Mexican Gold Acquires Tatatila Project in Mexico

Rhea-AI Summary

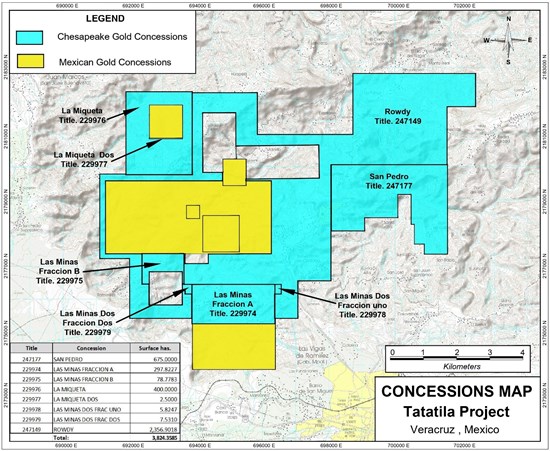

Mexican Gold (OTCQB: MEXGF) announced it has acquired 100% of the Tatatila Project in Veracruz, Mexico, covering 3,824.3585 hectares adjacent to its Las Minas project.

As consideration the company issued 4,451,361 common shares at a deemed $0.05 each (aggregate deemed value $222,568), representing 14.99% of issued and outstanding shares. A 1.5% NSR royalty was granted, with a buy-back option to repurchase 0.5% of the NSR for US$500,000 within 10 years. Consideration shares have a statutory hold until March 13, 2026 and a Lock Up releasing 25% on Nov 12, 2026 and every six months thereafter over 2.5 years. Transaction is subject to final TSXV acceptance.

Positive

- Land added: 3,824.3585 hectares adjacent to Las Minas

- 100% title acquired to Tatatila mineral concessions

- NSR buy-back: option to reduce royalty from 1.5% to 1% for US$500,000

Negative

- Dilution: Consideration shares equal 14.99% of outstanding stock

- Ongoing royalty: 1.5% NSR could reduce future project cash flows

- Lock-up liquidity: Consideration shares released over 2.5 years limiting immediate trading

News Market Reaction

On the day this news was published, MEXGF declined 8.16%, reflecting a notable negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Vancouver, British Columbia--(Newsfile Corp. - November 12, 2025) - Mexican Gold Mining Corp. (TSXV: MEX) (OTCQB: MEXGF) (the "Company" or "Mexican Gold") is pleased to announce that, pursuant to a mining concessions assignment agreement (the "Assignment Agreement") between the Company and its subsidiary, Roca Verde Exploración de México, S.A. de C.V. ("Roca Verde"), with Chesapeake Gold Corp. ("Chesapeake") and its subsidiaries Minerales El Prado, S.A. de C.V. ("MEP") and Chesapeake México, S.A. de C.V. ("Chesapeake Mexico") disclosed in the Company's news release of October 1, 2025, Mexican Gold has acquired

Figure 1: Tatatila Mining Concessions (shaded in blue)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11437/274187_9f914f4b74d52855_002full.jpg

The Tatatila concessions surround or are adjacent to Mexican Gold's Las Minas Project.

As consideration for the Tatatila Project, the Company has issued to Chesapeake an aggregate of 4,451,361 common shares of the Company (the "Consideration Shares"), each issued at a deemed value of

All Consideration Shares are subject to a statutory hold period expiring March 13, 2026, being the date that is four months and one day from the date of issuance in accordance with applicable Canadian securities legislation. In addition, the Consideration Shares are subject to further lock up restrictions (the "Lock Up") such that

The transaction remains subject to the receipt of final acceptance of the TSX Venture Exchange.

About Mexican Gold Mining Corp.

Mexican Gold is a Canadian-based mineral exploration and development company committed to building long-term value through ongoing discoveries and strategic acquisitions of prospective precious metals and copper projects in the Americas. Mexican Gold is exploring and advancing the Las Minas Project, which is located in the core of the Las Minas mining district in Veracruz State, Mexico, and host to one of the newest, under-explored skarn systems known in Mexico.

For more information, please contact:

Jack Campbell - CEO, President, and Director

E-mail: info@mexicangold.ca

Website: www.mexicangold.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward-Looking Information

This news release contains certain "forward-looking information" and "forward-looking statements" (collectively "forward-looking statements") within the meaning of applicable securities legislation. All statements, other than statements of historical fact, included herein, without limitation, statements relating to future operating or financial performance of the Company, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as "expects", "anticipates", "believes", "intends", "estimates", "potential", "possible", and similar expressions, or statements that events, conditions, or results "will", "may", "could", or "should" occur or be achieved. Forward-looking statements in this news release relate to, among other things, the staged releases of the Consideration Shares from Lock Up and the receipt of final acceptance of the TSX Venture Exchange. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation, the ability of the Company to obtain final acceptance of the TSX Venture Exchange. Readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these items. The Company does not assume any obligation to update the forward-looking statements should beliefs, opinions, projections, or other factors change, except as required by applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/274187