Omdia Forecasts Cellular IoT Connections to Reach 5.9 Billion by 2035

Key Terms

cellular iot technical

5g redcap technical

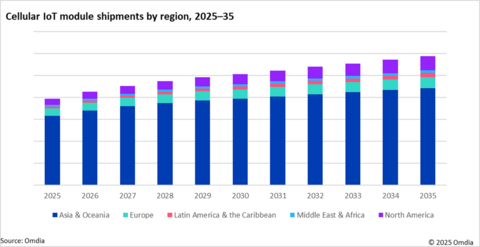

Cellular IoT module shipments by region, 2025-35

This in-depth study highlights the transformative impact of 5G technologies on the cellular IoT landscape, identifying three pivotal technologies as primary growth drivers: 5G RedCap, 5G Massive IoT, and 4G LTE Cat-1bis modules.

5G eRedCap: Launch momentum to build in 2026

The research highlights 5G RedCap as a transformative development, with adoption projected to gain momentum starting in 2025. Positioned as the optimal mid-tier connectivity solution, RedCap caters to 5G devices that do not require the advanced specifications of Ultra-Reliable Low Latency Communications (uRLLC) or Enhanced Mobile Broadband (eMBB). Additionally, RedCap offers critical futureproofing benefits as the industry transitions toward phasing out 4G networks beyond 2030.

The study notes that while initial deployment of RedCap has been slower than expected, 2025 has showed some promise with the launch of the latest Apple Watch range that incorporates RedCap technology. Complementing this growth, eRedCap module launches are expected to begin in 2026, further expanding mid-tier connectivity options and driving adoption across a broader range of use cases.

"The implementation of 5G RedCap in the latest range of Apple Watches has signalled the starting gun for RedCap adoption," explains Alexander Thompson, Senior Analyst for IoT at Omdia. "Going forward, enterprises will have a wider and wider selection of connectivity technologies to benefit any application. The expected launch of 5G eRedCap modules in 2026 will provide further cellular IoT connection growth over the next decade.”

Automotive will comprise one in five cellular IoT connections in 2035

The automotive segment will rise from 500m connections to around 1.2bn over the next ten years, increasing its market share from

“The rapid rise of software-defined vehicles, the fundamental need for over-the-air updates, regulatory mandates and vehicle-to-everything, are all made possible by cellular connected vehicles, which is why we expect to see vehicles represent 1 in 5 cellular connections by 2025,” added Andrew Brown, IoT Practice Lead at Omdia.

Omdia's Cellular IoT Market Tracker 2021-2035 highlights the latest trends in the cellular IoT market, providing key analysis by region, air interface and application of module shipments, module revenues, connections (installed base) and connectivity revenues.

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets grounded in real conversations with industry leaders and hundreds of thousands of data points, make our market intelligence our clients’ strategic advantage. From R&D to ROI, we identify the greatest opportunities and move the industry forward.

View source version on businesswire.com: https://www.businesswire.com/news/home/20251208399944/en/

Fasiha Khan – Fasiha.khan@omdia.com

Source: Omdia