Myriad Uranium Completes High-Resolution Ground Geophysics at Red Basin, Secures 100% Ownership, and Launches Market Awareness Program

Rhea-AI Summary

Myriad Uranium (OTCQB: MYRUF) completed high-resolution ground magnetic and radiometric surveys over its Red Basin claims in New Mexico and has earned a 100% interest in 86 lode claims covering ~1,776 acres following an option agreement dated January 30, 2025. The surveys collected 160 line-km magnetic and 142 line-km gamma data to help refine exploration targeting; final outputs are expected in the coming weeks. Myriad engaged Machai Capital for a 12-month market awareness program, paying $300,000 plus GST and issuing 300,000 stock options exercisable at $0.35 until November 25, 2027 (vest Mar 25, 2026). Historical resource estimates are described as not verified and not treated as current resources.

Positive

- Earned 100% interest in 86 Red Basin lode claims (~1,776 acres)

- Completed 160 line-km magnetic survey and 142 line-km gamma survey

- Engaged Machai for 12-month market awareness program with $300,000 fee

Negative

- Issued 300,000 stock options exercisable at $0.35 (possible dilution)

- Historical resource estimates remain unverified and not current resources

News Market Reaction

On the day this news was published, MYRUF gained 9.49%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

MYRUF was down 2.85% while peers like CAMZF (+0.78%), IMTCF (+3.64%), and NBRFF (+8.25%) were flat-to-up, suggesting a stock-specific move rather than a sector-wide trend.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 08 | Project earn-in milestone | Positive | -5.4% | Earned 75% interest in Copper Mountain after >$5.5M in spending. |

| Dec 04 | Geophysical survey update | Positive | +0.3% | Completed large-scale airborne survey at Copper Mountain with data pending. |

| Nov 26 | Red Basin progress | Positive | +9.5% | Completed Red Basin ground geophysics, secured 100% interest, began marketing. |

| Nov 13 | Equity financing | Neutral | +0.1% | Closed C$8.603M bought-deal private placement to fund U.S. uranium projects. |

| Nov 05 | Media interview | Neutral | +22.1% | CEO interview feature aimed at investor engagement and visibility. |

News around project advancement and marketing has often coincided with positive price moves, but there is at least one instance where a major project milestone saw a negative reaction.

Over the last months, Myriad Uranium has advanced multiple U.S. uranium projects and its capital position. On Nov 13, 2025, it closed a C$8.603M bought deal to fund Copper Mountain and Red Basin. On Nov 26, 2025, it reported completing Red Basin geophysics and securing 100% claim ownership, alongside a new market awareness program, which coincided with a +9.49% move. Subsequent Copper Mountain survey results and a 75% earn-in showed mixed market reactions, while a media interview on Nov 5 aligned with a strong +22.08% gain.

Market Pulse Summary

The stock moved +9.5% in the session following this news. A strong positive reaction aligns with prior responses to Red Basin news, where this announcement previously saw a +9.49% move. The market may have focused on the transition to 100% ownership, detailed geophysical work, and the 12‑month marketing push. However, gains in the past have sometimes reversed after milestones, and the project’s historical resource figures are explicitly described as non‑current, which adds uncertainty to how much value the new data ultimately supports.

Key Terms

roll-front deposits technical

in-situ recovery technical

gamma mapping technical

scintillation detector technical

NaI (Tl) crystal technical

open pit technical

underground mining technical

in-situ leaching technical

AI-generated analysis. Not financial advice.

Vancouver, British Columbia--(Newsfile Corp. - November 26, 2025) - Myriad Uranium Corp. (CSE: M) (OTCQB: MYRUF) (FSE: C3Q) ("Myriad" or the "Company") is pleased to announce that it has completed ground radiometric and magnetic surveys over the original claim areas that were the subject of the

Myriad also announces the engagement of Machai Capital to enhance investor awareness. Further details are provided below.

Thomas Lamb, Myriad's CEO, commented "We are delighted to complete this earn-in to

"We are also pleased to announce a significant new investment in investor awareness with the engagement of Machai Capital. With recent milestones achieved and additional developments on the horizon, this is the right moment to expand our international visibility as we advance our projects."

Ground Geophysical Survey Parameters and Results

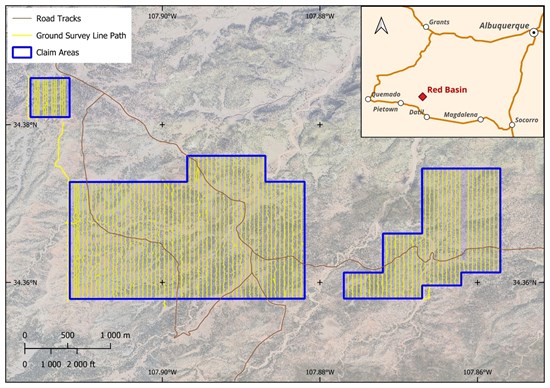

The ground magnetic and radiometric surveys were conducted at 50 m line spacing along a north-south orientation.

- The magnetic survey was completed with 160 line-km of total data collected. Crews operated a Geometrics MagEx portable cesium-vapor magnetometer paired with a Geometrics MagStation base station for diurnal corrections. Both the rover and base sampled at 5 Hz. With an average walking speed of ~4 km/h, the resulting station spacing was roughly 0.2 m.

- Gamma mapping covered 142 line-km over the same grid area. The crew used an ERG RadScout mapping system consisting of RadScout software on a Juniper handheld, receiving counts from a Ludlum Model 3000 meter connected to a Ludlum 44-10 scintillation detector. The 44-10 uses a 2" × 2" NaI (Tl) crystal, which provides high sensitivity for total-count gamma surveys. Sampling was at 1 Hz, giving an average station spacing of ~1 m.

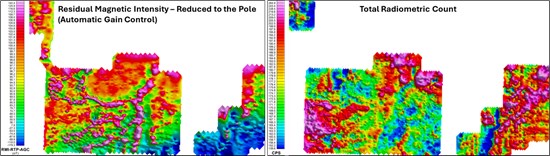

The recorded line paths for the data collection are shown in Figure 1 and preliminary output images are shown in Figure 2. Final data and outputs are expected in the coming weeks. The magnetic image shows channel-like features that appear to correlate with existing drainage patterns for the most part but may also give indication of sub-surface channels. Further interpretation and ground-truthing of the data and its determination of its utility for exploration targeting is still planned.

Figure 1: Ground survey line paths for recorded data

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6301/276002_69309881a4dc69ce_002full.jpg

Figure 2: Preliminary image outputs for the ground radiometric and magnetic surveys

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6301/276002_69309881a4dc69ce_003full.jpg

Geology and Mineralisation at Red Basin

Exploration and minor production in the Red Basin district dates back to the 1950s with approximately 1,194 pounds of U3O8 produced from ore with an average grade of

Mineralisation is hosted in channelised roll-front deposits within permeable sandstones of the Crevasse Canyon Formation and pre-Baca Formation paleosols. Historical drilling on the Project has delineated a thick section of roll-front type uranium-vanadium mineralisation cropping out on the surface to approximately 450 feet down dip. The meandering uranium-vanadium bearing sandstones can be more than a mile in length and 600 or more feet wide. The host formations are amenable to open pit or underground mining and possibly in-situ leaching.

A 1980 assessment of uranium resources in the Colorado Plateau physiographic province (U.S. Department of Energy, 1980) estimated that Myriad's Red Basin Project contains approximately 1.6 million pounds U3O8 at an average grade of

An Open-File report (No. 138) produced by the New Mexico Bureau of Mines and Minerals (Chamberlin, 1981) indicates that the Red Basin area could contain as much as 30 – 45 million pounds of U3O8. In addition, the deposits could contain significant amounts of associated vanadium, up to

Market Awareness Program

The Company has engaged Machai Capital Inc. ("Machai") for a 12-month term to provide digital marketing services including content creation, social media marketing, email marketing, and search engine optimisation. Machai is an arms-length marketing, advertising and public awareness firm based in Vancouver, British Columbia.

Upon execution of an agreement dated November 25, 2025, Myriad paid Machai

Machai is arm's length to Myriad and, to the knowledge of Myriad, other than the stock options issued under the agreement, neither Machai nor its principals have any present equity interest in the Company's securities, directly or indirectly, or any right to acquire any equity interest. Machai can be reached at #101 – 17565 58th Avenue, Surrey, BC V3S 4E3; Tel: (604) 375-0084, Email: suneal@machaicapital.com.

Historical Estimates

While Myriad Uranium has determined that the historical estimates described in this news release are relevant to the Red Basin Project area and are reasonably reliable given the authors and circumstances of their preparation, and are suitable for public disclosure, readers are cautioned not to place undue reliance on these historical estimates as an indicator of current mineral resources or mineral reserves at the Project area. A qualified person (as defined under NI 43-101) has not done sufficient work to classify any of the historical estimates as current mineral resources or mineral reserves, and Myriad Uranium is not treating the historical estimates as a current mineral resource or mineral reserve. Also, while the Red Basin claims contain all or most of each deposit referred to, some of the resources may be located outside the current Red Basin Project area. Furthermore, the estimates are decades old and based on drilling data for which the logs are not available to Myriad.

From Myriad Uranium's viewpoint, limitations include that the Company has not been able to verify or validate historical data. To verify the historical estimates and potentially re-state them as current resources, a program of digitization of available data would be required. This must be followed by re-logging and/or re-drilling to generate new data to the extent necessary that it is comparable with the original data, or new data that can be used to establish the correlation and continuity of geology and grades between boreholes with sufficient confidence to estimate mineral resources.

Qualified Person

The scientific or technical information in this news release respecting the Company's Red Basin Project has been approved by George van der Walt, MSc., Pr.Sci.Nat., FGSSA, a Qualified Person as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects. Mr. van der Walt is employed by The MSA Group (Pty) Ltd (MSA), a leading geological consultancy providing services to the minerals industry, based in Johannesburg, South Africa. He has more than 20 years industry experience and sufficient relevant experience in the type and style of mineralisation to report on exploration results.

The information and interpretations thereof are based on the Qualified Person's initial review of historical reports, which were recently obtained by the Company. The information did not include original data such as drilling records, sampling, analytical or test data underlying the information or opinions contained in the written documents. Therefore, the Qualified Person has not reviewed or otherwise verified the information and has not done sufficient work to classify the historical estimates as current mineral resources or mineral reserves. The Qualified Person considers the information to be relevant based on the amount and quality of work undertaken and reported historically.

About Myriad Uranium Corp.

Myriad Uranium Corp. is a uranium exploration company with an earnable

For further information, please refer to Myriad's disclosure record on SEDAR+ (www.sedarplus.ca), contact Myriad by telephone at +1.604.418.2877, or refer to Myriad's website at www.myriaduranium.com.

Myriad Contacts:

Thomas Lamb

President and CEO

tlamb@myriaduranium.com

Forward-Looking Statements

This news release contains "forward-looking information" that is based on the Company's current expectations, estimates, forecasts and projections. This forward-looking information includes, among other things, the Company's business, plans, outlook and business strategy. The words "may", "would", "could", "should", "will", "likely", "expect", "anticipate", "intend", "estimate", "plan", "forecast", "project" and "believe" or other similar words and phrases are intended to identify forward-looking information. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect, including with respect to the Company's business plans respecting the exploration and development of the Company's mineral properties, the proposed work program on the Company's mineral properties and the potential and economic viability of the Company's mineral properties. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the Company's actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking information. Such factors include, but are not limited to: changes in economic conditions or financial markets; increases in costs; litigation; legislative, environmental and other judicial, regulatory, political and competitive developments; access to minerals where the surface rights above them have not been settled; and technological or operational difficulties. This list is not exhaustive of the factors that may affect our forward-looking information. These and other factors should be considered carefully, and readers should not place undue reliance on such forward-looking information. The Company does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking information whether as a result of new information, future events or otherwise, except as required by applicable law.

The CSE has not reviewed, approved or disapproved the contents of this news release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276002