of operations

| Three months ended March 31, | Gold equivalent ounces | |||||||||||||

| Produced | Sold | Production cost of sales ($millions) | Production cost of sales/equivalent ounce sold | |||||||||||

| 2025 | 2024 | 2025 | 2024 | 2025 | 2024 | 2025 | 2024 | |||||||

| Tasiast | 137,629 | 159,199 | 129,493 | 151,014 | 105.0 | 99.7 | 811 | 660 | ||||||

| Paracatu | 146,639 | 128,273 | 146,855 | 128,110 | 139.6 | 135.7 | 951 | 1,059 | ||||||

| La Coipa | 52,315 | 71,245 | 55,870 | 71,125 | 64.1 | 52.1 | 1,147 | 733 | ||||||

| Fort Knox | 112,054 | 53,350 | 112,110 | 56,292 | 131.8 | 82.5 | 1,176 | 1,466 | ||||||

| Round Mountain | 35,686 | 68,352 | 35,960 | 68,169 | 57.0 | 90.6 | 1,585 | 1,329 | ||||||

| Bald Mountain | 45,538 | 46,980 | 43,801 | 47,241 | 49.2 | 52.1 | 1,123 | 1,103 | ||||||

| United States Total | 193,278 | 168,682 | 191,871 | 171,702 | 238.0 | 225.2 | 1,240 | 1,312 | ||||||

| Less: Manh Choh non-controlling interest ( | (17,773 | ) | - | (17,525 | ) | - | (20.7 | ) | - | |||||

| United States Attributable Total | 175,505 | 168,682 | 174,346 | 171,702 | 217.3 | 225.2 | 1,246 | 1,312 | ||||||

| Operations Total(a) | 529,861 | 527,399 | 524,089 | 522,400 | 546.7 | 512.9 | 1,043 | 982 | ||||||

| Attributable Total(a) | 512,088 | 527,399 | 506,564 | 522,400 | 526.0 | 512.9 | 1,038 | 982 | ||||||

| (a) | Totals include immaterial sales and related costs from Maricunga for the three months ended March 31, 2024. | |||

Consolidated balance sheets

| (unaudited, expressed in millions of U.S. dollars, except share amounts) | ||||||||

| As at | ||||||||

| March 31, | December 31, | |||||||

| 2025 | 2024 | |||||||

| Assets | ||||||||

| Current assets | ||||||||

| Cash and cash equivalents | $ | 694.6 | $ | 611.5 | ||||

| Restricted cash | 11.9 | 10.2 | ||||||

| Accounts receivable and prepaid assets | 247.4 | 257.3 | ||||||

| Inventories | 1,271.6 | 1,243.2 | ||||||

| Other current assets | 17.5 | 4.5 | ||||||

| 2,243.0 | 2,126.7 | |||||||

| Non-current assets | ||||||||

| Property, plant and equipment | 7,924.4 | 7,968.6 | ||||||

| Long-term investments | 66.5 | 51.9 | ||||||

| Other long-term assets | 714.7 | 713.1 | ||||||

| Deferred tax assets | 5.3 | 5.3 | ||||||

| Total assets | $ | 10,953.9 | $ | 10,865.6 | ||||

| Liabilities | ||||||||

| Current liabilities | ||||||||

| Accounts payable and accrued liabilities | $ | 529.5 | $ | 543.0 | ||||

| Current income tax payable | 193.1 | 236.7 | ||||||

| Current portion of long-term debt | - | 199.9 | ||||||

| Current portion of provisions | 59.4 | 62.5 | ||||||

| Other current liabilities | 11.3 | 18.0 | ||||||

| 793.3 | 1,060.1 | |||||||

| Non-current liabilities | ||||||||

| Long-term debt | 1,235.9 | 1,235.5 | ||||||

| Provisions | 956.3 | 941.5 | ||||||

| Other long-term liabilities | 78.6 | 78.9 | ||||||

| Deferred tax liabilities | 551.1 | 549.0 | ||||||

| Total liabilities | $ | 3,615.2 | $ | 3,865.0 | ||||

| Equity | ||||||||

| Common shareholders' equity | ||||||||

| Common share capital | $ | 4,493.6 | $ | 4,487.3 | ||||

| Contributed surplus | 10,631.4 | 10,643.0 | ||||||

| Accumulated deficit | (7,850.2 | ) | (8,181.3 | ) | ||||

| Accumulated other comprehensive loss | (72.5 | ) | (87.4 | ) | ||||

| Total common shareholders' equity | 7,202.3 | 6,861.6 | ||||||

| Non-controlling interests | 136.4 | 139.0 | ||||||

| Total equity | $ | 7,338.7 | $ | 7,000.6 | ||||

| Total liabilities and equity | $ | 10,953.9 | $ | 10,865.6 | ||||

| Common shares | ||||||||

| Authorized | Unlimited | Unlimited | ||||||

| Issued and outstanding | 1,230,443,992 | 1,229,125,606 | ||||||

Consolidated statements of operations

| (unaudited, expressed in millions of U.S. dollars, except per share amounts) | ||||||||

| Three months ended | ||||||||

| March 31, | March 31, | |||||||

| 2025 | 2024 | |||||||

| Revenue | ||||||||

| Metal sales | $ | 1,497.5 | $ | 1,081.5 | ||||

| Cost of sales | ||||||||

| Production cost of sales | 546.7 | 512.9 | ||||||

| Depreciation, depletion and amortization | 288.4 | 270.7 | ||||||

| Total cost of sales | 835.1 | 783.6 | ||||||

| Gross profit | 662.4 | 297.9 | ||||||

| Other operating expense | 14.0 | 27.6 | ||||||

| Exploration and business development | 42.3 | 41.7 | ||||||

| General and administrative | 35.7 | 35.4 | ||||||

| Operating earnings | 570.4 | 193.2 | ||||||

| Other (expense) income - net | (13.2 | ) | 0.1 | |||||

| Finance income | 4.2 | 3.9 | ||||||

| Finance expense | (35.2 | ) | (21.5 | ) | ||||

| Earnings before tax | 526.2 | 175.7 | ||||||

| Income tax expense - net | (136.8 | ) | (69.1 | ) | ||||

| Net earnings | $ | 389.4 | $ | 106.6 | ||||

| Net earnings (loss) attributable to: | ||||||||

| Non-controlling interests | $ | 21.4 | $ | (0.4 | ) | |||

| Common shareholders | $ | 368.0 | $ | 107.0 | ||||

| Earnings per share attributable to common shareholders | ||||||||

| Basic | $ | 0.30 | $ | 0.09 | ||||

| Diluted | $ | 0.30 | $ | 0.09 | ||||

Consolidated statements of cash flows

| (unaudited, expressed in millions of U.S. dollars) | ||||||||

| Three months ended | ||||||||

| March 31, | March 31, | |||||||

| 2025 | 2024 | |||||||

| Net inflow (outflow) of cash related to the following activities: | ||||||||

| Operating: | ||||||||

| Net earnings | $ | 389.4 | $ | 106.6 | ||||

| Adjustments to reconcile net earnings to net cash provided from operating activities: | ||||||||

| Depreciation, depletion and amortization | 288.4 | 270.7 | ||||||

| Share-based compensation expense | 4.6 | 2.5 | ||||||

| Finance expense | 35.2 | 21.5 | ||||||

| Deferred tax expense | 3.5 | 8.6 | ||||||

| Foreign exchange (gains) losses and other | (15.0 | ) | 15.0 | |||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable and other assets | 7.1 | 8.8 | ||||||

| Inventories | (38.4 | ) | 5.9 | |||||

| Accounts payable and accrued liabilities | 100.6 | 13.6 | ||||||

| Cash flow provided from operating activities | 775.4 | 453.2 | ||||||

| Income taxes paid | (178.3 | ) | (78.8 | ) | ||||

| Net cash flow provided from operating activities | 597.1 | 374.4 | ||||||

| Investing: | ||||||||

| Additions to property, plant and equipment | (207.7 | ) | (241.9 | ) | ||||

| Interest paid capitalized to property, plant and equipment | (13.5 | ) | (34.9 | ) | ||||

| Net additions to long-term investments and other assets | (9.1 | ) | (3.1 | ) | ||||

| Increase in restricted cash - net | (1.7 | ) | (0.5 | ) | ||||

| Interest received and other - net | 4.2 | 3.9 | ||||||

| Net cash flow used in investing activities | (227.8 | ) | (276.5 | ) | ||||

| Financing: | ||||||||

| Repayment of debt | (200.0 | ) | - | |||||

| Interest paid | (24.0 | ) | (18.5 | ) | ||||

| Payment of lease liabilities | (1.5 | ) | (3.4 | ) | ||||

| Funding from non-controlling interest | - | 15.5 | ||||||

| Distributions paid to non-controlling interest | (24.0 | ) | - | |||||

| Dividends paid to common shareholders | (36.9 | ) | (36.9 | ) | ||||

| Other - net | - | 0.3 | ||||||

| Net cash flow used in financing activities | (286.4 | ) | (43.0 | ) | ||||

| Effect of exchange rate changes on cash and cash equivalents | 0.2 | (0.4 | ) | |||||

| Increase in cash and cash equivalents | 83.1 | 54.5 | ||||||

| Cash and cash equivalents, beginning of period | 611.5 | 352.4 | ||||||

| Cash and cash equivalents, end of period | $ | 694.6 | $ | 406.9 | ||||

| Operating Summary | ||||||||||||||||||

| Mine | Period | Tonnes Ore Mined | Ore Processed (Milled) | Ore Processed (Heap Leach) | Grade (Mill) | Grade (Heap Leach) | Recovery (a)(b) | Gold Eq Production(c) | Gold Eq Sales(c) | Production cost of sales | Production cost of sales/oz(d) | Cap Ex - sustaining(e) | Total Cap Ex(e) | |||||

| ('000 tonnes) | ('000 tonnes) | ('000 tonnes) | (g/t) | (g/t) | (%) | (ounces) | (ounces) | ($ millions) | ($/ounce) | ($ millions) | ($ millions) | |||||||

| West Africa | Tasiast | Q1 2025 | 1,812 | 1,932 | - | 2.15 | - | 95% | 137,629 | 129,493 | $ | 105.0 | $ | 811 | $ | 13.7 | $ | 80.1 |

| Q4 2024 | 1,824 | 2,205 | - | 2.13 | - | 139,411 | 144,041 | $ | 104.4 | $ | 725 | $ | 33.7 | $ | 105.4 | |||

| Q3 2024 | 1,748 | 2,203 | - | 2.46 | - | 162,155 | 158,521 | $ | 109.0 | $ | 688 | $ | 13.5 | $ | 83.8 | |||

| Q2 2024 | 1,985 | 2,161 | - | 2.70 | - | 161,629 | 156,038 | $ | 102.3 | $ | 656 | $ | 7.0 | $ | 75.2 | |||

| Q1 2024 | 2,044 | 2,073 | - | 2.46 | - | 159,199 | 151,014 | $ | 99.7 | $ | 660 | $ | 10.1 | $ | 79.5 | |||

| Americas | Paracatu | Q1 2025 | 13,318 | 12,507 | - | 0.43 | - | 83% | 146,639 | 146,855 | $ | 139.6 | $ | 951 | $ | 24.4 | $ | 24.4 |

| Q4 2024 | 12,944 | 13,116 | - | 0.40 | - | 123,899 | 124,690 | $ | 131.6 | $ | 1,055 | $ | 35.1 | $ | 35.1 | |||

| Q3 2024 | 13,127 | 14,551 | - | 0.38 | - | 146,174 | 145,235 | $ | 146.1 | $ | 1,006 | $ | 41.2 | $ | 41.2 | |||

| Q2 2024 | 14,094 | 15,053 | - | 0.35 | - | 130,228 | 130,174 | $ | 135.2 | $ | 1,039 | $ | 44.6 | $ | 44.6 | |||

| Q1 2024 | 14,078 | 15,609 | - | 0.31 | - | 128,273 | 128,110 | $ | 135.7 | $ | 1,059 | $ | 19.6 | $ | 19.6 | |||

| La Coipa(f) | Q1 2025 | 1,265 | 971 | - | 2.19 | - | 80% | 52,315 | 55,870 | $ | 64.1 | $ | 1,147 | $ | 15.6 | $ | 15.6 | |

| Q4 2024 | 1,385 | 1,017 | - | 1.98 | - | 58,533 | 57,852 | $ | 68.2 | $ | 1,179 | $ | 26.6 | $ | 26.6 | |||

| Q3 2024 | 786 | 809 | - | 2.17 | - | 50,502 | 48,594 | $ | 52.2 | $ | 1,074 | $ | 21.3 | $ | 24.9 | |||

| Q2 2024 | 690 | 882 | - | 1.97 | - | 65,851 | 63,506 | $ | 58.8 | $ | 926 | $ | 10.7 | $ | 10.7 | |||

| Q1 2024 | 1,035 | 827 | - | 2.09 | - | 71,245 | 71,125 | $ | 52.1 | $ | 733 | $ | 7.2 | $ | 7.2 | |||

| Fort Knox ( | Q1 2025 | 6,530 | 1,071 | 4,790 | 2.77 | 0.19 | 91% | 112,054 | 112,110 | $ | 131.8 | $ | 1,176 | $ | 28.2 | $ | 28.2 | |

| Q4 2024 | 7,692 | 1,524 | 6,664 | 1.51 | 0.21 | 104,901 | 108,512 | $ | 141.0 | $ | 1,299 | $ | 53.3 | $ | 54.0 | |||

| Q3 2024 | 7,612 | 1,105 | 5,822 | 4.03 | 0.19 | 149,093 | 140,121 | $ | 134.2 | $ | 958 | $ | 56.6 | $ | 70.4 | |||

| Q2 2024 | 8,331 | 2,003 | 6,385 | 0.85 | 0.22 | 69,914 | 70,477 | $ | 94.8 | $ | 1,345 | $ | 47.6 | $ | 89.2 | |||

| Q1 2024 | 10,037 | 1,850 | 8,778 | 0.67 | 0.24 | 53,350 | 56,292 | $ | 82.5 | $ | 1,466 | $ | 37.7 | $ | 78.6 | |||

| Fort Knox (attributable)(g) | Q1 2025 | 6,445 | 982 | 4,790 | 2.35 | 0.19 | 90% | 94,281 | 94,585 | $ | 111.1 | $ | 1,175 | $ | 24.6 | $ | 24.6 | |

| Q4 2024 | 7,619 | 1,483 | 6,664 | 1.28 | 0.21 | 91,755 | 94,763 | $ | 125.1 | $ | 1,320 | $ | 51.1 | $ | 52.1 | |||

| Q3 2024 | 7,509 | 991 | 5,822 | 3.44 | 0.19 | 119,500 | 112,346 | $ | 109.3 | $ | 973 | $ | 55.4 | $ | 67.2 | |||

| Q2 2024 | 8,249 | 2,003 | 6,385 | 0.85 | 0.22 | 69,914 | 70,477 | $ | 94.8 | $ | 1,345 | $ | 47.6 | $ | 79.5 | |||

| Q1 2024 | 10,009 | 1,850 | 8,778 | 0.67 | 0.24 | 53,350 | 56,292 | $ | 82.5 | $ | 1,466 | $ | 37.7 | $ | 68.8 | |||

| Round Mountain | Q1 2025 | 1,927 | 856 | 2,163 | 0.66 | 0.27 | 77% | 35,686 | 35,960 | $ | 57.0 | $ | 1,585 | $ | 2.8 | $ | 29.6 | |

| Q4 2024 | 3,111 | 768 | 1,736 | 1.05 | 0.22 | 42,969 | 45,342 | $ | 80.0 | $ | 1,764 | $ | 4.4 | $ | 33.9 | |||

| Q3 2024 | 2,958 | 790 | 1,032 | 0.74 | 0.29 | 42,279 | 41,436 | $ | 63.8 | $ | 1,540 | $ | 5.2 | $ | 35.9 | |||

| Q2 2024 | 2,956 | 806 | 1,541 | 1.11 | 0.35 | 61,787 | 60,049 | $ | 93.9 | $ | 1,564 | $ | 2.1 | $ | 37.2 | |||

| Q1 2024 | 4,246 | 960 | 3,257 | 1.32 | 0.37 | 68,352 | 68,169 | $ | 90.6 | $ | 1,329 | $ | 3.7 | $ | 19.3 | |||

| Bald Mountain | Q1 2025 | 5,803 | - | 5,803 | - | 0.35 | nm | 45,538 | 43,801 | $ | 49.2 | $ | 1,123 | $ | 6.9 | $ | 17.8 | |

| Q4 2024 | 7,622 | - | 7,622 | - | 0.46 | nm | 44,642 | 51,291 | $ | 58.7 | $ | 1,144 | $ | 4.6 | $ | 6.4 | ||

| Q3 2024 | 6,384 | - | 6,384 | - | 0.53 | nm | 43,496 | 44,410 | $ | 58.9 | $ | 1,326 | $ | 5.0 | $ | 6.1 | ||

| Q2 2024 | 2,906 | - | 2,906 | - | 0.47 | nm | 45,929 | 39,818 | $ | 50.6 | $ | 1,271 | $ | 4.4 | $ | 4.6 | ||

| Q1 2024 | 1,480 | - | 1,480 | - | 0.42 | nm | 46,980 | 47,241 | $ | 52.1 | $ | 1,103 | $ | 32.4 | $ | 32.4 | ||

| (a) | Due to the nature of heap leach operations, recovery rates at Bald Mountain cannot be accurately measured on a quarterly basis. Recovery rates at Fort Knox and Round Mountain represent mill recovery only. | |||||||||||||

| (b) | "nm" means not meaningful. | |||||||||||||

| (c) | Gold equivalent ounces include silver ounces produced and sold converted to a gold equivalent based on the ratio of the average spot market prices for the commodities for each period. The ratios for the quarters presented are as follows: Q1 2025: 89.69:1; Q4 2024: 84.67:1; Q3 2024: 84.06:1; Q2 2024: 81.06:1; Q1 2024: 88.70:1. | |||||||||||||

| (d) | “Production cost of sales per equivalent ounce sold” is defined as production cost of sales divided by total gold equivalent ounces sold. | |||||||||||||

| (e) | "Total Cap Ex" is “Additions to property, plant and equipment” on the interim condensed consolidated statements of cash flows. "Cap Ex - sustaining" is a non-GAAP financial measure. The definition and reconciliation of this non-GAAP financial measure is included on pages 21 to 22 of this news release. | |||||||||||||

| (f) | La Coipa silver grade and recovery were as follows: Q1 2025: 31.97 g/t, | |||||||||||||

| (g) | The Fort Knox segment is composed of Fort Knox and Manh Choh, and comparative results shown are presented in accordance with the current year’s presentation. Manh Choh tonnes of ore processed and grade were as follows: Q1 2025: 294,238 tonnes, 7.39 g/t; Q4 2024: 138,937 tonnes, 9.58 g/t; Q3 2024: 379,786 tonnes, 9.13 g/t. Tonnes of ore processed and grade were nil for all other periods presented as production commenced in July 2024. The attributable results for Fort Knox include | |||||||||||||

Reconciliation of non-GAAP financial measures and ratios

The Company has included certain non-GAAP financial measures and ratios in this document. These financial measures and ratios are not defined under IFRS and should not be considered in isolation. The Company believes that these financial measures and ratios, together with financial measures and ratios determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Company. The inclusion of these financial measures and ratios is meant to provide additional information and should not be used as a substitute for performance measures prepared in accordance with IFRS. These financial measures and ratios are not necessarily standard and therefore may not be comparable to other issuers.

Adjusted Net Earnings Attributable to Common Shareholders and Adjusted Net Earnings per Share

Adjusted net earnings attributable to common shareholders and adjusted net earnings per share are non-GAAP financial measures and ratios which determine the performance of the Company, excluding certain impacts which the Company believes are not reflective of the Company’s underlying performance for the reporting period, such as the impact of foreign exchange gains and losses, reassessment of prior year taxes and/or taxes otherwise not related to the current period, impairment charges (reversals), gains and losses and other one-time costs related to acquisitions, dispositions and other transactions, and non-hedge derivative gains and losses. Although some of the items are recurring, the Company believes that they are not reflective of the underlying operating performance of its current business and are not necessarily indicative of future operating results. Management believes that these measures and ratios, which are used internally to assess performance and in planning and forecasting future operating results, provide investors with the ability to better evaluate underlying performance, particularly since the excluded items are typically not included in public guidance. However, adjusted net earnings and adjusted net earnings per share measures and ratios are not necessarily indicative of net earnings and earnings per share measures and ratios as determined under IFRS.

The following table provides a reconciliation of net earnings to adjusted net earnings for the periods presented:

| (expressed in millions of U.S. dollars, except per share amounts) | Three months ended | ||||||

| March 31, | |||||||

| 2025 | 2024 | ||||||

| Net earnings attributable to common shareholders - as reported | $ | 368.0 | $ | 107.0 | |||

| Adjusting items: | |||||||

| Foreign exchange losses (gains) | 7.7 | (3.5 | ) | ||||

| Foreign exchange (gains) losses on translation of tax basis and foreign exchange on deferred income taxes within income tax expense | (5.9 | ) | 4.0 | ||||

| Taxes in respect of prior periods | (7.9 | ) | 8.0 | ||||

| Other(a) | 1.7 | 10.5 | |||||

| Tax effects of the above adjustments | 0.4 | (1.1 | ) | ||||

| (4.0 | ) | 17.9 | |||||

| Adjusted net earnings attributable to common shareholders | $ | 364.0 | $ | 124.9 | |||

| Weighted average number of common shares outstanding - Basic | 1,229.6 | 1,228.3 | |||||

| Adjusted net earnings per share | $ | 0.30 | $ | 0.10 | |||

| Basic earnings per share attributable to common shareholders - as reported | $ | 0.30 | $ | 0.09 | |||

| (a) | Other includes various impacts, such as one-time costs and credits at sites, restructuring costs, adjustments related to prior years as well as gains and losses on assets and hedges, which the Company believes are not reflective of the Company’s underlying performance for the reporting period. |

Attributable Free Cash Flow

Attributable free cash flow is a non-GAAP financial measure and is defined as net cash flow provided from operating activities less attributable capital expenditures and non-controlling interest included in net cash flows provided from operating activities. The Company believes that this measure, which is used internally to evaluate the Company’s underlying cash generation performance and the ability to repay creditors and return cash to shareholders, provides investors with the ability to better evaluate the Company’s underlying performance. However, this measure is not necessarily indicative of operating earnings or net cash flow provided from operating activities as determined under IFRS.

The following table provides a reconciliation of attributable free cash flow for the periods presented:

| (expressed in millions of U.S. dollars) | Three months ended | ||||||

| March 31, | |||||||

| 2025 | 2024 | ||||||

| Net cash flow provided from operating activities - as reported | $ | 597.1 | $ | 374.4 | |||

| Adjusting items: | |||||||

| Attributable(a) capital expenditures | (204.1 | ) | (232.1 | ) | |||

| Non-controlling interest(b) cash flow (from) used in operating activities | (22.2 | ) | 3.0 | ||||

| Attributable(a) free cash flow | $ | 370.8 | $ | 145.3 | |||

See page 22 for details of the footnotes referenced within the table above.

Attributable Adjusted Operating Cash Flow

Attributable adjusted operating cash flow is a non-GAAP financial measure and is defined as net cash flow provided from operating activities excluding changes in working capital, certain impacts which the Company believes are not reflective of the Company’s regular operating cash flow, and net cash flows provided from operating activities, net of working capital changes, relating to non-controlling interests. Working capital can be volatile due to numerous factors, including the timing of tax payments. The Company uses attributable adjusted operating cash flow internally as a measure of the underlying operating cash flow performance and future operating cash flow-generating capability of the Company. However, the attributable adjusted operating cash flow measure is not necessarily indicative of net cash flow provided from operating activities as determined under IFRS.

The following table provides a reconciliation of attributable adjusted operating cash flow for the periods presented:

| (expressed in millions of U.S. dollars) | Three months ended | ||||||

| March 31, | |||||||

| 2025 | 2024 | ||||||

| Net cash flow provided from operating activities - as reported | $ | 597.1 | $ | 374.4 | |||

| Adjusting items: | |||||||

| Working capital changes: | |||||||

| Accounts receivable and other assets | (7.1 | ) | (8.8 | ) | |||

| Inventories | 38.4 | (5.9 | ) | ||||

| Accounts payable and other liabilities, including income taxes paid | 77.7 | 65.2 | |||||

| 706.1 | 424.9 | ||||||

| Non-controlling interest(b) cash flow (from) used in operating activities, net of working capital changes | (29.9 | ) | 0.8 | ||||

| Attributable(a) adjusted operating cash flow | $ | 676.2 | $ | 425.7 | |||

See page 22 for details of the footnotes referenced within the table above.

Attributable Average Realized Gold Price per Ounce

Attributable average realized gold price per ounce is a non-GAAP ratio which calculates the average price realized from gold sales attributable to the Company. The Company believes that this measure provides a more accurate measure with which to compare the Company's gold sales performance to market gold prices. The following table provides a reconciliation of attributable average realized gold price per ounce for the periods presented:

| (expressed in millions of U.S. dollars, except ounces and average realized gold price per ounce) | Three months ended | ||||||

| March 31, | |||||||

| 2025 | 2024 | ||||||

| Metal sales - as reported | $ | 1,497.5 | $ | 1,081.5 | |||

| Less: silver revenue(c) | (22.5 | ) | (39.1 | ) | |||

| Less: non-controlling interest(b) gold revenue | (50.1 | ) | - | ||||

| Attributable(a) gold revenue | $ | 1,424.9 | $ | 1,042.4 | |||

| Gold ounces sold | 516,268 | 503,604 | |||||

| Less: non-controlling interest(b) gold ounces sold | (17,383 | ) | - | ||||

| Attributable(a) gold ounces sold | 498,885 | 503,604 | |||||

| Attributable(a) average realized gold price per ounce | $ | 2,856 | $ | 2,070 | |||

| Average realized gold price per ounce(d) | $ | 2,857 | $ | 2,070 | |||

See page 22 for details of the footnotes referenced within the table above

Attributable Production Cost of Sales per Equivalent Ounce Sold

Production cost of sales per equivalent ounce sold is defined as production cost of sales, as reported on the interim condensed consolidated statement of operations, divided by the total number of gold equivalent ounces sold. This measure converts the Company’s non-gold production into gold equivalent ounces and credits it to total production.

Attributable production cost of sales per equivalent ounce sold is a non-GAAP ratio and is defined as attributable production cost of sales divided by the attributable number of gold equivalent ounces sold. This measure converts the Company’s attributable non-gold production into gold equivalent ounces and credits it to total attributable production. Management uses this measure to monitor and evaluate the performance of its operating properties that are attributable to its shareholders.

The following table provides a reconciliation of production cost of sales and attributable production cost of sales per equivalent ounce sold for the periods presented:

| (expressed in millions of U.S. dollars, except ounces and production cost of sales per equivalent ounce) | Three months ended | |||||

| March 31, | ||||||

| 2025 | 2024 | |||||

| Production cost of sales - as reported | $ | 546.7 | $ | 512.9 | ||

| Less: non-controlling interest(b)production cost of sales | (20.7 | ) | - | |||

| Attributable(a)production cost of sales | $ | 526.0 | $ | 512.9 | ||

| Gold equivalent ounces sold | 524,089 | 522,400 | ||||

| Less: non-controlling interest(b)gold equivalent ounces sold | (17,525 | ) | - | |||

| Attributable(a)gold equivalent ounces sold | 506,564 | 522,400 | ||||

| Attributable(a)production cost of sales per equivalent ounce sold | $ | 1,038 | $ | 982 | ||

| Production cost of sales per equivalent ounce sold(e) | $ | 1,043 | $ | 982 | ||

See page 22 for details of the footnotes referenced within the table above.

Attributable Production Cost of Sales per Ounce Sold on a By-Product Basis

Attributable production cost of sales per ounce sold on a by-product basis is a non-GAAP ratio which calculates the Company’s non-gold production as a credit against its per ounce production costs, rather than converting its non-gold production into gold equivalent ounces and crediting it to total production, as is the case in co-product accounting. Management believes that this ratio provides investors with the ability to better evaluate Kinross’ production cost of sales per ounce on a comparable basis with other major gold producers who routinely calculate their cost of sales per ounce using by-product accounting rather than co-product accounting.

The following table provides a reconciliation of attributable production cost of sales per ounce sold on a by-product basis for the periods presented:

| (expressed in millions of U.S. dollars, except ounces and production cost of sales per ounce) | Three months ended | ||||||

| March 31, | |||||||

| 2025 | 2024 | ||||||

| Production cost of sales - as reported | $ | 546.7 | $ | 512.9 | |||

| Less: non-controlling interest(b) production cost of sales | (20.7 | ) | - | ||||

| Less: attributable(a) silver revenue(c) | (22.1 | ) | (39.1 | ) | |||

| Attributable(a) production cost of sales net of silver by-product revenue | $ | 503.9 | $ | 473.8 | |||

| Gold ounces sold | 516,268 | 503,604 | |||||

| Less: non-controlling interest(b) gold ounces sold | (17,383 | ) | - | ||||

| Attributable(a) gold ounces sold | 498,885 | 503,604 | |||||

| Attributable(a) production cost of sales per ounce sold on a by-product basis | $ | 1,010 | $ | 941 | |||

| Production cost of sales per equivalent ounce sold(e) | $ | 1,043 | $ | 982 | |||

See page 22 for details of the footnotes referenced within the table above.

Attributable All-In Sustaining Cost and All-In Cost per Ounce Sold on a By-Product Basis

Attributable all-in sustaining cost and all-in cost per ounce sold on a by-product basis are non-GAAP financial measures and ratios, as applicable, calculated based on guidance published by the World Gold Council (“WGC”). The WGC is a market development organization for the gold industry and is an association whose membership comprises leading gold mining companies including Kinross. Although the WGC is not a mining industry regulatory organization, it worked closely with its member companies to develop these metrics. Adoption of the all-in sustaining cost and all-in cost metrics is voluntary and not necessarily standard, and therefore, these measures and ratios presented by the Company may not be comparable to similar measures and ratios presented by other issuers. The Company believes that the all-in sustaining cost and all-in cost measures complement existing measures and ratios reported by Kinross.

All-in sustaining cost includes both operating and capital costs required to sustain gold production on an ongoing basis. The value of silver sold is deducted from the total production cost of sales as it is considered residual production, i.e. a by-product. Sustaining operating costs represent expenditures incurred at current operations that are considered necessary to maintain current production. Sustaining capital represents capital expenditures at existing operations comprising mine development costs, including capitalized development, and ongoing replacement of mine equipment and other capital facilities, and does not include capital expenditures for major growth projects or enhancement capital for significant infrastructure improvements at existing operations.

All-in cost is comprised of all-in sustaining cost as well as operating expenditures incurred at locations with no current operation, or costs related to other non-sustaining activities, and capital expenditures for major growth projects or enhancement capital for significant infrastructure improvements at existing operations.

Attributable all-in sustaining cost and all-in cost per ounce sold on a by-product basis are calculated by adjusting production cost of sales, as reported on the interim condensed consolidated statements of operations, as follows:

| (expressed in millions of U.S. dollars, except ounces and costs per ounce) | Three months ended | ||||||

| March 31, | |||||||

| 2025 | 2024 | ||||||

| Production cost of sales - as reported | $ | 546.7 | $ | 512.9 | |||

| Less: non-controlling interest(b)production cost of sales | (20.7 | ) | - | ||||

| Less: attributable(a)silver revenue(c) | (22.1 | ) | (39.1 | ) | |||

| Attributable(a)production cost of sales net of silver by-product revenue | $ | 503.9 | $ | 473.8 | |||

| Adjusting items on an attributable(a)basis: | |||||||

| General and administrative(f) | 35.7 | 30.7 | |||||

| Other operating expense - sustaining(g) | 0.2 | 0.8 | |||||

| Reclamation and remediation - sustaining(h) | 22.3 | 18.3 | |||||

| Exploration and business development - sustaining(i) | 12.5 | 8.7 | |||||

| Additions to property, plant and equipment - sustaining(j) | 88.2 | 109.3 | |||||

| Lease payments - sustaining(k) | 1.3 | 3.4 | |||||

| All-in Sustaining Cost on a by-product basis - attributable(a) | $ | 664.1 | $ | 645.0 | |||

| Adjusting items on an attributable(a)basis: | |||||||

| Other operating expense - non-sustaining(g) | 16.2 | 10.1 | |||||

| Reclamation and remediation - non-sustaining(h) | 2.3 | 1.7 | |||||

| Exploration and business development - non-sustaining(i) | 29.4 | 32.9 | |||||

| Additions to property, plant and equipment - non-sustaining(j) | 115.9 | 122.8 | |||||

| Lease payments - non-sustaining(k) | 0.2 | - | |||||

| All-in Cost on a by-product basis - attributable(a) | $ | 828.1 | $ | 812.5 | |||

| Gold ounces sold | 516,268 | 503,604 | |||||

| Less: non-controlling interest(b)gold ounces sold | (17,383 | ) | - | ||||

| Attributable(a)gold ounces sold | 498,885 | 503,604 | |||||

| Attributable(a)all-in sustaining cost per ounce sold on a by-product basis | $ | 1,331 | $ | 1,281 | |||

| Attributable(a)all-in cost per ounce sold on a by-product basis | $ | 1,660 | $ | 1,613 | |||

| Production cost of sales per equivalent ounce sold(e) | $ | 1,043 | $ | 982 | |||

See page 22 for details of the footnotes referenced within the table above.

Attributable All-In Sustaining Cost and All-In Cost per Equivalent Ounce Sold

The Company also assesses its attributable all-in sustaining cost and all-in cost on a gold equivalent ounce basis. Under these non-GAAP financial measures and ratios, the Company’s production of silver is converted into gold equivalent ounces and credited to total production.

Attributable all-in sustaining cost and all-in cost per equivalent ounce sold are calculated by adjusting production cost of sales, as reported on the interim condensed consolidated statements of operations, as follows:

| (expressed in millions of U.S. dollars, except ounces and costs per ounce) | Three months ended | |||||

| March 31, | ||||||

| 2025 | 2024 | |||||

| Production cost of sales - as reported | $ | 546.7 | $ | 512.9 | ||

| Less: non-controlling interest(b)production cost of sales | (20.7 | ) | - | |||

| Attributable(a)production cost of sales | $ | 526.0 | $ | 512.9 | ||

| Adjusting items on an attributable(a)basis: | ||||||

| General and administrative(f) | 35.7 | 30.7 | ||||

| Other operating expense - sustaining(g) | 0.2 | 0.8 | ||||

| Reclamation and remediation - sustaining(h) | 22.3 | 18.3 | ||||

| Exploration and business development - sustaining(i) | 12.5 | 8.7 | ||||

| Additions to property, plant and equipment - sustaining(j) | 88.2 | 109.3 | ||||

| Lease payments - sustaining(k) | 1.3 | 3.4 | ||||

| All-in Sustaining Cost - attributable(a) | $ | 686.2 | $ | 684.1 | ||

| Adjusting items on an attributable(a)basis: | ||||||

| Other operating expense - non-sustaining(g) | 16.2 | 10.1 | ||||

| Reclamation and remediation - non-sustaining(h) | 2.3 | 1.7 | ||||

| Exploration and business development - non-sustaining(i) | 29.4 | 32.9 | ||||

| Additions to property, plant and equipment - non-sustaining(j) | 115.9 | 122.8 | ||||

| Lease payments - non-sustaining(k) | 0.2 | - | ||||

| All-in Cost - attributable(a) | $ | 850.2 | $ | 851.6 | ||

| Gold equivalent ounces sold | 524,089 | 522,400 | ||||

| Less: non-controlling interest(b)gold equivalent ounces sold | (17,525 | ) | - | |||

| Attributable(a)gold equivalent ounces sold | 506,564 | 522,400 | ||||

| Attributable(a)all-in sustaining cost per equivalent ounce sold | $ | 1,355 | $ | 1,310 | ||

| Attributable(a)all-in cost per equivalent ounce sold | $ | 1,678 | $ | 1,630 | ||

| Production cost of sales per equivalent ounce sold(e) | $ | 1,043 | $ | 982 | ||

See page 22 for details of the footnotes referenced within the table above.

Capital Expenditures and Attributable Capital Expenditures

Capital expenditures are classified as either sustaining capital expenditures or non-sustaining capital expenditures, depending on the nature of the expenditure. Sustaining capital expenditures typically represent capital expenditures at existing operations including capitalized exploration costs and capitalized development unless related to major projects, ongoing replacement of mine equipment and other capital facilities and other capital expenditures and is calculated as total additions to property, plant and equipment (as reported on the interim condensed consolidated statements of cash flows), less non-sustaining capital expenditures. Non-sustaining capital expenditures represent capital expenditures for major projects, including major capital development projects at existing operations that are expected to materially benefit the operation, as well as enhancement capital for significant infrastructure improvements at existing operations. Management believes the distinction between sustaining capital expenditures and non-sustaining expenditures is a useful indicator of the purpose of capital expenditures and this distinction is an input into the calculation of attributable all-in sustaining costs per ounce and attributable all-in costs per ounce. The categorization of sustaining capital expenditures and non-sustaining capital expenditures is consistent with the definitions under the WGC all-in cost standard. Sustaining capital expenditures and non-sustaining capital expenditures are not defined under IFRS, however, the sum of these two measures total to additions to property, plant and equipment as disclosed under IFRS on the interim condensed consolidated statements of cash flows.

Additions to property, plant and equipment per the interim condensed consolidated statements of cash flows includes

The following table provides a reconciliation of the classification of capital expenditures for the periods presented:

| (expressed in millions of U.S. dollars) | |||||||||||||||||||||||

| Three months ended March 31, 2025 | Tasiast (Mauritania) | Paracatu (Brazil) | La Coipa (Chile) | Fort Knox(l) (USA) | Round Mountain (USA) | Bald Mountain (USA) | Total USA | Other | Total | ||||||||||||||

| Sustaining capital expenditures | $ | 13.7 | $ | 24.4 | $ | 15.6 | $ | 28.2 | $ | 2.8 | $ | 6.9 | $ | 37.9 | $ | 0.2 | $ | 91.8 | |||||

| Non-sustaining capital expenditures | 66.4 | - | - | - | 26.8 | 10.9 | 37.7 | 11.8 | 115.9 | ||||||||||||||

| Additions to property, plant and equipment - per cash flow | $ | 80.1 | $ | 24.4 | $ | 15.6 | $ | 28.2 | $ | 29.6 | $ | 17.8 | $ | 75.6 | $ | 12.0 | $ | 207.7 | |||||

| Less: Non-controlling interest(b) | $ | - | $ | - | $ | - | $ | (3.6 | ) | $ | - | $ | - | $ | (3.6 | ) | $ | - | $ | (3.6 | ) | ||

| Attributable(a)capital expenditures | $ | 80.1 | $ | 24.4 | $ | 15.6 | $ | 24.6 | $ | 29.6 | $ | 17.8 | $ | 72.0 | $ | 12.0 | $ | 204.1 | |||||

| Three months ended March 31, 2024 | |||||||||||||||||||||||

| Sustaining capital expenditures | $ | 10.1 | $ | 19.6 | $ | 7.2 | $ | 37.7 | $ | 3.7 | $ | 32.4 | $ | 73.8 | $ | (1.4 | ) | $ | 109.3 | ||||

| Non-sustaining capital expenditures | 69.4 | - | - | 40.9 | 15.6 | - | 56.5 | 6.7 | 132.6 | ||||||||||||||

| Additions to property, plant and equipment - per cash flow | $ | 79.5 | $ | 19.6 | $ | 7.2 | $ | 78.6 | $ | 19.3 | $ | 32.4 | $ | 130.3 | $ | 5.3 | $ | 241.9 | |||||

| Less: Non-controlling interest(b) | $ | - | $ | - | $ | - | $ | (9.8 | ) | $ | - | $ | - | $ | (9.8 | ) | $ | - | $ | (9.8 | ) | ||

| Attributable(a)capital expenditures | $ | 79.5 | $ | 19.6 | $ | 7.2 | $ | 68.8 | $ | 19.3 | $ | 32.4 | $ | 120.5 | $ | 5.3 | $ | 232.1 | |||||

See page 22 for details of the footnotes referenced within the tables above.

Endnotes

| (a) | “Attributable” measures and ratios include Kinross’ share of Manh Choh ( |

| (b) | “Non-controlling interest” represents the non-controlling interest portion in Manh Choh ( |

| (c) | “Silver revenue” represents the portion of metal sales realized from the production of secondary or by-product metal (i.e. silver), which is produced as a by-product of the process used to produce gold and effectively reduces the cost of gold production. |

| (d) | “Average realized gold price per ounce” is defined as gold revenue divided by total gold ounces sold. |

| (e) | “Production cost of sales per equivalent ounce sold” is defined as production cost of sales divided by total gold equivalent ounces sold. |

| (f) | “General and administrative” expenses are as reported on the interim condensed consolidated statements of operations, excluding certain impacts which the Company believes are not reflective of the Company’s underlying performance for the reporting period. General and administrative expenses are considered sustaining costs as they are required to be absorbed on a continuing basis for the effective operation and governance of the Company. |

| (g) | “Other operating expense – sustaining” is calculated as “Other operating expense” as reported on the interim condensed consolidated statements of operations, less the non-controlling interest portion in Manh Choh ( |

| (h) | “Reclamation and remediation – sustaining” is calculated as current period accretion related to reclamation and remediation obligations plus current period amortization of the corresponding reclamation and remediation assets, less the non-controlling interest portion in Manh Choh ( |

| (i) | “Exploration and business development – sustaining” is calculated as “Exploration and business development” expenses as reported on the interim condensed consolidated statements of operations, less the non-controlling interest portion in Manh Choh ( |

| (j) | “Additions to property, plant and equipment – sustaining” and “non-sustaining” are as presented on pages 21 and 22 of this news release and include Kinross’ share of Manh Choh’s ( |

| (k) | “Lease payments – sustaining” represents the majority of lease payments as reported on the interim condensed consolidated statements of cash flows and is made up of the principal and financing components of such cash payments, less the non-controlling interest portion in Manh Choh ( |

| (l) | The Fort Knox segment is composed of Fort Knox and Manh Choh for all periods presented. |

Appendix A

Figure 1: At Round Mountain Phase X, drill results continue to confirm good grades and widths in the primary target zones.

https://www.globenewswire.com/NewsRoom/AttachmentNg/0a429c1e-3820-4db5-941f-144d16edceb1

Figure 2: At Curlew, drill results continue to demonstrate increased grades and widths that could support high-margin production.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/68f69198-0769-475f-8fa0-724430e0104e

Cautionary statement on forward-looking information

All statements, other than statements of historical fact, contained or incorporated by reference in this news release including, but not limited to, any information as to the future financial or operating performance of Kinross, constitute “forward-looking information” or “forward-looking statements” within the meaning of certain securities laws, including the provisions of the Securities Act (Ontario) and the provisions for “safe harbor” under the United States Private Securities Litigation Reform Act of 1995 and are based on expectations, estimates and projections as of the date of this news release. Forward-looking statements contained in this news release, include, but are not limited to, those under the headings (or headings that include) “2025 first-quarter highlights”, “Return of Capital to shareholders”, “Operations”, “Development projects and exploration highlights”, “Sustainability”, and “CEO commentary”, as well as statements with respect to our guidance for production, cost guidance, including production costs of sales, all-in sustaining cost of sales, and capital expenditures; statements with respect to our forecasts for cash flow and free cash flow; anticipated returns of capital to shareholders, including the declaration, payment and sustainability of the Company’s dividends; the size, scope and execution of the proposed share buybacks and the anticipated timing thereof, including the Company’s statement targeting share buybacks for 2025 of at least

Key Sensitivities

Approximately

A

Specific to the Brazilian real, a

Specific to the Chilean peso, a

A

A

Other information

Where we say "we", "us", "our", the "Company", or "Kinross" in this news release, we mean Kinross Gold Corporation and/or one or more or all of its subsidiaries, as may be applicable.

The technical information about the Company’s mineral properties contained in this news release has been prepared under the supervision of Mr. Nicos Pfeiffer, an officer of the Company who is a “qualified person” within the meaning of National Instrument 43-101.

Source: Kinross Gold Corporation

____________________

12 Refers to all of the currencies in the countries where the Company has mining operations, fluctuating simultaneously by