Meridian Accelerates Post Financing 2026's Field and Corporate Programmes

Rhea-AI Summary

Meridian (OTCQX: MRRDF) closed a CAD 57.5M financing and will accelerate Cabaçal DFS work, ordering long‑lead items in Q1 2026 and aiming for DFS delivery in Q4 2026. The company plans initial civil works in the 2026 dry season and targets restart of production by end‑2028 (subject to licences). Meridian also plans up to 10,750m of 2026 drilling across Cabaçal, Jauru, Araputanga and Espigão and reports high‑grade Santa Helena drill intersections. The company is reviewing a dual listing on the London Stock Exchange.

Positive

- Closed CAD 57.5M financing

- DFS delivery targeted Q4 2026

- Ordering long‑lead items in Q1 2026

- Planned initial civil works in 2026 dry season

- Up to 10,750m diamond drilling planned in 2026

- Smelter tests show easy‑to‑smelt, clean concentrate

Negative

- Restart timeline subject to Installation License approvals

- Construction start contingent on successful granting of licences

- Exploration geophysical targets are preliminary and inconclusive

- Resource infill requires follow‑up drilling to validate historical data

HIGHLIGHTS:

- Meridian to advance Cabaçal DFS with delivery schedule for Q4 2026;

- CAD 57.5M financing allows for acceleration of time sensitive programmes;

— Long lead items to be ordered Q1 2026;

— Initiation of civil works brought forward to the 2026 dry season;

- CAD 57.5M financing allows for acceleration of time sensitive programmes;

- Meridian outlines an expansion of exploration programmes in 2026;

- 2026 programme to test initially Cabaçal mine-corridor targets;

- Field programmes planned on Jauru & Araputanga Greenstone Belts;

- Testing Espigão IOCG targets;

- Santa Helena Central returns further high-grade drill results:

- CD-806: 2.6m @ 2.4g/t Au,

1.7% Cu, 93.2g/t Ag,15.7% Zn &2.6% Pb; - CD-796: 5.7m @ 1.0g/t Au,

1.0% Cu, 27.6g/t Ag,5.2% Zn &0.9% Pb; - CD-792: 4.6m @ 2.5g/t Au,

0.5% Cu, 47.3g/t Ag,4.6% Zn &1.1% Pb; - CD-786: 2.0m @ 2.4g/t Au,

4.1% Cu, 73.7g/t Ag,6.3% Zn &0.8% Pb; and

- CD-806: 2.6m @ 2.4g/t Au,

- Meridian to consider London Stock Exchange dual listing

London, United Kingdom--(Newsfile Corp. - February 17, 2026) - Meridian Mining plc (TSX: MNO) (FSEL N2E) (Tradegate: N2E) (OTCQX: MRRDF) ("Meridian" or the "Company") is pleased to announce that following the closing of the recent CAD 57.5M financing1, it is bringing forward various programmes to accelerate the return of the Cabaçal Au-Cu-Ag mine ("Cabaçal") back into production. Including ordering long lead items and advancing pre-construction civil works. The Company is also reporting that its 2026 gold-copper-silver exploration drill programmes will include up to 10,750m of diamond drilling along the Cabaçal, Jauru, and Araputanga Greenstone Belts and Espigão prospects. Meridian is also reporting further drill results from the Santa Helena Central mineral resource area2 that include multiple intersections of high-grade polymetallic VMS mineralization. The Company is reviewing a dual listing on the London Stock Exchange Main Market under the Equity Share - Commercial Company designation to target exposure to both FTSE index inclusion, and the UK investment market.

Mr. Gilbert Clark, CEO, comments: "Working off a strong financial base, Meridian is now financed beyond Cabaçal's final investment decision into early construction works, and we are accelerating the necessary programmes to ensure we meet our timeline for the restart of Au-Cu-Ag production at Cabaçal by the end of 2028 (subject to licence approvals). Our vision is not singular; we have the funds available to expand the dual track strategy of mine development and Cu-Au-Ag exploration. We have an extensive suite of exciting copper and gold prospects to test across our expanded exploration portfolio. We are currently assessing a dual listing for our common shares on the London Stock Exchange to enhance the Company's access to pools of equity capital in the UK and market indexation."

CABAÇAL DEFINITIVE FEASIBILITY STUDY UPDATE

The Company continues to advance Cabaçal's Definitive Feasibility Study (the "DFS"), alongside its engineering contractors3 to complete the multiple work streams and studies required. With the finalization of the specifications certain long-lead item's (such as the SAG mill, electrical transformers and gravity circuit), tendering and ordering procedures are expected to be completed before the end of Q1 2026. To take advantage of the 2026 dry season, initial civil works including road upgrades are planned, to have the access ready for a potential construction start in H1 2027 (pending the successful granting of the Installation License). Meridian is also advancing the smelter performance tests of Cabaçal's copper concentrates (that include high contents of gold and silver) which are being tested by Kingston Process Metallurgy Inc. Kingston, Ontario. The initial smelter tests indicate that Cabaçal's concentrate is easy to smelt, produces a clean matte and an acceptable slag ("Photo 1").

Photo 1: Left: 10 kW induction furnace arrangement. Right: view looking on top of the melt.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7354/284046_photo%

Cabaçal Belt Exploration

Further geochemical reconnaissance work has progressed in parallel with recent drilling programmes, with results including a new gold-in-soil response of 244.9 Au ppm. This sample was from a colluvial layer over a granite-tonalite intrusive complex, with the unusually elevated grade possibly reflecting a nugget effect in the sampling and/or some secondary concentration processes but nonetheless indicating anomalous gold in an unexpected position. This possibly reflects intrusive-related and/or orogenic gold mineralization processes, neighbouring Cabaçal's VMS stratigraphy of the greenstone belt. The result was from a broad-spaced soil campaign designed to follow up a stream anomaly, that was sourced from unrelated local catchments to those draining off the Cabaçal resource area. The background soil response over the intrusive basement lithologies is generally below detection, but in the area, other positive soil responses range from 5 to 105 ppb Au, with such responses falling close to the perimeter of the tonalite body and marginal to an intrusive granite. Although granite-tonalite bodies are less common gold-hosts, significant mineralization can form under the right conditions (as seen in analogues such the Tintina Gold Province (Dublin Gulch - Eagle - Yukon, Canada), and the Boddington Gold Mine - Western Australia).

Further evaluation of this gold anomalous contact zone is underway at prospect-scale to belt-scale. The position is locally concealed under more recent alluvial cover. Approximately 3.5km south-east along strike from this position, some further drainage anomalies are associated with a zone of quartz veining with multiple orientations across the granite-greenstone contact. This is an area where the Company has recently received an environmental license (LOPM; Licença de Operação para Pesquisa Mineral). An induced polarization survey has been undertaken, defining a NE-trending chargeability response associated with the veining zone and drainage anomaly, with trenching and reconnaissance drilling being planned. Geophysical and geochemical exploration targets are preliminary in nature and not conclusive evidence of the likelihood of a mineral deposit.

The Company continues to evaluate the potential of the strike extensions to the Aguapei Group's "Fortuna Formation" sandstone unit to represent a gold host, following the recognition of the gold potential in the formation in the south-east sector of the belt. Some reconnaissance drilling is being planned in the Cigarra target area as a first test of the potential in the northern sector of the belt. It is also possible that this unit covers strike-projections of the greenstone belt at explorable depths.

The Company will be pursuing its programmes in 2026 with an expanded array of geophysical equipment. Orders have been placed for drone-based magnetic, radiometric, and Lidar sensors to facilitate improved prospect-scale interpretation of structure and VMS stratigraphy, in areas of poor exposure which characterize much of the belt. This equipment is expected to arrive in the later part of Q1. Some of the sulphide assemblage in the Cabaçal and Santa Helena deposits is associated with pyrrhotite, a magnetic sulphide mineral, and the magnetic sensor will assist with both structural mapping and definition of magnetic hydrothermal alteration assemblages at depth. The radiometric sensor is a more shallow-seeking exploration tool and will assist with characterizing areas of cover and residual basement to test the effectiveness of geochemistry. Lidar will assist with structural mapping / lineament analysis and levelling of the magnetic survey data.

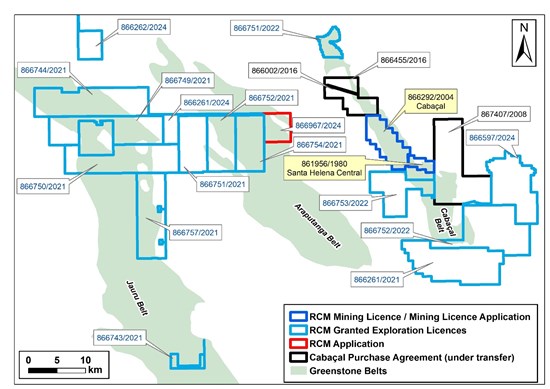

Araputanga - Jauru Belt Exploration

The Company continues with the compilation of historical data over the Jauru and Araputanga Greenstone Belts ("Figure 1"), in parallel with the landholder liaison activities. The initial focus of digitization of historical soil data will be on licences 866752/2021 and 866754/2021, over the BP Minerals "A1" target area, and data assessment over the northern Jauru Belt licences (866262/2024, 866744/2021, 866749/2021), covering the Jauru copper anomaly and J9 gold anomaly. In addition to the geochemical records, amongst the archives, the Company has located some historical BP Minerals ground geophysics data sheets and will assess with its consultants the value in compiling this information, which although gathered with older equipment may assist in the planning and prioritization of data collection with modern campaigns.

Figure 1: Cabaçal, Araputanga and Jauru greenstone belts

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7354/284046_ba5019daf4252bb3_003full.jpg

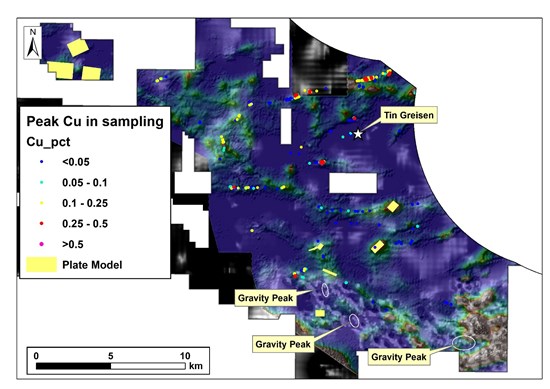

Espigão Exploration

Processing by the Company's geophysical consultancy Core Geophysics has highlighted a broad gravity feature developed in the southeastern sector of Espigão displaying a regional response, terrain corrected, up to 15mgal above background. Residual filtering has defined a number of smaller/discrete anomalies of interest up to 2km in size ("Figure 2"). The source of the anomalies needs further investigation, but responses at Espigão fall within ranges of known IOCG deposits. The strongest responses are developed in a structurally favourable setting, lying to the north of an inflexion point on the margin of the hinge zone between the Parecis Basin and the Proterozoic crystalline basement. The regional geology places the gravity anomalies close to first‐order terrane boundary faults. Extensive multielement soil anomalies are distributed over an area of ~20km by 15km4. These features suggest that a major thermal event has occurred, potentially at crustal scale. Espigão's mineralization assemblages are suggestive of hydrothermal zonation pattern. A 1,200m drill programme is planned, with target depth of between 200 and 300m below surface.

Figure 2: Espigão 1VD gravity map (greyscale), with HeliTEM conductivity colour drape. Peak gravity responses are circled, and the projection of Maxwell conductivity plates are shown in yellow polygons. Peak Cu values from surface trenching, drilling, auger and channel sampling are shown.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7354/284046_ba5019daf4252bb3_004full.jpg

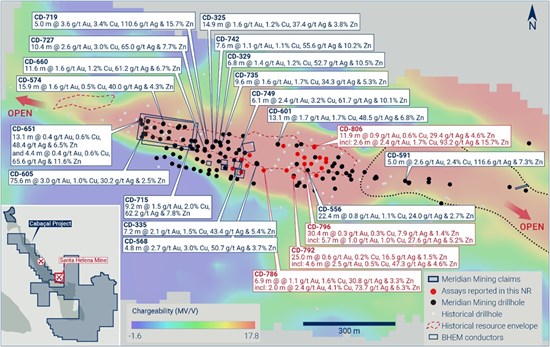

Resource Development Drilling - Santa Helena Central

The Company has continued to conduct an infill drilling campaign at the Santa Helena Central area ("Figure 3"), following the database cut-off date for the recent Mineral Resource update5. Drilling was focussed on closing a 50 by 50m drill pattern to locally 25 by 25m with the objective of increasing the resource classification level, and gathering more mineralization for a second phase of metallurgical studies.

Highlights from the recent drilling have included:

- CD-806 11.9m @ 0.9g/t Au,

0.6% Cu, 29.4g/t Ag,4.6% Zn &0.7% Pb from 48.5m;- Including 2.6m @ 2.4g/t Au,

1.7% Cu, 93.2g/t Ag,15.7% Zn &2.6% Pb from 57.0m;

- Including 2.6m @ 2.4g/t Au,

- CD-796: 30.4m @ 0.3g/t Au,

0.3% Cu, 7.9g/t Ag,1.4% Zn &0.3% Pb from 10.1m;- Including: 5.7m @ 1.0g/t Au,

1.0% Cu, 27.6g/t Ag,5.2% Zn &0.9% Pb from 21.0m;

- Including: 5.7m @ 1.0g/t Au,

- CD-792: 25.0m @ 0.6g/t Au,

0.2% Cu, 16.5g/t Ag,1.5% Zn &0.5% Pb from 6.6m;- Including: 4.6m @ 2.5g/t Au,

0.5% Cu, 47.3g/t Ag,4.6% Zn &1.1% Pb from 16.8m;

- Including: 4.6m @ 2.5g/t Au,

- CD-786: 6.9m @ @ 1.1g/t Au,

1.6% Cu, 30.8g/t Ag,3.3% Zn &0.5% Pb from 22.9m;- Including 2.0m @ 2.4g/t Au,

4.1% Cu, 73.7g/t Ag,6.3% Zn &0.8% Pb from 26.0m.

- Including 2.0m @ 2.4g/t Au,

Follow up drilling is planned to test historical grade control drilling areas to help validate this data and reassess the statistical levelling that is currently applied in Santa Helena's mineral resource estimate.

Figure 3: Recent drill results from the Santa Helena Central area.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7354/284046_ba5019daf4252bb3_005full.jpg

Recent drilling was more focussed in the central to eastern sector of the deposit where there was lesser historical development in a shallowing sector of the resource.

CD-786 confirmed good intervals of shallow unmined mineralization in the fresh-rock-transition zone, in which peak grades of

CD-792 and CD-796 similarly tested up-dip from historical development, in the fresh-rock - transition zone, adjacent to positions where data from some of the later generation of BP Minerals data had been lost. Results confirmed that mineral zones were broader and better than the limited records of reported composites from these holes (e.g. JUCHD-110: 6.85m @ 0.65 g/t Au, with base metals not reported; JUCHD-111: 1.35m @ 0.73g/ Au,

CD-806 returned a shallower than expected fresh rock mineral zone, in a fold keel position, ~31m above the historical galleries.

London Stock Exchange Dual Listing Consideration

The Company is reviewing dual listing its common shares on the London Stock Exchange Main Market under the Equity Share - Commercial Company designation to target exposure to both FTSE index inclusion, and the UK investment market. As a United Kingdom domiciled plc, this presents Meridian with a unique investment opportunity for further expansion of its institutional and retail investor base. Currently more than

Technical Notes

For Santa Helena Central, composites were defined based on the updated cut-off grades of 0.125 g/t AuEq. Fixed recoveries were used from the initial metallurgical testwork programme (Fresh Rock Recovery: Zn

Drill core samples have been analysed at ALS laboratory in Lima, Peru. Samples are dried, crushed with

Soils samples have been analysed at the accredited SGS laboratory in Belo Horizonte. gold analyses have been conducted by FAA505 (fire assay of a 50g charge), and base metal analysis by portable XRF calibrated with certified references. ~

Induced polarization surveys have been conducted by the Company's in-house team utilizing its GDD GRx8-16c receiver and 5000W-2400-15A transmitter. Results are sent daily for processing and quality control to the Company's consultancy, Core Geophysics. Modelling of conductivity response is undertaken using industry-standard Maxwell software. Geophysical and geochemical exploration targets are preliminary in nature and not conclusive evidence of the likelihood of a mineral deposit.

Qualified Person Statement

Mr. Erich Marques, B.Sc., FAIG, Chief Geologist of Meridian Mining and a Qualified Person as defined by National Instrument 43-101, has reviewed, verified and approved the technical information in this news release.

About Meridian

Meridian Mining is focused on:

- The development and exploration of the advanced stage Cabaçal VMS gold‐copper project;

- Expanding the initial resource inventory in the Santa Helena area through extension of Santa Helena Central, and new discoveries;

- Regional scale exploration of the Cabaçal VMS Belt to expand the Cabaçal Hub strategy; and

- Exploration in the Jauru & Araputanga Greenstone Belts (the above all located in the State of Mato Grosso, Brazil).

The Pre-feasibility Study technical report (the "PFS Technical Report") dated March 31, 2025, entitled: "Cabaçal Gold-Copper Project NI 43-101 Technical Report and Pre-feasibility Study" outlines a base case after-tax NPV5 of USD 984 million and

The Cabaçal Mineral Reserve estimate consists of Proven and Probable reserves of 41.7 million tonnes at 0.63g/t gold,

Readers are encouraged to read the PFS Technical Report in its entirety. The PFS Technical Report may be found under the Company's profile on SEDAR+ at www.sedarplus.ca and on the Company's website at www.meridianmining.co.

The PFS Technical Report was prepared for the Company by Tommaso Roberto Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering Canada ULC; Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering Canada ULC; John Anthony McCartney, C.Geol., Ausenco Chile Ltda.; Porfirio Cabaleiro Rodriguez (Engineer Geologist FAIG), of GE21 Consultoria Mineral; Leonardo Soares (B.Sc. Geo, MAIG), Senior Geological Consultant of GE21 Consultoria Mineral; Norman Lotter (Mineral Processing Engineer; P.Eng.), of Flowsheets Metallurgical Consulting Inc.; and, Juliano Felix de Lima (Engineer Geologist MAIG), of GE21 Consultoria Mineral.

On behalf of the Board of Directors of Meridian Mining plc

Mr. Gilbert Clark - CEO and Director

Meridian Mining plc

8th Floor, 4 More London Riverside

London SE1 2AU

United Kingdom

Email: info@meridianmining.co

Ph: +44 (0) 203 930 3145 (GMT)

Media Enquiries:

Gareth Tredway / Eliza Logan

Tel: +44 (0) 207 920 3150

Email: meridianmining@tavistock.co.uk

Stay up to date by subscribing for news alerts here: https://meridianmining.co/contact/

Follow Meridian on X: https://X.com/MeridianMining

Further information can be found at: www.meridianmining.co

Cautionary Statement on Forward-Looking Information

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed under the heading "Risk Factors" in Meridian's most recent Annual Information Form filed on www.sedarplus.ca. While these factors and assumptions are considered reasonable by Meridian, in light of management's experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise.

Table 1: Santa Helena Central drill results.

| Hole-id | Dip | Azi | EOH (m) | Zone | Int (m) | AuEq (g/t) | Au (g/t) | Cu (%) | Ag (g/t) | Zn (%) | Pb (%) | From (m) |

| CD-822 | -60 | 037 | 80.7 | SHM | ||||||||

| 1.0 | 0.2 | 0.0 | 0.1 | 3.0 | 0.5 | 0.0 | 12.5 | |||||

| 1.7 | 0.2 | 0.0 | 0.0 | 0.3 | 0.8 | 0.0 | 21.3 | |||||

| 10.2 | 0.4 | 0.2 | 0.1 | 5.7 | 0.7 | 0.1 | 43.8 | |||||

| Including | 0.8 | 3.5 | 1.1 | 1.4 | 49.9 | 5.1 | 0.6 | 44.7 | ||||

| 3.4 | 0.5 | 0.1 | 0.0 | 7.8 | 1.0 | 0.5 | 61.9 | |||||

| 0.7 | 0.3 | 0.5 | 0.0 | 0.1 | 0.0 | 0.0 | 80.0 | |||||

| CD-820 | -80 | 033 | 80.2 | SHM | ||||||||

| 0.7 | 0.1 | 0.0 | 0.0 | 0.1 | 0.5 | 0.0 | 20.0 | |||||

| 1.2 | 0.1 | 0.0 | 0.0 | 1.3 | 0.4 | 0.2 | 32.1 | |||||

| 0.8 | 0.1 | 0.0 | 0.1 | 1.9 | 0.0 | 0.0 | 38.4 | |||||

| 17.3 | 0.3 | 0.1 | 0.1 | 3.4 | 0.7 | 0.1 | 50.7 | |||||

| CD-818 | -90 | 000 | 35.2 | SHM | ||||||||

| 17.5 | 0.4 | 0.2 | 0.1 | 12.6 | 0.4 | 0.4 | 0.0 | |||||

| 3.3 | 0.2 | 0.0 | 0.0 | 1.6 | 0.5 | 0.1 | 21.0 | |||||

| CD-815 | -80 | 212 | 50.1 | SHM | ||||||||

| 13.6 | 1.2 | 0.5 | 0.6 | 11.2 | 1.1 | 0.2 | 6.4 | |||||

| Including | 2.9 | 4.7 | 2.2 | 2.3 | 42.8 | 3.8 | 0.6 | 13.7 | ||||

| Including | 1.3 | 8.9 | 4.1 | 4.5 | 83.0 | 6.4 | 1.2 | 13.7 | ||||

| 2.2 | 0.5 | 0.3 | 0.0 | 5.9 | 1.0 | 0.2 | 23.9 | |||||

| 6.5 | 0.3 | 0.0 | 0.0 | 3.3 | 0.6 | 0.3 | 32.0 | |||||

| CD-811 | -72 | 034 | 101.3 | SHM | ||||||||

| 3.6 | 0.2 | 0.0 | 0.0 | 0.3 | 0.6 | 0.0 | 34.4 | |||||

| 1.0 | 0.2 | 0.0 | 0.0 | 0.3 | 0.5 | 0.0 | 42.0 | |||||

| 8.3 | 1.0 | 0.4 | 0.4 | 14.6 | 1.4 | 0.2 | 53.3 | |||||

| Including | 1.1 | 5.4 | 2.0 | 2.9 | 83.6 | 4.7 | 0.5 | 54.3 | ||||

| 2.0 | 0.4 | 0.1 | 0.0 | 4.6 | 0.8 | 0.3 | 68.0 | |||||

| 0.9 | 0.1 | 0.2 | 0.0 | 0.4 | 0.0 | 0.0 | 86.3 | |||||

| CD-810 | -71 | 011 | 80.3 | SHM | ||||||||

| 2.1 | 0.5 | 0.6 | 0.0 | 0.8 | 0.0 | 0.0 | 1.1 | |||||

| 0.7 | 0.2 | 0.0 | 0.0 | 0.5 | 0.6 | 0.0 | 25.3 | |||||

| 0.9 | 0.3 | 0.3 | 0.1 | 1.2 | 0.0 | 0.0 | 32.5 | |||||

| 4.1 | 0.4 | 0.2 | 0.3 | 5.2 | 0.2 | 0.0 | 43.1 | |||||

| 13.7 | 0.6 | 0.2 | 0.1 | 9.5 | 1.1 | 0.2 | 50.9 | |||||

| Including | 3.0 | 1.5 | 0.3 | 0.2 | 22.4 | 3.4 | 0.6 | 50.9 | ||||

| Including | 0.7 | 4.1 | 0.5 | 0.7 | 70.2 | 9.6 | 1.7 | 50.9 | ||||

| CD-806 | -89 | 000 | 110.2 | SHM | ||||||||

| 11.9 | 2.5 | 0.9 | 0.6 | 29.4 | 4.6 | 0.7 | 48.5 | |||||

| Including | 2.6 | 7.8 | 2.4 | 1.7 | 93.2 | 15.7 | 2.6 | 57.0 | ||||

| 1.0 | 0.7 | 0.6 | 0.0 | 10.2 | 1.0 | 0.2 | 63.0 | |||||

| 3.4 | 0.2 | 0.0 | 0.0 | 2.6 | 0.5 | 0.1 | 67.4 | |||||

| 4.7 | 0.2 | 0.0 | 0.0 | 2.3 | 0.4 | 0.2 | 92.3 | |||||

| CD-805 | -69 | 190 | 98.0 | SHM | ||||||||

| 3.0 | 0.5 | 0.7 | 0.0 | 0.5 | 0.0 | 0.0 | 2.0 | |||||

| 1.3 | 4.3 | 1.9 | 2.3 | 55.2 | 3.8 | 0.3 | 82.5 | |||||

| CD-801 | -72 | 189 | 80.3 | SHM | ||||||||

| 15.8 | 1.3 | 0.6 | 0.5 | 13.6 | 1.7 | 0.2 | 31.0 | |||||

| Including | 5.2 | 3.4 | 1.4 | 1.5 | 34.1 | 4.2 | 0.5 | 34.0 | ||||

| Including | 2.5 | 5.8 | 2.5 | 2.6 | 59.3 | 7.3 | 0.8 | 34.0 | ||||

| 4.0 | 0.2 | 0.1 | 0.1 | 3.0 | 0.4 | 0.1 | 49.6 | |||||

| 1.0 | 0.3 | 0.4 | 0.0 | 0.3 | 0.0 | 0.0 | 57.0 | |||||

| CD-799 | -65 | 189 | 50.2 | SHM | ||||||||

| 12.3 | 1.7 | 0.7 | 0.9 | 16.6 | 1.6 | 0.3 | 13.7 | |||||

| Including | 3.1 | 6.1 | 2.3 | 3.5 | 61.5 | 4.9 | 1.0 | 19.0 | ||||

| Including | 2.2 | 7.5 | 2.6 | 4.3 | 68.0 | 6.7 | 1.1 | 19.9 | ||||

| 16.5 | 0.6 | 0.1 | 0.1 | 5.3 | 1.3 | 0.4 | 29.3 | |||||

| CD-796 | -60 | 201 | 70.6 | SHM | ||||||||

| 30.4 | 0.8 | 0.3 | 0.3 | 7.9 | 1.4 | 0.3 | 10.1 | |||||

| Including | 5.7 | 3.0 | 1.0 | 1.0 | 27.6 | 5.2 | 0.9 | 21.0 | ||||

| 3.0 | 0.7 | 1.0 | 0.0 | 1.0 | 0.2 | 0.2 | 46.0 | |||||

| CD-792 | -48 | 190 | 50.0 | SHM | ||||||||

| 25.0 | 1.1 | 0.6 | 0.2 | 16.5 | 1.5 | 0.5 | 6.6 | |||||

| Including | 4.6 | 3.5 | 2.5 | 0.5 | 47.3 | 4.6 | 1.1 | 16.8 | ||||

| 0.8 | 0.2 | 0.0 | 0.0 | 1.7 | 0.4 | 0.2 | 41.0 | |||||

| 1.0 | 0.1 | 0.0 | 0.0 | 2.1 | 0.2 | 0.1 | 45.0 | |||||

| CD-790 | -49 | 193 | 70.1 | SHM | ||||||||

| 1.7 | 1.5 | 1.0 | 0.6 | 13.4 | 1.7 | 0.2 | 33.3 | |||||

| 11.2 | 1.0 | 0.4 | 0.3 | 12.1 | 1.6 | 0.3 | 39.0 | |||||

| Including | 1.4 | 5.0 | 1.6 | 2.3 | 49.9 | 6.9 | 1.0 | 39.0 | ||||

| 2.4 | 0.3 | 0.1 | 0.0 | 4.0 | 0.6 | 0.3 | 53.3 | |||||

| CD-789 | -42 | 009 | 91.7 | SHM | ||||||||

| 0.6 | 0.2 | 0.2 | 0.0 | 0.3 | 0.1 | 0.0 | 28.5 | |||||

| 22.2 | 0.6 | 0.2 | 0.2 | 7.8 | 0.9 | 0.3 | 34.7 | |||||

| Including | 2.6 | 3.2 | 0.6 | 1.8 | 49.9 | 3.9 | 0.8 | 41.2 | ||||

| Including | 1.5 | 4.8 | 0.9 | 2.8 | 72.4 | 5.4 | 1.0 | 41.2 | ||||

| 5.1 | 0.3 | 0.0 | 0.0 | 1.2 | 1.1 | 0.0 | 72.9 | |||||

| 0.6 | 0.4 | 0.1 | 0.0 | 2.3 | 1.1 | 0.1 | 80.7 | |||||

| 4.3 | 0.3 | 0.0 | 0.0 | 3.7 | 0.9 | 0.3 | 86.6 | |||||

| CD-788 | -64 | 192 | 60.2 | SHM | ||||||||

| 0.4 | 0.3 | 0.4 | 0.0 | 0.6 | 0.0 | 0.0 | 7.7 | |||||

| 0.8 | 0.2 | 0.2 | 0.0 | 0.5 | 0.1 | 0.0 | 12.2 | |||||

| 4.3 | 1.7 | 0.3 | 0.9 | 23.0 | 2.5 | 0.3 | 20.2 | |||||

| 14.8 | 0.2 | 0.0 | 0.0 | 2.2 | 0.4 | 0.1 | 30.9 | |||||

| 2.6 | 0.1 | 0.2 | 0.0 | 0.6 | 0.0 | 0.0 | 51.0 | |||||

| CD-786 | -72 | 011 | 75.2 | SHM | ||||||||

| 0.5 | 0.2 | 0.0 | 0.0 | 27.5 | 0.0 | 0.0 | 7.5 | |||||

| 6.9 | 3.0 | 1.1 | 1.6 | 30.8 | 3.3 | 0.5 | 22.9 | |||||

| Including | 2.0 | 6.9 | 2.4 | 4.1 | 73.7 | 6.3 | 0.8 | 26.0 | ||||

| 7.5 | 0.3 | 0.1 | 0.0 | 3.7 | 0.6 | 0.2 | 35.4 | |||||

| 3.0 | 0.3 | 0.0 | 0.0 | 6.9 | 0.7 | 0.4 | 48.0 | |||||

| CD-785 | -46 | 190 | 110.2 | SHM | ||||||||

| 0.5 | 0.3 | 0.5 | 0.0 | 0.7 | 0.0 | 0.0 | 56.3 | |||||

| 18.4 | 0.6 | 0.3 | 0.2 | 5.6 | 0.7 | 0.1 | 59.6 | |||||

| Including | 1.0 | 5.0 | 1.4 | 2.6 | 67.6 | 6.0 | 0.9 | 60.8 | ||||

| 4.6 | 0.2 | 0.0 | 0.0 | 1.0 | 0.5 | 0.0 | 80.0 | |||||

| CD-781 | -72 | 180 | 95.0 | SHM | ||||||||

| 0.7 | 0.4 | 0.5 | 0.0 | 0.2 | 0.0 | 0.0 | 14.4 | |||||

| 5.6 | 3.4 | 1.6 | 1.8 | 34.5 | 1.7 | 0.4 | 35.2 | |||||

| Including | 2.1 | 7.3 | 3.4 | 4.1 | 76.1 | 3.1 | 0.8 | 37.3 | ||||

| 6.2 | 0.8 | 0.6 | 0.0 | 10.7 | 0.9 | 0.4 | 57.0 | |||||

| 1.4 | 0.5 | 0.2 | 0.0 | 4.2 | 1.0 | 0.4 | 66.0 | |||||

| 1.6 | 0.4 | 0.0 | 0.1 | 2.6 | 0.9 | 0.3 | 74.4 | |||||

| 1.9 | 0.3 | 0.0 | 0.0 | 4.8 | 0.9 | 0.3 | 82.0 | |||||

| CD-780 | -89 | 000 | 100.3 | SHM | ||||||||

| 18.9 | 1.1 | 0.4 | 0.3 | 12.6 | 2.0 | 0.4 | 37.0 | |||||

| Including | 1.7 | 6.3 | 2.3 | 2.5 | 58.7 | 9.7 | 1.3 | 37.8 | ||||

| 3.5 | 0.7 | 0.2 | 0.1 | 13.2 | 1.3 | 0.3 | 70.8 | |||||

| CD-775 | -65 | 192 | 55.7 | SHM | ||||||||

| 4.5 | 2.0 | 0.7 | 0.9 | 22.0 | 2.2 | 0.4 | 30.1 | |||||

| Including | 2.4 | 3.6 | 1.4 | 1.7 | 41.0 | 3.8 | 0.7 | 31.6 | ||||

| 4.9 | 0.2 | 0.0 | 0.0 | 2.3 | 0.5 | 0.1 | 43.8 | |||||

| CD-774 | -51 | 199 | 90.4 | SHM | ||||||||

| 1.9 | 2.0 | 1.7 | 0.2 | 13.7 | 1.7 | 0.2 | 42.6 | |||||

| 1.4 | 0.2 | 0.1 | 0.0 | 1.6 | 0.3 | 0.2 | 47.6 | |||||

| 2.4 | 0.7 | 0.1 | 0.1 | 5.0 | 1.8 | 0.2 | 60.1 | |||||

| 4.6 | 0.2 | 0.0 | 0.0 | 1.6 | 0.5 | 0.2 | 69.4 | |||||

| CD-761 | -84 | 184 | 65.1 | SHM | ||||||||

| 1.5 | 0.4 | 0.5 | 0.8 | 2.2 | 0.8 | 0.1 | 10.2 | |||||

| 5.7 | 1.9 | 0.7 | 1.1 | 25.7 | 1.3 | 0.6 | 15.7 | |||||

| Including | 2.3 | 4.3 | 1.7 | 2.5 | 58.5 | 2.5 | 1.3 | 16.2 | ||||

| Including | 1.5 | 5.2 | 1.7 | 3.3 | 70.0 | 3.0 | 1.5 | 16.6 | ||||

| 11.2 | 0.7 | 0.2 | 0.2 | 8.6 | 1.4 | 0.3 | 29.4 | |||||

| Including | 1.4 | 2.5 | 0.6 | 0.7 | 26.6 | 5.2 | 0.9 | 29.4 | ||||

| Including | 1.5 | 1.6 | 0.3 | 0.7 | 19.4 | 2.8 | 0.3 | 32.9 | ||||

| 6.9 | 0.2 | 0.1 | 0.0 | 2.2 | 0.4 | 0.3 | 45.1 |

1 Meridian Mining News Release of February 12, 2026

2 Meridian Mining News Release of January 20, 2026

3 Meridian Mining news release of May 8, 2025

4 Meridian Mining News Release of May 18, 2020.

5 Meridian Mining News Release of January 20, 2026.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/284046