SURVEY: Middle-Income Americans Split on Outlook for Personal Finances

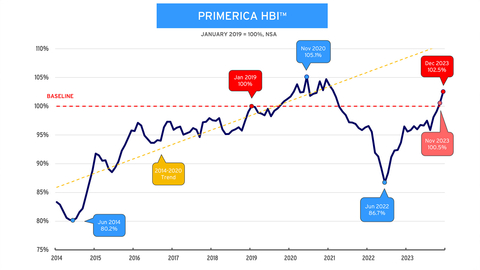

Purchasing power reaches highest levels since February 2022

Primerica Household Budget Index™ (HBI™) - In December 2023, the average purchasing power for middle-income households was

“While the Consumer Price Index (CPI) saw a jump of

Key Household Budget Index™ Findings

In December 2023, the increase of the HBI™ to

“As we head into 2024, we’re seeing improvements in the financial well-being of middle-income households as the cost of necessities like gasoline and heating fuel decline and they experience real, inflation-adjusted income gains,” said Amy Crews Cutts, Ph.D., CBE®, economic consultant to Primerica. “It may take some time with steady improvements before middle-income households start to feel that they are significantly better off. Nonetheless, in the Q4 2023 Primerica Financial Security Monitor™ fewer than

Key Findings from Primerica’s

The latest FSM™ survey data shows that exactly half (

-

Middle-income Americans continue to be split in their assessment of their personal finances. Exactly half (

50% ) say their personal financial situation is excellent or good, with the other half saying it is either not so good or poor. In addition, a large majority (80% ) are as concerned or more concerned about their credit card debt today compared to a year ago, and two-thirds (66% ) don’t know the interest rate for their credit cards. -

Majority of middle-income Americans remain pessimistic about the state of the economy. Overall, three-fifths (

60% ) are pessimistic about the economy over the next year. Broken out by age group, this includes nearly two-thirds (63% ) of respondents ages 18 to 34 and nearly three-quarters (72% ) of those ages 35 to 49. However, a slightly higher share (24% ) say they are optimistic heading into 2024 compared to the December 2022 survey, when just19% expressed optimism heading into 2023. -

Many are prioritizing reducing and managing debt in the coming year. When asked for their 2024 financial resolutions, more middle-income Americans mentioned paying off consumer and credit card debt (

40% ) and managing debt load (39% ) than tasks like creating an emergency fund (26% ), creating and sticking to a budget (25% ) and investing more in the future (23% ). Less than one-quarter (22% ) say they don’t make or follow resolutions. When forced to choose one, paying off credit card debt (35% ) outpaced managing debt load (18% ). -

Lack of time and anxiety are the main drivers in lack of financial planning. More than a quarter (

26% ) say they don’t contribute to a savings account, follow a budget, contribute to an investment account or set a financial budget each month. Anxiety (30% ) and not having time (20% ) continue to be cited as the biggest challenges people have tracking their financial information.

Primerica Financial Security Monitor™ (FSM™) Topline Trends Data

|

Dec. 2023 |

Sept. 2023 |

Jun. 2023 |

Mar.

|

Dec. 2022 |

Sep. 2022 |

Jun.

|

Mar. 2022 |

Dec.

|

How would you rate the condition of your personal finances? (Reporting “Excellent” and “Good” responses.)

Analysis: Respondents remain split on their assessment of their personal finances. |

|

|

|

|

|

|

|

|

|

Overall, would you say your income is…? (Reporting “Falling behind the cost of living” responses.)

Analysis: Concern about meeting the increased cost of living dropped over the last three months of 2023. |

|

|

|

|

|

|

|

|

|

Do you have an emergency fund that would cover an expense of

Analysis: The percentage of Americans who have an emergency fund that would cover an expense of |

|

|

|

|

|

|

|

|

|

How would you rate the economic health of your community? (Reporting “Not so good” and “Poor” responses.)

Analysis: Respondents’ rating of the economic health of their communities has remained relatively steady over the past year. |

|

|

|

|

|

|

|

|

|

How would you rate your ability to save for the future? (Reporting “Not so good” and “Poor” responses.)

Analysis: More than |

|

|

|

|

|

|

|

|

|

About Primerica’s Middle-Income Financial Security Monitor™ (FSM™)

Since September 2020, the Primerica Financial Security Monitor™ has surveyed middle-income households quarterly to gain a clear picture of their financial situation, and it coincides with the release of the monthly HBI™ four times annually. Polling was conducted online from December 5 – 12, 2023. Using Dynamic Online Sampling, Change Research polled 1,150 adults nationwide with incomes between

About the Primerica Household Budget Index™ (HBI™)

The Primerica Household Budget Index™ (HBI™) is constructed monthly on behalf of Primerica by its chief economic consultant Amy Crews Cutts, PhD, CBE®. The index measures the purchasing power of middle-income families with household incomes from

The HBI™ is presented as a percentage. If the index is above

Periodically, prior HBI™ values may be revised due to revisions in the CPI series and Consumer Expenditure Survey releases by the

About Primerica, Inc.

Primerica, Inc., headquartered in

View source version on businesswire.com: https://www.businesswire.com/news/home/20240130269021/en/

Public Relations

Gana Ahn

678-431-9266

gana.ahn@primerica.com

Investor Relations

Nicole Russell,

470-564-6663

nicole.russell@primerica.com

Source: Primerica, Inc.