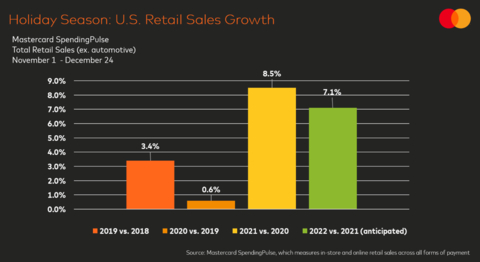

Mastercard SpendingPulse: U.S. Retail Sales Expected to Grow 7.1%* This Holiday Season

Mastercard SpendingPulse, Holiday Season:

“This holiday season, consumers may find themselves looking for ways to navigate the inflationary environment – from searching for deals to making trade-offs that allow for extra room in their gift-giving budgets,” said

The 2021 holiday season was resurgent for retailers (up +

-

Extended holiday shopping: With holiday shopping slated to begin early again this year, some of the season’s retail growth is expected to be pulled forward in October as consumers hunt for early deals. Key promotional days like Black Friday weekend are also expected to make a strong return along with

Christmas Eve , which falls on a Saturday, slated to be among the biggest days for retailers and last-minute shoppers. To understand how holiday shopping is shifting, check out the extended 75-day holiday forecast here.

-

‘Tis the season of savings: As inflation impacts consumer wallets, bargain hunting is expected to be in full force this holiday season. From deals and discounts to price monitoring and price matching, consumers are looking to stretch their dollars and get the most bang for their buck. E-commerce is anticipated to increase despite significant growth last year, up +

4.2% YOY/ +69.2% YO3Y, as the channel remains a convenient way for consumers to check prices in real time.

-

In-store experiences draw shoppers to stores: From the return of holiday doorbusters to new brick-and-mortar collaborations, retailers are aiming to boost holiday spirits by driving consumers into stores. In-store retail sales are expected to be up +

7.9% YOY/ +10.4% YO3Y. While e-commerce has seen marked growth in recent years, in-store spending made up more than 4/5 of retail sales from January throughAugust 2022 .

-

Fashion-forward gifting: Following nearly two years of loungewear and athleisure, consumers may be adding revamped wardrobes to their wish lists as social events and platforms have many dressing to impress. Apparel (+

4.6% YOY/ +25.3% YO3Y) and Luxury (+4.4% YOY/ +29.6% YO3Y) are expected to be hot holiday gift sectors, sending consumers into the new year in style.

“This holiday retail season is bound to be far more promotional than the last,” said

Mastercard SpendingPulse: August

The holiday season builds on the momentum seen this summer, with

*Total retail sales exclude automotive sales and measure the traditional holiday season defined

About Mastercard SpendingPulse

Mastercard SpendingPulse reports on national retail sales across all payment types in select markets around the world. The findings are based on aggregate sales activity in the

Mastercard SpendingPulse defines “U.S. retail sales” as sales at retailers and food services merchants of all sizes. Sales activity within the services sector (for example, travel services such as airlines and lodging) are not included.

About

View source version on businesswire.com: https://www.businesswire.com/news/home/20220911005077/en/

Alexandria.Pierroz@mastercard.com

914-260-1020

Source: Mastercard Investor Relations