NioCorp Reports Assay Results from First Complete Diamond Drill Hole from Drilling Program

Rhea-AI Summary

NioCorp (NASDAQ:NB) reported assays from the first completed diamond drill hole (NEC25-024) at the Elk Creek Project in southeast Nebraska on October 16, 2025. The hole returned multiple intervals including 42.00 m @ 1.33% Nb2O5 and other notable intercepts with elevated scandium, titanium oxide and TREO values. The Pentagon funded the drilling program, which supports conversion of resources/reserves and an ongoing review of up to $800 million in potential EXIM Bank debt financing. Remaining assays from the program are pending and additional technical work is required before any reserve/resource reclassification.

Positive

- NEC25-024 intercepted 42.00 m @ 1.33% Nb2O5

- Drilling program funded by the Pentagon

- Program supports review for up to $800M EXIM financing

- Phase I totaled 7,338.5 m of diamond drilling

Negative

- Assays are not reserves/resources under S-K 1300 or NI 43-101

- Remaining assay results are outstanding and pending

- Conversion to higher classifications requires additional technical work

News Market Reaction

On the day this news was published, NB declined 14.34%, reflecting a significant negative market reaction. Argus tracked a trough of -27.2% from its starting point during tracking. Our momentum scanner triggered 70 alerts that day, indicating high trading interest and price volatility. This price movement removed approximately $165M from the company's valuation, bringing the market cap to $988M at that time.

Data tracked by StockTitan Argus on the day of publication.

CENTENNIAL, CO, BRITISH COLUMBIA / ACCESS Newswire / October 16, 2025 / NioCorp Developments Ltd. ("NioCorp" or the "Company") (NASDAQ:NB), a leading U.S. critical minerals developer, is pleased to report assay results from the first completed diamond drill hole from its drilling program at its critical minerals project in Southeast Nebraska (the "Elk Creek Project").

The drilling program and associated technical work is being funded by the Pentagon and is designed to support the conversion of a portion of the Elk Creek Project's Indicated Mineral Resources into Measured Mineral Resources and the subsequent conversion of a portion of its Probable Mineral Reserves into Proven Mineral Reserves. The drilling program was designed to help meet Mineral Resource and Mineral Reserve classification requirements associated with the ongoing review of the Company's application for up to

Assays of the other completed drill holes during the now complete drilling program are underway at external laboratories.

"We appreciate the Pentagon's continued partnership in advancing this important work," said Mark A. Smith, CEO and Chairman of NioCorp. "These results are consistent with the existing Mineral Resource model for the Elk Creek deposit along with the lithologies logged by the field geology team when the hole was drilled, and confirm that the deposit is well understood. We look forward to receiving the remaining assay results, completing updates to our Mineral Resources and Mineral Reserves and continuing our discussions with EXIM Bank as we work to advance financing efforts for the Elk Creek Project."

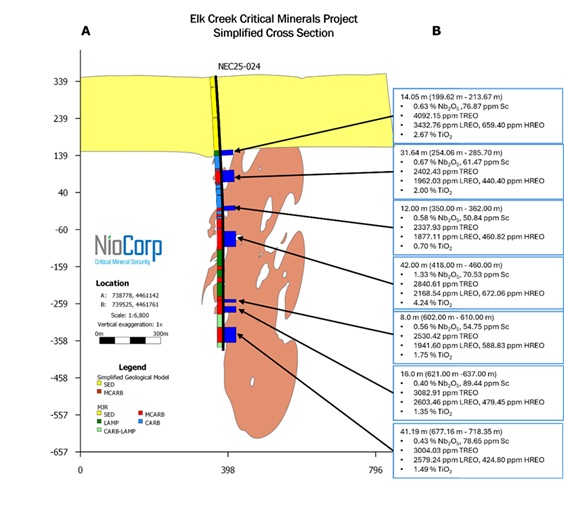

Table 1: Summary of Significant Drill Hole Results

Hole ID | From | To | Int. | Nb2O5 | Sc | TiO2 | LREO | HREO | TREO |

NEC25-024 | 199.62 | 213.67 | 14.05 | 0.63 | 76.87 | 2.67 | 3432.76 | 659.40 | 4092.15 |

254.06 | 285.70 | 31.64 | 0.67 | 61.47 | 2.00 | 1962.03 | 440.40 | 2402.43 | |

350.00 | 362.00 | 12.00 | 0.58 | 50.84 | 0.70 | 1877.11 | 460.82 | 2337.93 | |

418.00 | 460.00 | 42.00 | 1.33 | 70.53 | 4.24 | 2168.54 | 672.06 | 2840.61 | |

602.00 | 610.00 | 8.00 | 0.56 | 54.75 | 1.75 | 1941.60 | 588.83 | 2530.42 | |

621.00 | 637.00 | 16.00 | 0.40 | 89.44 | 1.35 | 2603.46 | 479.45 | 3082.91 | |

677.16 | 718.35 | 41.19 | 0.43 | 78.65 | 1.49 | 2579.24 | 424.80 | 3004.03 | |

Notes:

| |||||||||

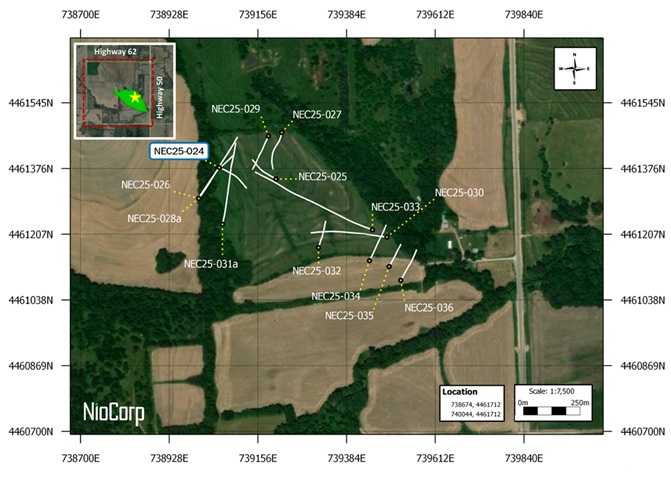

Figure 1: Drill Hole Location Map - Elk Creek Project, Southeast Nebraska

Figure 2: NEC25-024 - Drill Hole Location Map

Figure 3: NEC25-024 - Cross Section

The drilling program was divided into two phases. Phase I of the program comprised 11 HQ diamond drill holes totaling approximately 7338.5 meters, of which 731.67 meters were drilled in connection with the first drill hole (NEC25-024), with Phase II including four HQ holes totaling approximately 2,235 meters. Two additional geomechanical drill holes totaling approximately 1,950 meters were also completed as part of an accelerated effort to to support underground mine design related to access ramp development.

Table 2: Summary of Drill Hole Coordinates

Hole ID | Easting | Northing | Elevation | Azimuth | Dip |

NEC25-024 | 739057 | 4461378 | 350 | 118 | -81 |

Sampling, Analytical Methods and QA/QC Protocols

All drilling was completed using a Boart Longyear LF160 diamond drill rig with HQ size core. Drill core samples from Phase I of the program were shipped to SGS Analytical's preparation facility in Denver, Colorado for standard sample preparation which includes weighing, drying, crush (< 4 kg) up to 75% passing 2 mm, riffle split (250 g) and pulverize (Cr steel) to 90% passing 75 µm. The samples were subsequently analyzed using GE-ICM91A50 (sodium peroxide fusion with subsequent analysis by ICP and ICP/MS), GO_XRF72+GC_XRF76V (Nb₂O₅ and Ta2O5). The drill core was saw-cut into half-core with one half being sent for geochemical analysis and the other half-core remaining in the core box onsite. A quality assurance/quality control ("QA/QC") protocol was incorporated into the drilling program and included the insertion of certified reference material, silica blanks, duplicate quarters, pulps and rejects all at a rate of approximately

The assay results discussed in this press release are not measures of reserves or resources as defined in Subpart 1300 of Regulation S-K promulgated by the SEC ("S-K 1300") or National Instrument 43-101 ("NI 43-101"). The conversion of assay results in this news release into reserve or resource estimates in compliance with S-K 1300 and NI 43-101 requires additional technical work and analysis that remains ongoing. In addition, the assay results discussed in this press release may not be indicative of future assay results, and may not be indicative of our ability to convert any of the Elk Creek Project's Indicated Mineral Resources into Measured Mineral Resources or the subsequent conversion of any of its Probable Mineral Reserves into Proven Mineral Reserves. As such, the conversion of reported mineral resources to mineral reserves should not be assumed, and the reclassification of reported mineral resources from lower to higher levels of geological confidence should not be assumed.

Qualified Persons:

Trevor Mills, P.G., SME-RM, Principal Geologist / US Operations Manager of Dahrouge Geological Consulting USA Ltd., a Qualified Person as defined by NI 43-101, has reviewed and approved the technical information and verified the data contained within the news release. Mr. Mills has verified all scientific and technical data disclosed in this news release including the sampling and QA/QC results, and certified analytical data underlying the technical information disclosed herein. Mr. Mills noted no errors or omissions during the data verification process. The Company and Mr. Mills do not recognize any factors of sampling or recovery that could materially affect the accuracy or reliability of the assay data disclosed in this news release.

# # #

FOR MORE INFORMATION:

Jim Sims, Corporate Communications Officer, NioCorp Developments Ltd., (720) 334-7066, jim.sims@niocorp.com

Alex Guthrie, Director, Investor Relations, NioCorp Developments Ltd., (647) 999-0527, aguthrie@niocorp.com

@NioCorp $NB #Niobium #Scandium #rareearth #neodymium #dysprosium #terbium #ElkCreek

ABOUT NIOCORP

NioCorp is developing the Elk Creek Project that is expected to produce niobium, scandium, and titanium. The Company also is evaluating the potential to produce several rare earths from the Elk Creek Project. Niobium is used to produce specialty alloys as well as High Strength, Low Alloy steel, which is a lighter, stronger steel used in automotive, structural, and pipeline applications. Scandium is a specialty metal that can be combined with Aluminum to make alloys with increased strength and improved corrosion resistance. Scandium is also a critical component of advanced solid oxide fuel cells. Titanium is used in various lightweight alloys and is a key component of pigments used in paper, paint and plastics and is also used for aerospace applications, armor, and medical implants. Magnetic rare earths, such as neodymium, praseodymium, terbium, and dysprosium are critical to the making of neodymium-iron-boron magnets, which are used across a wide variety of defense and civilian applications.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements may include, but are not limited to, statements regarding the drilling program and the interpretation of the drilling and assay results and the benefits of such program, including estimations with respect to the extent of mineralization and the discovery of higher-grade intervals of mineralization; the potential conversion of Indicated Mineral Resources into Measured Mineral Resources and Probable Mineral Reserves into Proven Mineral Reserves; the expected results of the program and NioCorp's expectation that it will help advance the Company's debt financing process forward with the EXIM Bank; NioCorp's expectation of producing niobium, scandium, and titanium, and the potential of producing rare earths, at the Elk Creek Project; and NioCorp's ability to secure sufficient project financing to complete construction of the Elk Creek Project and move it to commercial operation. Forward-looking statements are typically identified by words such as "plan," "believe," "expect," "anticipate," "intend," "outlook," "estimate," "forecast," "project," "continue," "could," "may," "might," "possible," "potential," "predict," "should," "would" and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on the current expectations of the management of NioCorp and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. Forward-looking statements reflect material expectations and assumptions, including, without limitation, expectations and assumptions relating to: NioCorp's ability to receive sufficient project financing for the construction of the Elk Creek Project on acceptable terms, or at all; the future price of metals; and the stability of the financial and capital markets. Such expectations and assumptions are inherently subject to uncertainties and contingencies regarding future events and, as such, are subject to change. Forward-looking statements involve a number of risks, uncertainties or other factors that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those discussed and identified in public filings made by NioCorp with the Securities and Exchange Commission and with the applicable Canadian securities regulatory authorities and the following: NioCorp's ability to operate as a going concern; NioCorp's requirement of significant additional capital; NioCorp's ability to receive sufficient project financing for the construction of the Elk Creek Project on acceptable terms, or at all; NioCorp's ability to achieve the required milestones and receive the full

Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of NioCorp prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

All subsequent written and oral forward-looking statements concerning the matters addressed herein and attributable to NioCorp or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements contained or referred to herein. Except to the extent required by applicable law or regulation, NioCorp undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date hereof to reflect the occurrence of unanticipated events.

SOURCE: NioCorp Developments Ltd.

View the original press release on ACCESS Newswire