MAA REPORTS SECOND QUARTER 2024 RESULTS

Rhea-AI Summary

Endeavour Mining announced the first gold pour from its Lafigué mine in Côte d'Ivoire on June 28, 2024. The project was delivered on budget and a quarter ahead of schedule, only 21 months after construction began. Lafigué is expected to produce 90-110koz of gold in FY-2024 at an AISC of $900-975/oz, increasing to approximately 200koz in FY-2025. The mine has a nameplate capacity of 4.0Mtpa and is expected to achieve commercial production in Q3-2024. This marks Endeavour's fifth successful project built in West Africa in the last decade, highlighting their competitive advantage in the region. The company now enters a phase of increased free cash flow generation, de-levering, and enhanced shareholder returns.

Positive

- First gold pour achieved on budget and ahead of schedule

- Expected production of 90-110koz gold in FY-2024, increasing to ~200koz in FY-2025

- Low AISC of $900-975/oz, indicating high profitability

- Nameplate capacity of 4.0Mtpa with commercial production expected in Q3-2024

- Low capital intensity of ~$150/oz of M&I resources

- Potential to produce over 200koz per year for at least 13 years

Negative

- None.

Insights

Endeavour Mining's successful completion of the Lafigué mine in Côte d'Ivoire marks a significant milestone for the company and the West African mining sector. The project's delivery on budget and a quarter ahead of schedule demonstrates Endeavour's operational excellence and project management capabilities.

Key points to consider:

- The rapid timeline from discovery to production (less than eight years) showcases Endeavour's efficiency in resource development.

- With expected production of 90-110koz in 2024 and ~200koz in 2025, Lafigué will significantly boost Endeavour's output.

- The projected All-In Sustaining Cost (AISC) of $900-975/oz positions Lafigué as a low-cost producer, potentially enhancing Endeavour's profit margins.

- The

$31 million discovery cost, equivalent to$12 per ounce of M&I resources, indicates highly efficient exploration practices. - The low capital intensity of ~$150/oz of M&I resources suggests a potentially strong return on investment.

This achievement strengthens Endeavour's position in West Africa and could attract investor attention to the company's growth strategy and operational capabilities. The focus on free cash flow generation and enhanced shareholder returns moving forward may appeal to value-oriented investors.

The completion of the Lafigué mine represents a pivotal moment for Endeavour Mining's financial outlook. Here's why this development is significant:

- Capital Efficiency: The project's on-budget delivery and ahead-of-schedule completion suggest strong cost control and efficient capital allocation.

- Production Ramp-up: Expected production of 90-110koz in 2024, increasing to ~200koz in 2025, should contribute substantially to revenue growth.

- Cost Profile: With an AISC of

$900-975 /oz, Lafigué is positioned to be a low-cost producer, potentially boosting overall profit margins. - Cash Flow Impact: The transition to a "new phase of increased free cash flow generation" could significantly improve Endeavour's financial flexibility.

- Balance Sheet Implications: The focus on de-levering suggests a strategic move to strengthen the company's financial position.

- Shareholder Value: Enhanced shareholder returns are highlighted as a priority, which could positively impact stock performance.

Investors should monitor how quickly Lafigué ramps up to full production and its impact on Endeavour's overall financial metrics in the coming quarters. The company's ability to replicate this success with future projects, such as Assafou, will be important for long-term growth prospects.

Endeavour Mining's successful launch of the Lafigué mine carries significant strategic implications for both the company and the broader gold mining sector:

- Competitive Advantage: The company's track record of delivering five projects in West Africa within the last decade, all on budget and schedule, solidifies its position as a leader in the region.

- Market Positioning: Lafigué's low AISC of

$900-975 /oz could position Endeavour among the lowest-cost producers globally, potentially improving its market valuation. - Growth Strategy: The rapid transition from discovery to production at Lafigué (less than eight years) demonstrates a scalable model for organic growth, which could be appealing to investors.

- Regional Focus: Endeavour's success in West Africa, described as "the world's most prospective and largest gold producing region," may attract more attention to this area from competitors and investors.

- Industry Benchmarking: The low discovery cost of

$12 per ounce of M&I resources sets a new industry standard, potentially influencing how the market values exploration success.

This achievement could catalyze a re-rating of Endeavour's stock and increase investor interest in companies with strong project pipelines in West Africa. The market will likely watch closely how Endeavour balances its promises of increased cash flow, debt reduction and enhanced shareholder returns in the coming quarters.

Constructed in only 21 months · Delivered on budget and ahead of schedule · Investment phase completed

ENDEAVOUR ACHIEVES FIRST GOLD POUR AT LAFIGUÉ MINE IN CÔTE D’IVOIRE

Constructed in only 21 months · Delivered on budget and ahead of schedule · Investment phase completed

HIGHLIGHTS:

|

Abidjan, 2 July 2024 – Endeavour Mining plc (LSE:EDV, TSX:EDV, OTCQX:EDVMF) (“Endeavour”, the “Group” or the “Company”) is pleased to announce that the first gold pour from the Lafigué mine in Côte d’Ivoire was achieved on 28 June 2024, marking the successful delivery of the project construction on budget and a quarter ahead of schedule.

Ian Cockerill, CEO, commented “We are proud to have achieved our first gold pour at Lafigué, which, alongside the first gold pour at the Sabodala-Massawa BIOX® expansion that we achieved in April, marks the successful completion of the recent phase of investment and growth that we started in Q2-2022. We now begin a new phase of increased free cash flow generation, de-levering and enhanced shareholder returns.

The Lafigué project is the fifth project that we have successfully built in West Africa in the last decade, which is a testament to the strength of our in-house project construction team and is a demonstration of our competitive advantage in West Africa, the world’s most prospective and largest gold producing region.

Lafigué is an excellent example of our ability to leverage this advantage by self-generating a project pipeline. We discovered Lafigué for a cost of

We believe this level of value creation is repeatable in West Africa, and we have already identified the Assafou deposit on the Tanda-Iguela property in Côte d’Ivoire, where we have delineated a top tier resource and another potential cornerstone asset, which will underpin our next phase of organic growth in a few years time.

With the current phase of organic growth completed, we are now focused on quickly ramping up our recent development projects to maximise their returns and support our near-term capital allocation priorities of de-levering our balance sheet and enhancing our shareholder returns.”

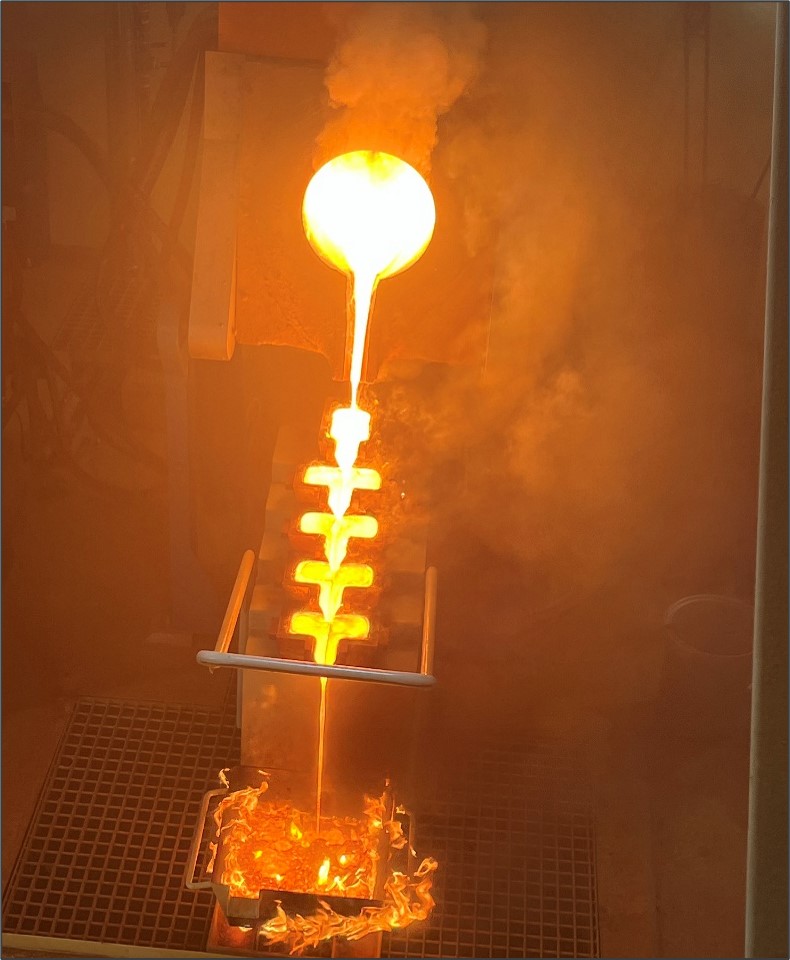

Since the start of wet commissioning on 30 May 2024, approximately 77kt of ore has been processed through the Lafigué processing plant, with all circuits operating in line with expectations. The first gold pour included gold from both the gravity and CIL circuits, and yielded approximately 380 ounces of gold. The Lafigué mine is expected to achieve commercial production and ramp up to its nameplate capacity of 4.0Mtpa in Q3-2024.

Figure 1: First gold pour at the Lafigué mine

Figure 2: Paul Day, General Manager at Lafigué with the first gold bar poured at the mine

ABOUT THE LAFIGUÉ MINE

The Lafigué mine is located towards the northern end of the Birimian aged Oumé-Fetekro greenstone belt, in north-central Côte d’Ivoire, approximately 500km from Abidjan by road. The Lafigué deposit is located in the northeast part of the Fetekro exploration permit, adjacent to existing infrastructure, including sealed paved roads and high voltage grid power. Endeavour has an

Endeavour began exploration on the Fetekro property in March 2017, following a strategic assessment of its exploration tenements which identified the project as a top priority target. To date, only a limited portion of the Fetekro property has been explored, as the priority has been the delineation of the Lafigué deposit. A maiden Mineral Resource Estimate for the Lafigué deposit was published on 29 October 2018 and subsequently updated on 3 September 2019, 18 August 2020 and 15 May 2022. A Preliminary Economic Assessment (“PEA”) was published on 18 August 2020 and a Preliminary Feasibility Study (“PFS”) was completed with the effective date of 31 December 2020.

Construction of the Lafigué project in Côte d'Ivoire was launched in Q4-2022, following the completion of a Definitive Feasibility Study (“DFS”) which confirmed Lafigué’s potential to be a cornerstone asset for Endeavour. The 2022 DFS contemplates a 12.8 year LOM with average annual production of 203koz at a low AISC of

As at 31 December 2023, Proven and Probable reserves totalled 49.8Mt at 1.69 g/t containing 2.7Moz of gold and Measured and Indicated resources (inclusive of reserves) totalled 46.2Mt at 2.04 g/t containing 3.0Moz of gold.

Given the strong exploration potential, Endeavour is targeting the discovery of 1.2 – 1.8Moz of Indicated resources across the Lafigué mining permit and the wider Fetekro exploration permit area over the 2021 to 2025 period at a discovery cost of

QUALIFIED PERSONS

Mark Morcombe, COO of Endeavour Mining plc., a Fellow of the Australasian Institute of Mining and Metallurgy, is a "Qualified Person" as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and approved the technical information in this news release.

CONTACT INFORMATION

| Jack Garman Vice President, Investor Relations +44 203 011 2723 jack.garman@endeavourmining.com | Brunswick Group LLP in London Carole Cable, Partner +44 207 404 5959 ccable@brunswickgroup.com |

ABOUT ENDEAVOUR MINING PLC

Endeavour Mining is one of the world’s senior gold producers and the largest in West Africa, with operating assets across Senegal, Cote d’Ivoire and Burkina Faso and a strong portfolio of advanced development projects and exploration assets in the highly prospective Birimian Greenstone Belt across West Africa.

A member of the World Gold Council, Endeavour is committed to the principles of responsible mining and delivering sustainable value to its employees, stakeholders and the communities where it operates. Endeavour is listed on the London and Toronto Stock Exchanges, under the symbol EDV.

For more information, please visit www.endeavourmining.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This news release contains "forward-looking statements" within the meaning of applicable securities laws. All statements, other than statements of historical fact, are "forward-looking statements". Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "expects", "expected", "budgeted", "forecasts", and "anticipates".

Forward-looking statements, while based on management's best estimates and assumptions, are subject to risks and uncertainties that may cause actual results to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to the successful integration of acquisitions; risks related to international operations; risks related to general economic conditions and credit availability, actual results of current exploration activities, unanticipated reclamation expenses; changes in project parameters as plans continue to be refined; fluctuations in prices of metals including gold; fluctuations in foreign currency exchange rates, increases in market prices of mining consumables, possible variations in ore reserves, grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes, title disputes, claims and limitations on insurance coverage and other risks of the mining industry; delays in the completion of development or construction activities, changes in national and local government regulation of mining operations, tax rules and regulations, and political and economic developments in countries in which Endeavour operates. Although Endeavour has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Please refer to Endeavour's most recent Annual Information Form filed under its profile at www.sedarplus.ca for further information respecting the risks affecting Endeavour and its business.

Attachment