Liberty Gold Reports Consistent Gold Grades from Infill Drilling at Black Pine Gold Project, Idaho

Rhea-AI Summary

Liberty Gold (OTCQX: LGDTF) reported additional 2025 reverse circulation infill drilling results at its 100% owned Black Pine oxide gold project in Idaho on December 3, 2025. Key drill intercepts include 0.68 g/t Au over 24.4 m, 0.81 g/t Au over 22.9 m and 0.61 g/t Au over 71.6 m. The company said results correlate with the pre-feasibility block model, support lateral continuity of high-grade oxide zones, and help convert Inferred resources to Indicated ahead of a Feasibility resource update.

Feasibility modelling is underway with an expected ~40,000 m of new drilling to be modelled; the 2025 program targets 33,000 m by mid-December, ~13,000 m of which will be included in a future update. Some holes remain in the lab and PQ core metallurgical results are pending in early 2026.

Positive

- Confirmed correlation with pre-feasibility block model

- Infill drilling converting Inferred to Indicated resources

- Defining new near-surface oxide gold where previously modelled as waste

- Feasibility modelling to include ~40,000 m of new drilling

- 2025 drilling program ~33,000 m, with ~13,000 m to be included in resource update

Negative

- ~30 Rangefront holes still in the lab; results pending

- PQ core metallurgical results expected in early 2026 (pending)

- Reported intercepts are drilled thickness; true thickness ~70-100% (uncertainty in true widths)

News Market Reaction

On the day this news was published, LGDTF declined 1.61%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Peers in the Gold industry showed mixed moves, with names like TDRRF up 1.88% and AMXEF down 4.03%, suggesting stock-specific rather than broad sector-driven trading for LGDTF.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 03 | Infill drilling update | Positive | -1.6% | Infill RC drilling confirmed modelled oxide gold grades and continuity. |

| Dec 01 | ESG disclosure update | Neutral | -2.6% | Publication of 2024 ESG report outlining sustainability and permitting progress. |

| Nov 26 | Permitting milestone | Positive | +8.2% | Mine Plan of Operations deemed complete, enabling NEPA EIS to proceed. |

| Nov 12 | Feasibility start | Positive | +3.5% | Commencement of Feasibility Study engineering for Black Pine project. |

| Nov 10 | Q3 2025 results | Neutral | +2.1% | Q3 loss alongside financing, cash position, and positive technical updates. |

Recent Black Pine development and drilling news often led to mixed reactions, with some positive permitting/feasibility milestones aligning with gains, while drilling and ESG updates have at times coincided with share price weakness.

Over the last month, Liberty Gold has focused on advancing its Black Pine oxide gold project. On Nov 10, 2025 it reported Q3 results and a financing/private placement, followed by commencement of Feasibility Study engineering on Nov 12. A key permitting step came on Nov 26 when the Mine Plan of Operations was deemed administratively complete. On Dec 1, Liberty released its 2024 ESG report. Today’s Dec 3 drilling results extend that trajectory by confirming the resource model with new infill intercepts.

Market Pulse Summary

This announcement detailed consistent oxide gold grades from infill reverse circulation drilling at Black Pine, supporting the pre-feasibility block model and converting Inferred to Indicated resources. With roughly 40,000 m of new drilling feeding the Feasibility resource model and a 33,000 m 2025 program, future updates will clarify how near-surface mineralization and new intercepts affect the project. Investors may focus on upcoming metallurgical results, resource revisions, and Feasibility Study progress for further context.

Key Terms

reverse circulation technical

pre-feasibility technical

feasibility study technical

metallurgical medical

geotechnical technical

oxide technical

block model technical

AI-generated analysis. Not financial advice.

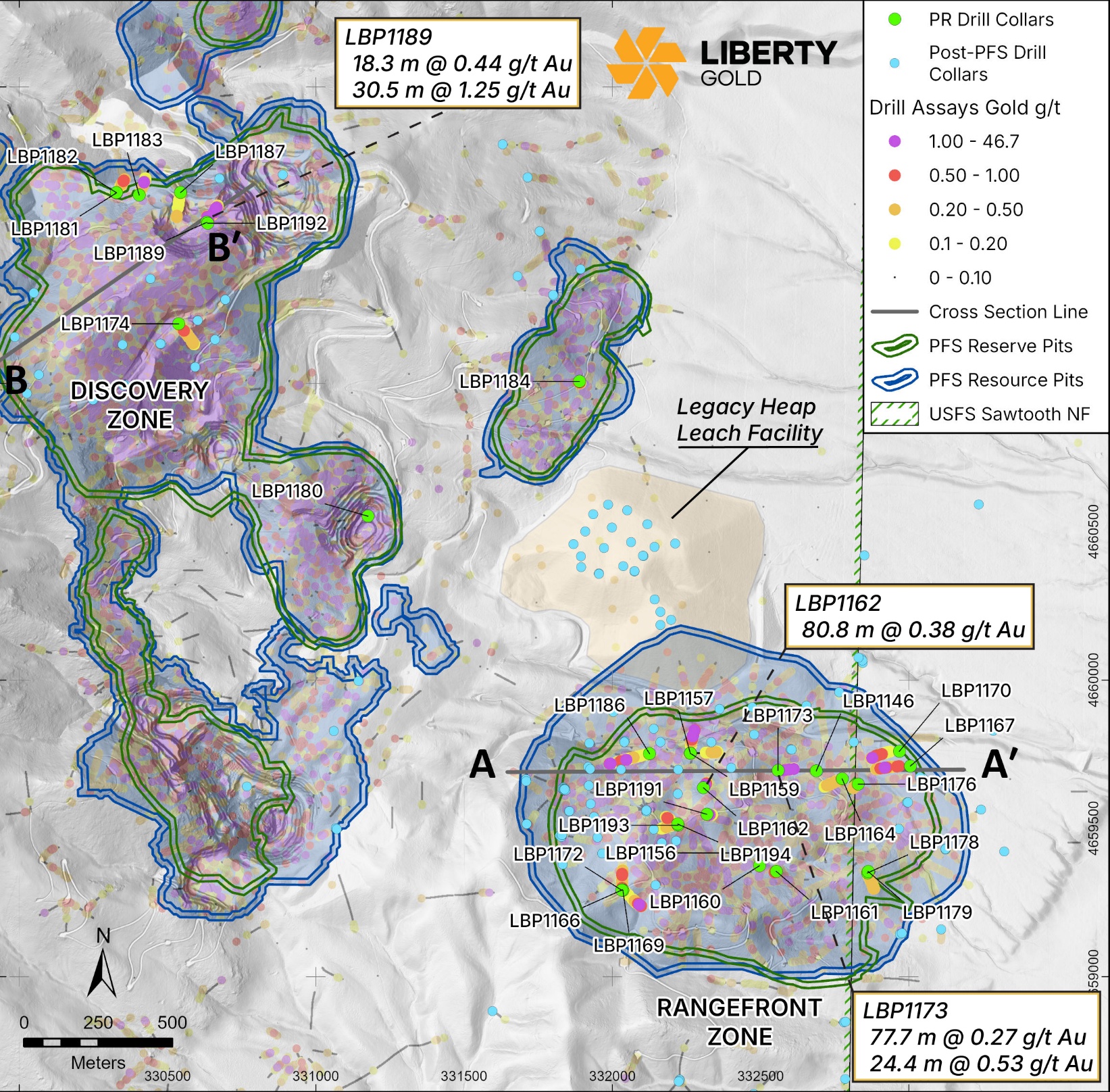

0.68 g/t Au over 24.4 meters and 0.81 g/t Au over 22.9 meters in LBP1179 at Rangefront

0.61 g/t Au over 71.6 meters in LBP1192 at Discovery

VANCOUVER, British Columbia, Dec. 03, 2025 (GLOBE NEWSWIRE) -- Liberty Gold Corp. (TSX: LGD; OTCQX: LGDTF) (“Liberty Gold” or the “Company”) is pleased to announce additional reverse circulation (“RC”) drill results from the 2025 resource infill drilling program at its

Highlights*

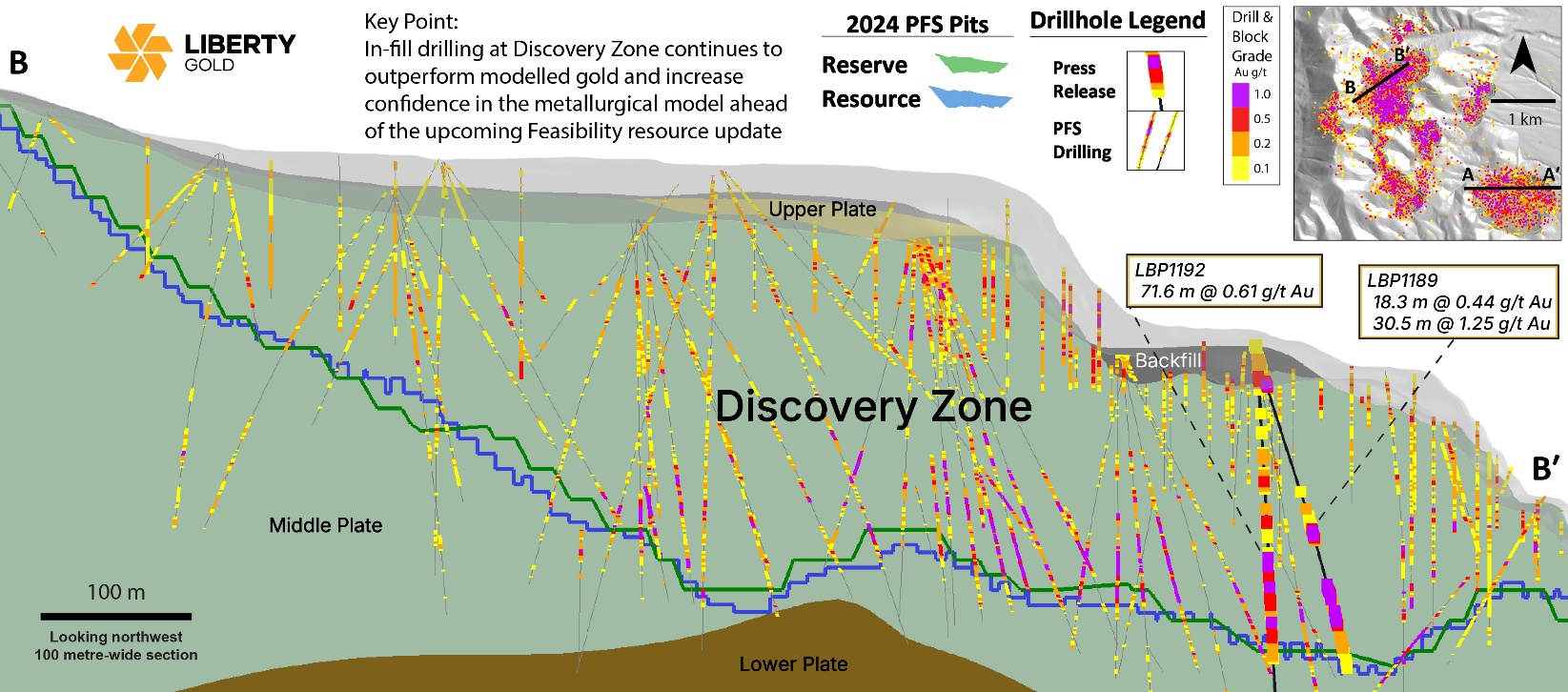

- Results demonstrate strong correlation with the pre-feasibility block model and reinforce confidence in the lateral continuity of high-grade oxide gold zones and leach recovery characteristics across the deposit providing the opportunity for further resource growth in the upcoming Feasibility resource update.

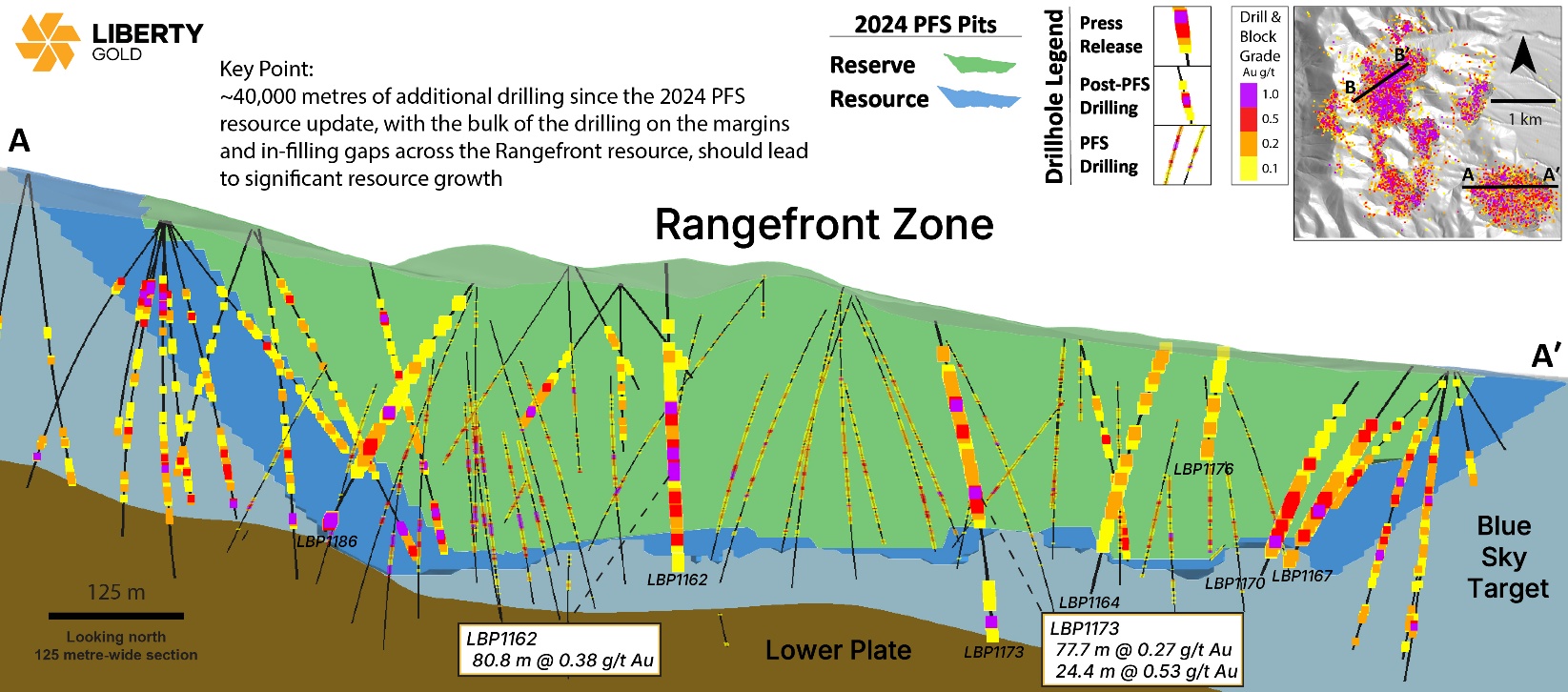

- Drilling across the current Rangefront resource pit is defining new near-surface gold mineralization in areas, which were previously classified as waste due to the lack of drilling. This is expected to have a positive impact on the strip ratio as Feasibility mine planning progresses.

- Infill drilling continues to convert Inferred resources to Indicated and provide detailed confirmation of gold grade and distribution, increasing model confidence ahead of the Feasibility Study.

- Feasibility Resource modelling is underway, with an expected ~40,000 metres (“m”) of new drilling into the model and is expected to be completed in early Q1, 2026.

- Drilling is on-going with 3 rigs and the 2025 program is expected to complete at 33,000 m by mid-December, approximately 13,000 m of which will be included in a future resource update.

* Results are reported as drilled thickness, true thickness is approximately 70

“Drilling at Discovery and Rangefront continues to provide strong, as-expected results, with some pleasant surprises for future oxide gold resource growth,” stated Pete Shabestari, Vice President of Exploration. “The consistency of these infill results gives us further validation of the resource model and reinforces our confidence in the continuity of gold mineralization as we advance preparation of the Feasibility resource estimate. Black Pine has consistently demonstrated resource growth commensurate with drilling, and we expect this to continue at Rangefront with our upcoming Feasibility resource update.”

For a table showing complete drill results for the current release, see this link:

https://libertygold.ca/images/news/2025/December/BP_Intercepts_20251203.pdf

Figure 1: Plan Map of the Rangefront and Discovery zones with current drill holes

g/t Au = grams per tonne of gold

RANGEFRONT ZONE HIGHLIGHTS:

21 drill holes are reported from Rangefront with an additional ~30 holes still in the lab, with drilling ongoing. Rangefront drilling continues to produce results in-line with modelled gold grade and metallurgical characteristics. The program is addressing near-surface ‘gaps’ in drill data, which were a result of early-stage, widely spaced exploration drill pads. This systematic infill drilling is defining new oxide gold mineralization, where previously there was interpreted waste/cover rocks and is expected to have a positive impact on waste to ore ratios in the feasibility mine planning.

In addition to exploration infill drilling metallurgical (“PQ”) core drilling (7 holes, 1,524 meters) has also been completed. Samples from that drilling are currently being processed, and results are expected in early 2026. Composites from these PQ core holes will contribute to the Phase 10 metallurgical program, designed to improve spatial coverage of variability samples across Rangefront, prompted by the increase in the mineralized footprint.

Figure 2: Cross Section through the Rangefront Zone

DISCOVERY ZONE HIGHLIGHTS:

Discovery Zone drilling has been focused on geotechnical data collection, geology and mineralization model validation, and resource class upgrades. Drilling in all areas has confirmed the resource model and added confidence in the metallurgical classification and modeling. Drilling to the north has confirmed and improved upon historic drill results and continues to show strong oxide gold results that should increase and expand modelled high-grade zones in the upcoming resource.

Figure 3: Cross Section through the Discovery Zone

ABOUT LIBERTY GOLD

Liberty Gold is focused on developing open pit oxide deposits in the Great Basin of the United States, home to large-scale gold projects that are ideal for open-pit mining. This region is one of the most prolific gold-producing regions in the world and stretches across Nevada and into Idaho and Utah. The Company is advancing the Black Pine Project in southeastern Idaho, a past-producing, Carlin-style gold system with a large, growing resource and strong economic potential. We know the Great Basin and are driven to discover and advance big gold deposits that can be mined profitably in open-pit scenarios and in an environmentally responsible manner.

For more information, visit libertygold.ca or contact:

Susie Bell, Manager, Investor Relations

Phone: 604-632-4677 or Toll Free 1-877-632-4677

info@libertygold.ca

Peter Shabestari, P.Geo., Vice-President Exploration, Liberty Gold, is the Company's designated Qualified Person for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and validated that the information contained in the release is accurate.

QUALITY ASSURANCE – QUALITY CONTROL

Drill composites were calculated using a cut-off of 0.10 g/t Au. Drill intersections are reported as drilled thicknesses. True widths of the mineralized intervals vary between

This news release contains “forward-looking information” and “forward-looking statements” within the meaning of applicable securities laws, including statements or information concerning, future financial or operating performance of Liberty Gold and its business, operations, properties and condition; planned de-risking activities at Liberty Gold’s mineral properties; future updates to the mineral resource, the potential quantity, recoverability and/or grade of minerals; the potential size of a mineralized zone or potential expansion of mineralization; proposed exploration and development of Liberty Gold’s exploration property interests; the results of mineral resource estimates or mineral reserve estimates and preliminary feasibility studies; and the Company’s anticipated expenditures.

Forward-looking information is often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "planned", "expect", "project", "predict", "potential", "targeting", "intends", "believe", "potential", and similar expressions, or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "should", "could", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information is not a guarantee of future performance and is based upon a number of estimates and assumptions of management at the date the statements are made including, among others, assumptions about future prices of gold, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, timely receipt of governmental or regulatory approvals, including any stock exchange approvals; receipt of a financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, results or timing of any mineral resources, resource conversion, pre-feasibility study, mineral reserves, or feasibility study; the availability of drill rigs, successful resolution of disputes and anticipated costs and expenditures. Many assumptions are based on factors and events that are not within the control of Liberty Gold and there is no assurance they will prove to be correct.

Such forward-looking information, involves known and unknown risks, which may cause the actual results to be materially different from any future results expressed or implied by such forward-looking information, including, risks related to the interpretation of results and/or the reliance on technical information provided by third parties as related to the Company’s mineral property interests; changes in project parameters as plans continue to be refined; current economic conditions; future prices of commodities; possible variations in grade or recovery rates; the costs and timing of the development of new deposits; failure of equipment or processes to operate as anticipated; the failure of contracted parties to perform; the timing and success of exploration activities generally; the timing or results of the publication of any mineral resources, mineral reserves or feasibility studies; delays in permitting; possible claims against the Company; labour disputes and other risks of the mining industry; delays in obtaining governmental approvals, financing, timing of the completion of exploration as well as those factors discussed in the Annual Information Form of the Company dated March 25, 2025, in the section entitled "Risk Factors", under Liberty Gold’s SEDAR+ profile at www.sedarplus.ca.

Although Liberty Gold has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results, and future events could differ materially from those anticipated in such statements. Liberty Gold disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except for material differences between actual results and previously disclosed material forward-looking information, or as otherwise required by law.

Except for statements of historical fact, information contained herein or incorporated by reference herein constitutes forward-looking statements and forward-looking information. Readers should not place undue reliance on forward-looking information. All forward-looking statements and forward-looking information attributable to us is expressly qualified by these cautionary statements.

Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Resources

The information, including any information incorporated by reference, and disclosure documents of Liberty Gold that are filed with Canadian securities regulatory authorities concerning mineral properties have been prepared in accordance with the requirements of securities laws in effect in Canada, which differ from the requirements of United States securities laws.

Without limiting the foregoing, these documents use the terms “measured resources”, “indicated resources”, “inferred resources” and “mineral reserves”. These terms are Canadian mining terms as defined in, and required to be disclosed in accordance with, NI 43-101, which references the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards, adopted by the CIM Council, as amended. However, these standards differ significantly from the mineral property disclosure requirements of the United States Securities and Exchange Commission (the “SEC”) in Regulation S-K Subpart 1300 (the “SEC Modernization Rules”) under the United States Securities Act of 1934, as amended. The Company does not file reports with the SEC and is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards.

Without limiting the foregoing, these documents use the terms “measured resources”, “indicated resources”, “inferred resources” and “mineral reserves”. These terms are Canadian mining terms as defined in, and required to be disclosed in accordance with, NI 43-101, which references the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards, adopted by the CIM Council, as amended. However, these standards differ significantly from the mineral property disclosure requirements of the United States Securities and Exchange Commission (the “SEC”) in Regulation S-K Subpart 1300 (the “SEC Modernization Rules”) under the United States Securities Act of 1934, as amended. The Company does not file reports with the SEC and is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Definition Standards.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/bf9ed1af-4a92-4b6a-a22c-d11639aee1df

https://www.globenewswire.com/NewsRoom/AttachmentNg/15034b27-1399-471f-bde7-6c2dce8b3460

https://www.globenewswire.com/NewsRoom/AttachmentNg/9ff85c8d-9aab-44b5-8d3c-8e6178880cee