American Rebel Holdings, Inc. (NASDAQ: AREB) Files Q3 2025 Form 10-Q Showing Positive Stockholders’ Equity of $3,378,257; Exceeds Nasdaq’s $2.5 Million Equity Standard

Rhea-AI Summary

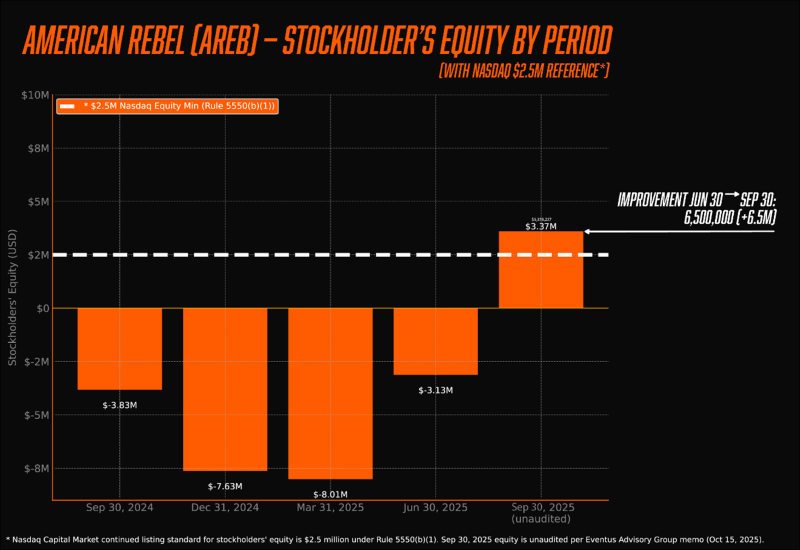

American Rebel Holdings (NASDAQ: AREB) filed its Form 10-Q for the quarter ended September 30, 2025, reporting total stockholders' equity of $3,378,257.

That amount exceeds the Nasdaq Capital Market continued listing equity standard of $2.5 million. The filing was submitted on November 10, 2025, after a Nasdaq Panel decision on October 20, 2025 that conditioned continued listing on evidence of equity compliance via a public filing by November 15, 2025.

American Rebel reported an improvement from a stockholders' deficit of $(8,012,673) on March 31, 2025 and $(3,127,891) on June 30, 2025 to positive equity of $3,378,257 as of September 30, 2025, representing improvements of approximately $11.4M and $6.5M, respectively.

Positive

- Stockholders' equity of $3,378,257 as of Sept 30, 2025

- Equity level exceeds Nasdaq $2.5M continued listing threshold

- Improvement of ~$11.4M since March 31, 2025

Negative

- Nasdaq Panel retains discretion to review filing and request information

- Reported stockholders' deficit of $(8,012,673) on March 31, 2025

- Reported stockholders' deficit of $(3,127,891) on June 30, 2025

News Market Reaction – AREB

On the day this news was published, AREB declined 7.20%, reflecting a notable negative market reaction. Argus tracked a peak move of +28.6% during that session. Argus tracked a trough of -9.2% from its starting point during tracking. Our momentum scanner triggered 15 alerts that day, indicating notable trading interest and price volatility. This price movement removed approximately $595K from the company's valuation, bringing the market cap to $8M at that time.

Data tracked by StockTitan Argus on the day of publication.

Approximately

Nashville, TN., Nov. 12, 2025 (GLOBE NEWSWIRE) -- American Rebel Holdings, Inc. (“American Rebel” or the “Company”) (NASDAQ: AREB) highlighted the continued improvement in the stockholders’ equity as part of the recently filed Quarterly Report on Form 10-Q for the period ended September 30, 2025. AMERICAN REBEL HOLDINGS, INC. 10-Q 2025-09-30 The filing reports total stockholders’ equity of

NASDAQ Framework and Panel Process

- Equity standard: Nasdaq Capital Market continued listing requires stockholders’ equity of at least

$2.5 million (one of three alternative standards). - Panel decision: The Panel’s October 20, 2025 decision granted continued listing conditioned on evidencing equity compliance via a timely public filing by November 15, 2025; the Panel may review the filing and request additional information.

The Form 10-Q for the period ended September 30, 2025, filed on November 10, 2025, reports stockholders’ equity above

“Restoring positive stockholders’ equity was our top listing priority. The 10-Q shows we are above the Nasdaq

Continued Quarterly Stockholder Equity Improvement comparatively to the periods ended March 31, 2025, and June 30, 2025

- American Rebel moved from a stockholders’ deficit of

$(8,012,673) as of March 31, 2025, to positive equity of$3,378,257 as of September 30, 2025, an improvement of approximately$11.4 million . The March 31, 2025, deficit was disclosed in the Company’s Q1 2025 Form 10-Q. - American Rebel moved from a stockholders’ deficit of

$(3,127,891) as of June 30, 2025, to positive equity of$3,378,257 as of September 30, 2025, an improvement of approximately$6.5 million . The June 30, 2025, deficit was disclosed in the Company’s Q2 2025 Form 10-Q.

About American Rebel Holdings, Inc. (NASDAQ: AREB)

American Rebel began as a designer and marketer of branded safes and personal security products and has since grown into a diversified patriotic lifestyle company with offerings in beer, branded safes, apparel, and accessories. With the introduction of American Rebel Light Beer in 2024 the company is growing rapidly across the USA with top-tier distribution partners in the premium light lager category.

Learn more at americanrebelbeer.com/investor-relations and at www.americanrebel.com

Watch the American Rebel Story as told by our CEO Andy Ross: The American Rebel Story.

Media Inquiries

Monica Brennan

Monica@NewtoTheStreet.com

Matt Sheldon

Matt@Precisionpr.com

Forward Looking Statement

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward-looking statements. These statements include, without limitation, statements regarding American Rebel Holdings, Inc.’s (the “Company”) expectations about its continued compliance with The Nasdaq Capital Market’s continued listing requirements, including the minimum stockholders’ equity standard under Nasdaq Listing Rule 5550(b)(1); the Company’s belief that the Form 10-Q for the period ended September 30, 2025 (filed November 10, 2025) evidences compliance with the Nasdaq equity standard and satisfies the Nasdaq Hearings Panel’s decision dated October 20, 2025 requiring the Company to evidence such compliance by November 15, 2025; the Panel’s ongoing review and discretion, including the possibility of requests for additional information; the Company’s plans, strategies, and expectations to enhance and maintain stockholders’ equity, liquidity, operating performance, and long-term stockholder value; and other future operational or financial results, initiatives, milestones, timing, and objectives. Words such as “believe,” “expect,” “intend,” “plan,” “anticipate,” “estimate,” “may,” “should,” “could,” and similar expressions, or the negative of these terms, are intended to identify forward-looking statements.

Forward-looking statements are based on current expectations, estimates, assumptions, and projections and involve known and unknown risks, uncertainties, and other factors that are difficult to predict and that could cause actual results to differ materially from those expressed or implied by the forward-looking statements. These risks and uncertainties include, among others: the outcome of Nasdaq’s continued monitoring of the Company’s compliance with all applicable listing standards and the Panel’s exercise of discretion; the Company’s ability to execute operational, financial, and strategic initiatives to sustain compliance with Nasdaq’s standards, including maintaining stockholders’ equity at or above required thresholds; market acceptance and performance of the Company’s products and brands; the strength and reliability of distribution partners and supply chains; costs and availability of raw materials and production capacity; competitive pressures; general economic, financial market, and industry conditions; the Company’s ability to obtain additional financing on acceptable terms, if needed; dilution resulting from any financing or corporate actions; integration and performance of any acquisitions or partnerships; regulatory, legal, tax, and compliance matters; reliance on key personnel; and the other risks and uncertainties described from time to time in the Company’s filings with the Securities and Exchange Commission.

Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this press release. The Company undertakes no obligation to update or revise any forward-looking statements to reflect events or circumstances after the date hereof, except as required by law.

Investor Contact

American Rebel Holdings, Inc.

IR@americanrebel.com