Scottie Resources Unlocks ~C$9M from Bulk Sample - Successful 'Dry Run' Demonstrates Future Potential DSO Pathway

Rhea-AI Summary

Scottie Resources (OTCQB:SCTSF) reports sale of a Bulk Sample from the Bend Vein at Scottie Gold Mine Project, preparing an estimated 4,588 wet tonnes crushed to 1/2" minus with preliminary assays averaging 15.89 g/t Au and 42.28 g/t Ag. The parcel is booked for shipment Dec 10–12, 2025, with a 90% upfront payment five days after sailing (priced at US$4,100/oz Au and US$49.50/oz Ag) and a 10% final reconciliation. Company says the Bulk Sample equals roughly 10 days of full production per the 2025 PEA and expects proceeds (~C$9M net) to fund the Feasibility Study and permitting. The company also upsized a charity flow-through financing to up to 11,327,420 shares for gross proceeds up to $24,240,678.80.

Positive

- Bulk Sample net proceeds of approximately C$9 million

- Preliminary grades of 15.89 g/t Au and 42.28 g/t Ag

- Prepared 4,588 tonnes of crushed product for export

- Represents about 10 days of planned full production

- Upsized financing to $24,240,678.80 (11,327,420 shares)

Negative

- Final 10% payment subject to reconciliation of finalized assays

- Reported Bulk Sample economics exclude certain site overheads and taxes

- Bend Vein resource is small: 25,000 tonnes, 8.9k inferred oz

- Shipment timing booked Dec 10–12, 2025, exposing short-term logistics risk

News Market Reaction

On the day this news was published, SCTSF gained 6.77%, reflecting a notable positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

Within Other Precious Metals & Mining, peers were mixed: some showed strong gains (ACKRF +25.27%, VLMGF +7.28%, TBXXF +6.76%), while others were flat or slightly down. SCTSF was modestly lower (-0.24%), suggesting a more stock-specific setup rather than a unified sector move.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 08 | PEA filing | Positive | +4.1% | Filed NI 43-101 PEA, detailing economics for Scottie Gold Mine project. |

| Dec 04 | Award recognition | Positive | -1.8% | President received AME H.H. “Spud” Huestis Award for exploration work. |

| Dec 01 | Bulk sample sale | Positive | +6.8% | Reported ~C$9M bulk sample monetization and upsized charity flow-through. |

| Nov 04 | Drill results | Positive | -1.6% | Reported strong P-Zone drill intercepts and referenced robust PEA economics. |

| Oct 28 | PEA economics | Positive | +0.0% | Released PEA showing attractive DSO economics and optional toll-mill case. |

Recent Scottie news has often been positive, with roughly balanced aligned vs. divergent price reactions, indicating that strong project updates do not always translate into immediate price follow-through.

Over the last several months, Scottie Resources has reported a series of project-building milestones at the Scottie Gold Mine Project. The October 28 Preliminary Economic Assessment outlined a DSO-focused plan with notable NPV and short payback metrics. Subsequent drill results at P-Zone, an upsized bulk sample monetization (~C$9M net) and recognition for Dr. Mumford’s exploration work reinforced the project narrative. Filing of the NI 43-101 PEA on December 8, 2025 further advanced technical de-risking, with generally constructive but sometimes uneven price reactions.

Market Pulse Summary

The stock moved +6.8% in the session following this news. A strong positive reaction aligns with prior responses to Scottie’s technical milestones, such as the earlier bulk sample news that saw a 6.77% move. The announcement combined high-grade bulk sample assays, an advance-priced offtake structure, and an upsized charity flow-through financing up to $24,240,678.80. Investors would have weighed these against financing dilution risk and the fact that current price already sat above the 0.86 200-day MA, which can limit follow-on momentum.

Key Terms

direct ship ore technical

preliminary economic assessment technical

canadian exploration expenses financial

flow-through mining expenditures financial

bond rod work index technical

particle size distribution technical

AI-generated analysis. Not financial advice.

Vancouver, British Columbia--(Newsfile Corp. - December 1, 2025) - Scottie Resources Corp. (TSXV: SCOT) (OTCQB: SCTSF) (FSE: SR80) ("Scottie" or the "Company") is pleased to report on the sale of its Bulk Sample which was mined, crushed, and transported over the 2025 summer season at the Bend Vein pit at the Scottie Gold Mine Project (SGMP) and is currently waiting to be shipped.

After having received the Bulk Sample permit in late July this year, Scottie quickly mobilized contractors and equipment and began work on the Bulk Sample with a view to completing the program before the end of the year.

Executing the sale, shipping, and export of the Bulk Sample required detailed logistical planning and effectively mirrored the expected workflow of future Direct Ship Ore ("DSO") operations. As outlined in the 2025 Preliminary Economic Assessment ("PEA") –see news release dated October 28, 2025-11-25 the Bulk Sample tonnage represents roughly 10 days of full production at the Scottie Gold Mine Project, demonstrating the scalability of the development plan.

Highlights:

An estimated 4,588 wet tonnes have been prepared for export to an Ocean Partners facility in Taiwan with better-than-expected average preliminary assays of 15.89 g/t gold and 42.28 g/t silver

Per the Company's agreement with Ocean Partners, a

90% upfront payment is to be received five days after sailing at a gold price of US$410 0/oz and silver price of US$49.50 /ozVessel has been booked and is expected to be loaded between December 10th and 12th 2025

The final

10% payment will reconcile any difference between estimated and final ounces and will be priced based on metal values at the time grades are finalized and agreed upon

"We are extremely pleased with the success of this season's Bulk Sample program," commented Dr. Thomas Mumford, President of the Company. "In addition to generating approximately

Bend Vein

Bend Vein (Figure 1) is a small resource included in the 2025 mineral resource estimate that outcrops at surface adjacent to the camp access road. Bend vein is included in the PEA as a small open pit resource of 25,000 tonnes with an average grade of 9.56 g/t gold for a total of 8.9K inferred ounces of gold. Mineralization style at Bend is analogous as the vein material at the Blueberry and Scottie Gold Mine deposits, gold-bearing massive to semi-massive pyrite-pyrrhotite rich veins hosted in andesitic host rocks of the Hazleton Group.

Figure 1 – Overview of Bend Vein zone and drilling prior to initial blast.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11118/276388_e091c16b74e18852_002full.jpg

Mining/Crushing Process

Permit applications were submitted for the Bulk Sample in January 2025 and approved in July 2025. Following receiving the required permits from the regulators, the week after, Scottie's mining contractor (a Stewart, BC based quarry operator) took the first blast, followed by sorting, mucking, drilling, and a second and final blast for the sample which was also sorted.

Sorting was performed under the supervision of a Scottie geologist familiar with the Bend vein, who worked directly with the excavator operators to sort mineralized rock from waste.

Once sorting was completed, the pit was backfilled with the waste material. The mineralized material was jaw crushed to 4" minus with the contractor's mobile crusher. The mineralized material was then trucked to the contractor's gravel pit in Stewart, BC, with a mixed fleet of highway trucks ranging from 30 t to 45 t capacity.

At the gravel pit the material was further crushed to ½" minus using a mobile cone crusher and mobile screening plant. Resulting in an estimated 4,588 tonnes, with a moisture content of

Figure 2 - Photo of Bulk Sample at Stewart Bulk Terminal awaiting transport. Product has been crushed to ½" minus. Scottie COO Sean Masse for scale.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11118/276388_e091c16b74e18852_003full.jpg

The sale, shipping and export processes are unique and very involved. This has been a very important planning and learning process for Scottie, as it represents the typical process that the DSO model would be in production. Based on the 2025 PEA, the Bulk Sample would represent about 10 days' production when SGMP is in full production.

Scottie used the same consultant that helped secure the agreement with Ocean Partners for the selling aspects of the Bulk Sample (this sale was explicitly excluded from the Ocean Partners offtake agreement) and the Scottie team worked through the regulatory aspects of the export.

Regulatory aspects include, CBSA permitting, Export licensure, Product Safety Data Sheets (SDS), IMSBC Code group classification (bulk cargo shipping safety), detailed assays for deleterious elements and their grades. All of these approvals and processes are required for production of the SGMP, now that these have been completed once, they would become matter of course and be kept up to date from time to time.

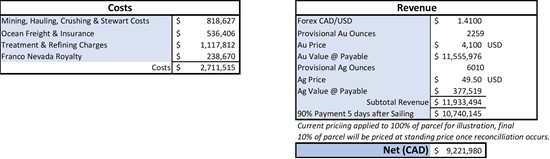

The following table shows the costs, revenue and profit from the Bulk Sample:

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11118/276388_scottietable1.jpg

All dollar ($) amounts in this news release are in Canadian dollar ($) unless otherwise indicated. As this is a trial mining process it does ignore some of the overheads related to operating the site and camp that would normally be attributed to the operation in steady state. Taxes are also not included.

Payment Terms

Scottie has elected to "Advance Price" this parcel, which is a feature of both our long term and Bulk Sample agreements with Ocean Partners. This enables Scottie to take a futures price for any parcel, rather than reconciling on M+1 or M+3 pricing terms, which would be the normal course under the agreement. The prices are included in the Revenue table above and come from the LME futures market via Ocean Partners' hedging desk.

Provisional payment of

Final sampling will take place at Ocean Partners' facility in Taiwan, carried out by an independent laboratory and assay facility in Taiwan. The parcel will be sampled on 250 t lots and samples will be taken for Scottie, Ocean Partners, the independent umpire and a reserve sample. Umpiring will occur if there is a discrepancy on gold greater than 0.2 g/t of gold or 5 g/t of silver.

The final

Valuable Engineering

The Bulk Sample represents not only a great opportunity to trial run most of the steps to the DSO model for the SGMP, but it also gave an opportunity to do some critical test-work that will help with further engineering.

- Bond Rod Work Index, used for understanding grinding energy required was measured to be 11.8 kWhr/t, this is "medium to moderately hard", typical materials in this range are raw cement materials, tin ore, etc. This compares to an average of 15.2 kWh/t for Brucejack ore.

- Bond Crushing Work Index (CWi) and Bond Abrasion Index (Ai) of 11.46 kWhr/t and Ai=0.119 respectively, these parameters are used in selecting and sizing a crusher that will be used to feed the sorting system. The CWi for the Bend Vein material is relatively low so that crushing to the sorting size should take a lower energy than a harder material, the abrasion index is in the medium to non-abrasive range, meaning that an impactor or jaw crusher are suitable. This will be an important aspect to investigate in our next study as impactors can generate less fines and, therefore, allow more of the overall plant feed to be sorted, producing a higher overall grade and a lower shipped tonnage.

- Grade to size fraction, used to understand if gold preferentially settles during crushing into the finer fractions. This is of critical importance to sorting performance as ore sorters generally do not sort <12.5mm, this undersize material is considered "fines" in the flowsheet and would be added to the concentrate from the sorters. This is significant factor because it will both dilute the grade of the final product and increase the tonnage. In the lab work, the gold does not preferentially migrate to the fines, this is likely since the gold is predominantly fine (~150 micron or finer) and closely associated with sulfide minerals, rather than larger free gold particles that would be freed with crushing and migrate into the fines.

- Particle size distribution (PSD), this work determines how the material performs during crushing, indicating how much "fines" is produced and what is the likely feed tonnage and size distribution that would be fed to the ore sorters. This is also important to the design of the screen decks used to sort the crushed product for sorting. The results of the analysis show that the material produced a "fine" fraction of

21% .

Upsize to Previously Announced Non-Brokered Financing

The Company also announces that, further to its November 17, 2025 news release, it has increased the size of its non-brokered private placement (the "Offering") in response to strong investor demand. The Offering will now consist of up to 11,327,420 charity flow-through common shares ("Charity FT Shares") at a price of

Each Charity FT Share will qualify as a "flow-through share" within the meaning of subsection 66(15) of the Income Tax Act (Canada) (the "Tax Act"). The gross proceeds will be used to fund "Canadian exploration expenses" that qualify as "flow-through mining expenditures" under the Tax Act and that will be incurred in connection with the Scottie Gold Mine Project in British Columbia. These expenditures will also qualify as "BC flow-through mining expenditures" under the Income Tax Act (British Columbia). All qualifying expenditures will be renounced in favour of the subscribers effective on or before December 31, 2025.

Readers are directed to the Company's November 17, 2025 news release for additional details regarding the Offering.

Quality Assurance and Control

Results from samples taken during the 2025 field season were analyzed at SGS Minerals in Burnaby, BC or MSA Labs in Prince George, BC. The sampling program was undertaken under the direction of Dr. Thomas Mumford. A secure chain of custody is maintained in transporting and storing of all samples. For the bulk sample analyses gold was assayed using Photon Assay. Analysis by four acid digestion with multi-element ICP-AES analysis was conducted on all samples with silver and base metal over-limits being re-analyzed by emission spectrometry.

Dr. Thomas Mumford, P.Geo., non-independent and President of the Company, a qualified person under National Instrument 43-101, has reviewed and approved the technical information contained in this news release on behalf of the Company.

ABOUT SCOTTIE RESOURCES.

Scottie Resources controls

The Scottie Gold Mine Project hosts 3,604K tonnes at 6.1 g/t Au for 703,000 oz gold (Inferred classification), highlighting a robust near-surface, high-grade resource with room for significant growth. A newly completed PEA outlines compelling economics with an after-tax NPV(

Scottie has successfully completed a Bulk Sample program expected to generate ~

Scottie's experienced leadership team has a strong track record in discovery, resource growth, and project advancement in the Golden Triangle. Their proven operating, technical, and capital markets expertise positions Scottie to efficiently advance the Scottie Gold Mine toward near-term development.

Additional Information

Brad Rourke

Chief Executive Officer

+1 250 877 9902; brad@scottieresources.com

Scottie Resources Corp.

FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking statements" within the meaning of Canadian securities legislation. These include, without limitation, statements with respect to: the economics and project parameters presented in the PEA, including IRR, AISC, NPV, and other costs and economic information; possible events, conditions or financial performance that is based on assumptions about future economic conditions and courses of action; the strategic plans, timing, costs and expectations for the Company's future development and exploration activities on the Scottie Gold Mine Property, including metallurgical test, mineralization and resource estimates and grades for drill intercepts, permitting for various work, and optimizing and updating the Company's resource model and preparing a feasibility study; information with respect to high grade areas and size of veins projected from underground sampling results and drilling results; and the accessibility of future mining at the Scottie Gold Mine Property. Such forward-looking statements or information are based on a number of assumptions, which may prove to be incorrect. Assumptions have been made regarding, among other things: the reliability of mineralization estimates, the conditions in general economic and financial markets; availability and costs of mining equipment and skilled labour; accuracy of the interpretations and assumptions used in calculating resource estimates; operations not being disrupted or delayed by unusual geological or technical problems; ability to develop and finance the Scottie Gold Mine Project; and effects of regulation by governmental agencies. References to improvements in grade or reduction in dilution from ore sorting are based on preliminary test work and/or production observations and are not necessarily indicative of realized economic value. While ore sorting may increase the grade of material shipped for processing, there is no certainty that such sorting will result in improved recoveries, lower costs, or enhanced project economics. Additional metallurgical testing, reconciliation, and economic studies are required to determine whether ore sorting will deliver positive value on a commercial scale. Accordingly, investors are cautioned not to assume that increases in grade from sorted material are indicative of economically viable mineralization or future profitability. The actual results could differ materially from those anticipated in these forward-looking statements as a result of risk factors including: fluctuations in precious metals prices, price of consumed commodities and currency markets; uncertainty as to actual capital costs, operating costs, production and economic returns, and uncertainty that development activities will result in profitable mining operations; risks related to mineral resource figures being estimates based on interpretations and assumptions which may result in less mineral production under actual conditions than is currently estimated; the interpretation of drilling results and other geological data; receipt, maintenance and security of permits and mineral property titles; environmental and other regulatory risks; project cost overruns or unanticipated costs and expenses; and general market and industry conditions. Forward-looking statements are based on the expectations and opinions of the Company's management on the date the statements are made. The assumptions used in the preparation of such statements, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statements were made. The Company undertakes no obligation to update or revise any forward-looking statements included in this news release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276388