Noble Plains Uranium Achieves 87% Success Rate with Strong Initial Drill Results from First Eight Holes at Duck Creek Project in Wyoming

Rhea-AI Summary

Noble Plains Uranium (OTCQB: NBLXF) reported initial drill results from eight holes at the Duck Creek Project (Wyoming) with a reported >87% hit ratio: seven of eight holes intersected mineralisation. Average Grade‑Thickness (GT) of 1.0 (about 67% higher than the 0.598 GT used in the company's prior technical target) with an average intercept thickness of 17.6 ft and average grade of 0.057% eU3O8. Results come from a planned up-to-150‑hole, 37,400 ft program aimed at confirming historic data, expanding the 3‑mile Wasatch roll-front trend, and first-ever Fort Union tests. The company targets a NI 43‑101 resource estimate in H1 2026 and cautions eU3O8 gamma readings may not equal lab uranium concentrations and the exploration target is conceptual.

Positive

- Hit ratio >87% (7 of 8 holes mineralised)

- Average GT of 1.0, ~67% above the prior 0.598 assumption

- Average intercept 17.6 ft at 0.057% eU3O8

Negative

- Sample size limited to 8 holes so far

- Two holes returned GT below typical 0.2 cut-off (holes 25-28-002, 25-28-008)

- eU3O8 readings may not reflect actual uranium due to possible disequilibrium

News Market Reaction – NBLXF

On the day this news was published, NBLXF gained 3.14%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Peers showed mixed moves, with TCEFF down 10.26% and NVTQF down 90.96%, while STTDF and SUUFF rose 4.9% and 1.64%, suggesting NBLXF’s gain is more company-specific than sector-wide.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 09 | Drill results update | Positive | +2.1% | Second batch of 16 Duck Creek holes with 81% success rate and strong GT. |

| Dec 01 | Initial drill results | Positive | +3.1% | First eight Duck Creek holes with >87% hit ratio and GT well above plan. |

| Nov 25 | Drill permit granted | Positive | -9.2% | Permit and launch of 37,400 ft, ~175-hole Duck Creek drill program. |

| Nov 03 | CEO transition | Neutral | +1.0% | Appointment of Drew Zimmerman as CEO and Paul Cowley as COO. |

| Oct 08 | Board appointment | Positive | -8.6% | Addition of veteran uranium geologist Chris Healey to board. |

Positive Duck Creek drill updates have recently coincided with modest price gains, while permitting and board changes saw negative reactions despite constructive narratives.

Over recent months, Noble Plains Uranium focused on advancing its Wyoming assets and corporate team. On Oct 08, it added veteran geologist Chris Healey to the board, followed by appointing Drew Zimmerman as CEO on Nov 03. The Duck Creek drill permit and 37,400 ft program were announced on Nov 25. The current Dec 01 release delivered strong initial Duck Creek drill results, which were reinforced by a second high‑success batch on Dec 09, all aimed at supporting a NI 43‑101 resource in 2026.

Market Pulse Summary

This announcement details strong initial drilling at Duck Creek, with seven of eight holes mineralised, an average GT of 1.0, and average thickness of 17.6 ft at 0.057% eU3O8. These results exceed GT assumptions used in the project’s conceptual exploration target and support a broader 37,400 ft, ~150‑hole program. Investors may watch future batches, deeper Fort Union tests, and progress toward a NI 43‑101 resource estimate targeted for the first half of 2026.

Key Terms

grade-thickness (gt) technical

roll front technical

national instrument 43-101 regulatory

gamma-ray probes technical

mud-rotary rig technical

AI-generated analysis. Not financial advice.

Vancouver, British Columbia--(Newsfile Corp. - December 1, 2025) - Noble Plains Uranium Corp. (TSXV: NOBL) (OTCQB: NBLXF) (FSE: INE0) ("Noble Plains" or the "Company"), a U.S. focused uranium exploration and development company, is pleased to announce strong thickness and grade results demonstrating a >

"These first holes represent the initial results from a planned 150-hole program and have exceeded expectations," stated Paul Cowley, Chief Operating Officer of Noble Plains. "Seven of the first eight holes intersected uranium mineralisation averaging five times above the industry standard Grade-Thickness ("GT") cut-off of 0.2 typically used in Wyoming roll front uranium deposits with an average GT of 1.0. GT is a simple calculation of thickness times grade. Average thickness of intercepts in these first 7 of 8 holes is 17.6 feet at an average grade of

Table 1: Drill Intercept Highlights

| Hole ID | Hole Depth (ft) | From (ft) | To (ft) | Length (ft) | Grade (% eU3O8)* | Grade x Thickness (GT) |

| 25-28-001 | 225 | 131.0 | 145.0 | 14.0 | 0.092 | 1.29 |

| 25-28-002 | 220 | 62.5 | 66.5 | 4.0 | 0.042 | 0.17 |

| 25-28-003 | 220 | 85.5 | 105.0 | 19.5 | 0.063 | 1.30 |

| 25-28-004 | 220 | 93.0 | 120.0 | 27.0 | 0.037 | 1.00 |

| 25-28-005 | 220 | 94.0 | 113.0 | 19.0 | 0.049 | 0.93 |

| 25-28-006 | 220 | 56.0 | 73.0 | 17.0 | 0.049 | 0.83 |

| 25-28-007 | 220 | 124.5 | 146.5 | 22.0 | 0.055 | 1.21 |

| 25-28-008 | 220 | 133.0 | 145.0 | 12.0 | 0.036 | 0.43 |

Including:

| Hole ID | Hole Depth (ft) | From (ft) | To (ft) | Length (ft) | Grade (% eU3O8)* | Grade x Thickness (GT) |

| 25-28-001 | 225 | 131.5 | 141.0 | 9.5 | 0.127 | 1.21 |

| 25-28-003 | 220 | 93.0 | 101.5 | 8.5 | 0.120 | 1.02 |

| 25-28-007 | 220 | 130.5 | 142.0 | 11.5 | 0.085 | 0.98 |

The Company filed a Technical Report, available on SEDAR+ under the Company's profile, on the Duck Creek Project on August 14, 2025, which outlined an exploration target ranging from 2.37 million tons at

The Company notes that the first seven mineralised holes returned an average GT of 1.0, approximately

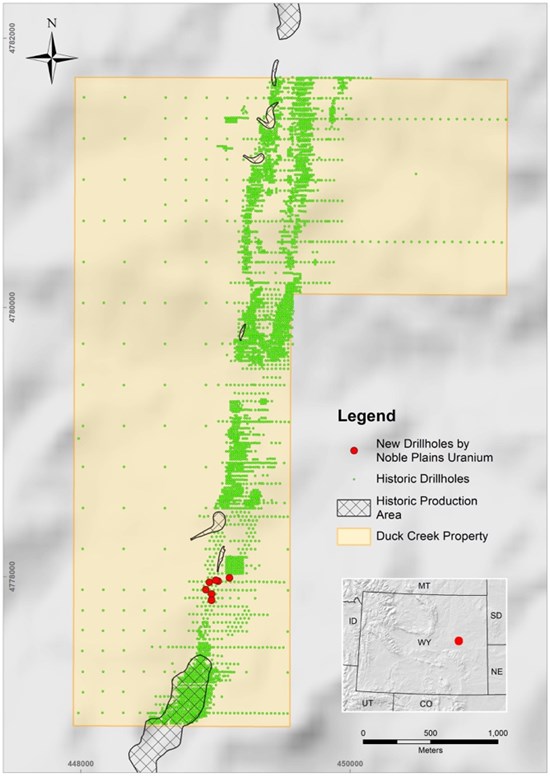

The Company is releasing these initial results early to demonstrate that the drill program is performing better than anticipated and to highlight the strength of the historic dataset the Company relied upon for acquisition, valuation, and program design. Figure 1 shows the location of the first eight holes within the 3-mile-long trend of historic drilling. These first holes are part of the 130 planned "expansion" holes referred to under the Ongoing Drill Program Overview section below. Larger batches of drill results will be released as the program advances.

"These results are a robust validation of our entire strategy at Noble Plains," said Drew Zimmerman, CEO of Noble Plains Uranium. "We moved quickly on Duck Creek because the historic dataset showed clear potential for meaningful pounds in the ground, and these early holes confirm we were right to have that conviction. Achieving an average GT of 1.0, five times the typical cut-off, on our very first holes is exceptional. We acquired an undervalued brownfield asset with over 4,000 historic holes and are now working to quantify the full potential of mineralization that is off to a strong start. This is our aim as a company: identify undervalued brownfield projects, execute decisively, and work to convert legacy data into pounds in the ground with urgency. With drilling continuing, momentum is building, and we're just getting started."

Figure 1 - New Drillhole Locations

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3717/276387_32f2f7438442eba9_001full.jpg

Ongoing Drill Program Overview

The Duck Creek drill program, permitted for up to 37,400 ft across ~150 holes, is structured around three key objectives:

1. Confirmation of Historic Data - 16 Holes

To verify 1,317 historic intercepts in the Wasatch Formation and support a uranium resource prepared in accordance with National Instrument 43-101 standards.

2. Expansion of Shallow Mineralisation ~ 130 Holes

Designed to extend mineralised boundaries and target higher-grade areas along the 3-mile-long Wasatch roll-front corridor.

3. First-Ever Drilling of the Fort Union Formation ~ 10 Holes

For the first time, Noble Plains will drill to ~1,200 ft to test the Fort Union, where neighbouring projects host the majority of their compliant resources.

Details of the Drilling Program

* The geophysical results are based on equivalent uranium (eU3O8) of the gamma-ray probes calibrated at the Department of Energy's Test Facility in Casper, Wyoming. A geophysical tool with gamma-ray, spontaneous potential, resistivity, and drift detectors was utilized. The reader is cautioned that the reported uranium grades may not reflect actual concentrations due to the potential for disequilibrium between uranium and its gamma emitting daughter products.

- Mineralized holes with thicker, higher-grade intercepts are interpreted to be in the Interface, Nose, or Near Seepage ground located within the projected roll front system.

- Mineralized holes with thinner, below cutoff grade intercepts are interpreted to be in the tails (Near Interior) or Remote Seepage ground located behind (altered) or ahead (reduced) of the projected roll front system, respectively.

- The drill results were determined using thickness and grade % cutoffs of 2-ft and

0.02% eU3O8.

The drilling was completed by Tyler Exploration Inc. utilizing a truck mounted mud-rotary rig and the geophysical logging by Hawkins CBM Logging, both of Wyoming. Bradley Parkes P.Geo, VP Exploration and Paul Cowley P.Geo, Chief Operating Officer for Noble Plains Uranium Corp., supervised the drilling activities.

Next Steps and Outlook

Drilling is ongoing and the Company will continue releasing results in batches to maintain transparency and demonstrate progress as the confirmation and expansion phases advance. The first deep Fort Union tests are planned for later in the program.

With the results of the first drill campaign currently in progress and the historic database, the Company continues to aim for a resource estimate prepared in accordance with National Instrument 43-101 standards in the first half of 2026.

About Noble Plains Uranium

Noble Plains Uranium Corp. is a U.S.-focused uranium exploration and development company advancing a portfolio of high-potential projects amenable to In Situ Recovery (ISR) — the most capital-efficient and environmentally responsible method of uranium extraction. Our strategy targets historically drilled and underexplored assets in proven jurisdictions, with the objective of rapidly delineating NI 43-101 compliant resources and building a scalable inventory of domestic uranium.

On Behalf of the Board of Directors,

"Drew Zimmerman", CEO & President

For further information, please contact: Drew Zimmerman: (778) 686-0973

Website: www.nobleplains.com

Bradley Parkes, P.Geo., VP Exploration of Noble Plains Uranium Corp., is the Qualified Person as defined in National Instrument 43-101, who has read and approved the technical content of this news release.

This news release includes certain forward-looking statements as well as management's objectives, strategies, beliefs and intentions. Forward-looking statements are frequently identified by such words as "may", "will", "plan", "expect", "anticipate", "estimate", "intend" and similar words referring to future events and results. Forward-looking statements include, but are not limited to, statements regarding the planned drill program, the timing of drilling and results, the potential to outline a uranium resource prepared in accordance with National Instrument 43-101 standards, the potential to confirm or expand mineralisation, and the expected advancement of the Company's exploration strategy. Forward-looking statements are based on the current opinions and expectations of management. All forward-looking information is inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including but not limited to: the Company's ability to complete the drill program as planned, the interpretation of historic data, the accuracy of geological modelling, the results of drilling and downhole probing, operational risks and weather delays, regulatory approvals, availability of equipment and personnel, the speculative nature of mineral exploration and development, and fluctuating commodity prices, as described in more detail in our recent securities filings available at www.sedarplus.ca. Actual events or results may differ materially from those projected in the forward-looking statements and we caution against placing undue reliance thereon. We assume no obligation to revise or update these forward-looking statements except as required by applicable law.

Neither the TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276387