Powermax Minerals Completes Initial Milestone Payments Related to the Option Agreement to Acquire Pinard Rare Earths Project

Rhea-AI Summary

Powermax Minerals (OTCQB: PWMXF) completed initial Option Agreement milestone payments to acquire a 100% interest in the Pinard Rare Earths project, subject to a 1.5% NSR.

The company issued 160,000 common shares and paid CAD $18,000 on the effective date; total consideration under the option is 320,000 shares and CAD $90,000 over three years. Powermax can buy down the NSR to 1.0% for CAD $500,000. The Pinard property covers 5,178 ha in northern Ontario and is hosted in an alkaline intrusive complex.

Positive

- Option agreement sets clear payment schedule: 320,000 shares

- Total cash consideration defined: CAD 90,000 over three years

- Buydown provision: NSR reducible to 1.0% for CAD 500,000

- Property size specified: 5,178 hectares contiguous claims

Negative

- NSR of 1.5% remains until buydown payment is made

- Initial cash outlay executed: CAD 18,000 reduces liquidity

- Future share payments total 160,000 shares, causing dilution

News Market Reaction

On the day this news was published, PWMXF gained 4.82%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Toronto, Ontario--(Newsfile Corp. - November 13, 2025) - Powermax Minerals Inc. (CSE: PMAX) (OTCQB: PWMXF) (FSE: T23) ("Powermax" or the "Company") is pleased to announce, further to its news release dated November 3rd, 2025 regarding its entry into an option agreement ("Option Agreement") pursuant to which it may acquire a

Under the terms of the Option Agreement, the Company may acquire the Project, subject to the NSR, by making the following cash and share payments to the optionors ("Optionors"):

| Due Date | Common Share Payments | Cash Payment (CAD) |

| Upon signing the Option Agreement ("Effective Date") | - | |

| Within 7 business days of receipt of approval from the Canadian Securities Exchange | 160,000 | - |

| On the 1st anniversary of the Effective Date | 160,000 | |

| On the 2nd anniversary of the Effective Date | - | |

| On the 3rd anniversary of the Effective Date | - | |

| Total | 320,000 |

The Company notes that the NSR is subject to a buyback right in favour of the Company, under which the Company may reduce the NSR to

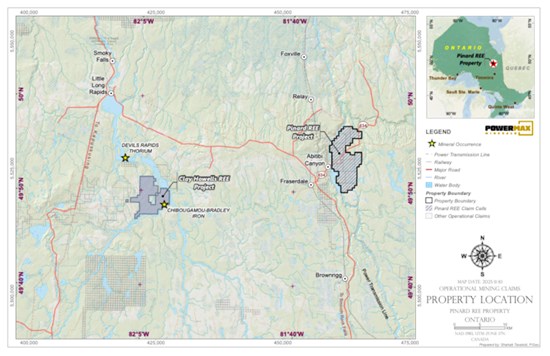

The Project is located in northern Ontario, Canada, roughly 70 km north-northeast of the town of Kapuskasing, and is defined by 255 contiguous mining claims spanning a total of 5178 ha. The mining claims and patents can be easily accessed by 4×4 pick-up truck using an all-weather access road.

The Pinard Intrusive Rock Complex is an Alkaline igneous host with rocks ranging from nepheline syenites and trachyte's to peralkaline granites. These complexes usually occur in plate tectonic settings associated with rifts, faults, or hotspot magmatism (Sage, 1988). Early Precambrian aged formations like the Pinard Complex are typical of the Kapuskasing Sup-Province Geology and is similar to the Clay Howell Intrusive, which hosts a REE deposit 20 kilometers to the SW of the Pinard Property.

Figure 1: Pinard REE Project Property Location Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11633/274304_df5a7a7014073977_002full.jpg

Qualified Person

Afzaal Pirzada, P.Geo., a Director of the Company and a "Qualified Person" as defined by National Instrument 43-101, reviewed and approved the scientific and technical information disclosed in this press release.

On Behalf of the Board of Directors

Paul Gorman, CEO & Director

Email: info@powermaxminerals.com

Website: www.powermaxminerals.com

About Powermax Minerals Inc.

Powermax Minerals Inc. is a Canadian mineral exploration company focused on advancing rare earth element projects. The Company holds an option to acquire the Cameron REE Property, comprising three mineral claims totaling approximately 2,984 hectares in British Columbia. Powermax also optioned to acquire the Atikokan REE Property, consisting of 455 unpatented mining claims in NW Ontario. Powermax also owns a

Forward-Looking Statements

Except for the statements of historical fact, this news release contains "forward-looking information" within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates and projections as at the date of this news release. "Forward-looking information" in this news release includes: statements involving the potential acquisition of the Project; expectations involving the Option Arrangement and NSR; and anticipated receipt of CSE approvals. The forward-looking information in this news release reflects the current expectations, assumptions and/or beliefs of the Company based on information currently available to the Company. The Company has also assumed that no significant events occur outside of the Company's normal course of business. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to the inherent uncertainty therein. The Company disclaims any intention or obligation to update or revise any forward-looking information unless required by applicable law.

Neither the Canadian Securities Exchange nor its Market Regulator (as that term is defined in CSE Policies) accepts responsibility for the adequacy or accuracy of this news release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/274304