First Andes Silver to Acquire Silver Focused Properties in New South Wales, Australia

Rhea-AI Summary

First Andes Silver (OTC: MSLVF) will acquire three silver-focused exploration licence applications in New South Wales, Australia — Carrington, Stoney Creek and Dartmoor — totaling ~454 km2 (45,400 ha) in the Lachlan Orogen, announced December 9, 2025.

Key highlights include historical surface assays up to 6,037 g/t Ag and 85 g/t Au at Carrington, past samples of 212 g/t Ag at Stoney Creek and reported small-scale Dartmoor production averaging 980 g/t Ag and 12% Cu. Purchase consideration: AUD $15,500 plus 1,500,000 common shares, subject to TSX Venture Exchange acceptance.

Positive

- Acquisition adds ~454 km2 of silver-focused tenure in Lachlan Orogen

- Historic high-grade assays up to 6,037 g/t Ag and 85 g/t Au at Carrington

- Portfolio contains at least 12 historic silver/gold/polymetallic mines and prospects

- Transaction aligns with capital strategy via modest upfront cash and staged commitments

Negative

- Consideration includes 1,500,000 common shares, creating potential dilution

- Transaction is subject to TSX Venture Exchange acceptance, not final

- Reported grades are historic surface and production samples, not current resources

News Market Reaction

On the day this news was published, MSLVF declined 7.07%, reflecting a notable negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

MSLVF gained 10.46% while peers were mixed: SWLFF up 4.8%, PEXZF up 9.03%, GGLXF flat, and ENDMF and PLLMF down. The move appears more stock‑specific than a broad sector rotation.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 09 | Asset acquisition | Positive | -7.1% | Acquisition of three NSW silver exploration licence applications with high historic grades. |

| Dec 08 | Exploration update | Positive | +2.3% | Santas Gloria Phase 1 soils completed early and under budget with lab work underway. |

| Nov 03 | Drilling summary | Positive | +14.9% | Consolidated 2024–2025 drilling results and outlined Phase 3 drill plans for 2026. |

| Sep 16 | Drill results | Positive | +4.5% | Final Santas Gloria assays with multiple significant AgEq intercepts in San Jorge Vein. |

| Aug 22 | Market making deal | Neutral | +0.0% | Engagement of ICP Securities for automated market making at fixed monthly fee. |

Recent operational and exploration updates have generally seen positive price reactions, with this acquisition announcement previously showing the only notable divergence.

Over the last few months, First Andes Silver has focused on advancing its Santas Gloria project and strengthening trading liquidity. Drilling results and exploration updates on Santas Gloria in September 2025 and November 2025 produced constructive market reactions, as did an exploration program update on December 8, 2025. An automated market‑making agreement in August 2025 had a neutral impact. The current acquisition of three New South Wales silver projects on December 9, 2025 adds a new exploration pipeline alongside the existing Peruvian flagship asset.

Market Pulse Summary

The stock moved -7.1% in the session following this news. A negative reaction despite positive-sounding exploration news would fit the one prior divergence seen when this acquisition was first announced, contrasting with generally constructive responses to drilling and program updates in 2025. With the share price still well below its 52‑week high yet up sharply from the 52‑week low, positioning could amplify downside if investors focus on dilution from the 1,500,000 share issuance or execution risk across multiple projects.

Key Terms

asset purchase agreement financial

skarns technical

epithermal technical

orogenic technical

gossan technical

National Instrument 43-101 regulatory

Qualified Person regulatory

AI-generated analysis. Not financial advice.

Vancouver, British Columbia--(Newsfile Corp. - December 9, 2025) - FIRST ANDES SILVER LTD. (TSXV: FAS) (OTC Pink: MSLVF) (FSE: 9TZ0) ("First Andes" or the "Company") today announced that it has entered into an asset purchase agreement to acquire three (3) silver-focused exploration licence applications totalling approximately 454 km² in New South Wales, Australia. The concessions, located within the well-mineralized Lachlan Orogenic Belt, are known as the Carrington Project ("Carrington"), the Stoney Creek Project ("Stony Creek") and the Dartmoor Project ("Dartmoor") (together, the "Silver Projects").

Highlights:

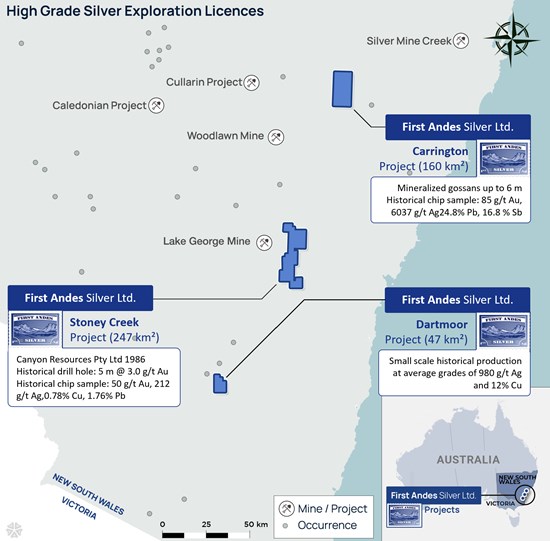

- Three large silver-gold exploration licence applications totaling approximately 454 km² (45,400 ha) in the highly prospective Lachlan Orogen of New South Wales, Australia (Figure 1);

- Portfolio covers an area containing at least 12 historic silver, gold and polymetallic mines and prospects, including multiple high-grade past producers;

- Historical silver and gold grades from surface grab, chip and production samples (see Sentinel Resources Corp. news release dated October 13, 2020):

- 6,037 g/t Ag and 85 g/t Au at Carrington

- 212 g/t Ag and 18 g/t Au at Stoney Creek, and

- Small-scale historic production averaging 980 g/t Ag and

12% Cu at Dartmoor;

- Multiple complementary deposit styles: iron-rich Au-Ag-Pb-Sb skarns at Carrington, epithermal and/or orogenic Au-Ag vein systems at Stoney Creek, and VHMS-style massive sulphide mineralization at Dartmoor;

- Transaction structured with modest upfront consideration and staged exploration commitments, aligning with First Andes' capital deployment strategy;

- Provides additional exploration opportunities while continuing to aggressively advance First Andes' flagship Santas Gloria Silver Project.

Colin Smith, CEO, commented: "We are pleased to be acquiring three highly prospective silver exploration licences in New South Wales, a jurisdiction well known for its silver-rich deposits. The combination of high-grade historic silver and gold results, multiple deposit styles and excellent access to infrastructure provides First Andes with a cost-effective, year-round exploration pipeline that complements our flagship Santas Gloria Silver Project in Peru. While Santas Gloria remains our primary focus, we see strong potential to generate additional discoveries and shareholder value from the NSW Silver Projects over time."

Carrington (ELA 6982)

Carrington is a 160 km² exploration licence application (ELA 6982) covering an iron-rich skarn system with Au-Ag-Pb-Sb mineralization located in the Lachlan Orogenic Belt of southeastern New South Wales. Two parallel mineralized structures lie east and west of a sandstone ridge, with the historic Carrington mine developed on the eastern structure and the Iron Duke prospect on the western structure. The prospects are hosted by limestone members of the Jerrara Formation and are spatially associated with the regionally significant Yarralaw Fault.

Historic mining at Carrington exploited laterally extensive mineralized gossans up to 6 meters wide. Rock chip sampling of gossanous material has returned grades of up to 85 g/t Au, 6,037 g/t Ag,

Furthermore, the NSW government "minview" website states that over 0.5 Mt of iron gossan is present. This is significant given silver-gold mineralization is commonly associated with gossans developed above primary sulphide mineralization. The tonnage cited suggests a robust system.

Stoney Creek (ELA 6983)

Stoney Creek is a 247 km² licence application (ELA 6983) situated in the Lachlan Orogenic Belt, covering a highly prospective corridor of Devonian volcanic rocks. The project hosts at least seven historic silver-gold mines and prospects, including the Stony Creek prospect and the Krawaree underground silver mine, which are classified as orogenic base-metal to low-sulphidation epithermal vein systems developed along the westerly dipping Gundillion Fault.

The Stony Creek prospect comprises an approximately 85-meter-wide alteration zone hosting quartz-sulphide vein stockworks. Historic rock-chip sampling has returned assays of up to 18.4 g/t Au and 212 g/t Ag, while historic drilling by Canyon Resources Pty Ltd in 1986 reported an intercept of 5 m grading 3.0 g/t Au.

Gundillions Reef, located approximately 1.4 km northwest of Stony Creek, is defined by a series of shafts, drives and small open pits that have been worked to depths of around 200 meters. Underground workings have been traced for over 2 kilometers and rock-chip grab samples have returned assays of up to 44 g/t Au and 150 g/t Ag, highlighting the potential for high-grade gold-silver shoots along the Gundillion Fault corridor (see Sentinel Resources Corp. news release dated October 13, 2020).

Dartmoor (ELA 6981)

Dartmoor is a 47 km² exploration licence application (ELA 6981) located at the western margin of the Hill End and Cooma zones in the eastern Lachlan Orogenic Belt. The tenure includes two historic polymetallic mines, Dartmoor and Dartmoor East, interpreted to be of VHMS-Kuroko affinity. Mineralization is expressed as an extensive gossanous horizon that can be traced for over 1.5 km along strike.

Small-scale historic production at Dartmoor reportedly averaged approximately 980 g/t Ag and

Terms of Transaction

The Company entered into an asset purchase agreement with South Star Pty Ltd. (the "Vendor") whereby the Vendor has agreed to sell all of its interest in the Silver Projects for AUD

Figure 1: Location map of Silver Projects.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10525/277392_8bf2616354bdbb40_002full.jpg

Qualified Person

Dr. Christopher Wilson, Ph.D., FAusIMM (CP), FSEG, FGS, a Qualified Person under National Instrument 43-101, has reviewed and approved the technical information contained in this news release. Dr. Wilson serves as Chief Geologist of First Andes Silver Ltd. and is a shareholder of the Company.

About First Andes Silver Ltd.

First Andes Silver Ltd. is a British Columbia company that holds a

For more information please contact:

Colin Smith, CEO & Director

Phone: 604 806-0626 (ext. 108)

E-mail: info@firstandes.com

Forward-Looking Statements

Information set forth in this news release contains forward-looking statements that are based on assumptions as of the date of this news release. These statements reflect management's current estimates, beliefs, intentions and expectations. They are not guarantees of future performance. The Company cautions that all forward-looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond the Company's control. Such factors include, among other things: risks and uncertainties relating to Company's limited operating history, ability to obtain sufficient financing to carry out its exploration programs and the need to comply with environmental and governmental regulations. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, the Company undertakes no obligation to publicly update or revise forward-looking information.

The forward-looking statements contained in this news release are made as of the date of this news release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/277392