Omdia: Global Tablet Shipments Grew 10% in 2025 as Market Nears Slowdown

Key Terms

cross-OS functionality technical

AI-driven experiences technical

generative AI ecosystem technical

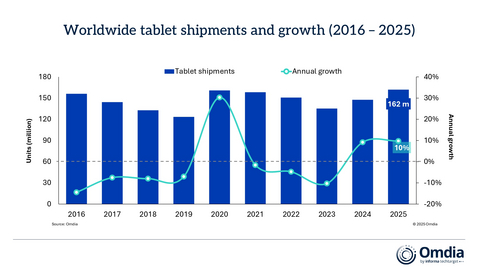

Worldwide tablet shipments and growth (2016 – 2025)

Central &

“In 2025, the tablet market delivered its highest annual shipment volume since the pandemic-driven demand boom of 2020,” said Himani Mukka, Research Manager at Omdia. “Seasonal holiday demand, combined with vendor pre-build activity ahead of anticipated memory constraints, provided a meaningful uplift to shipments in the final quarter. However, tablet demand will come under increasing pressure in 2026.”

Mukka added, “Vendors will need to carefully balance competitiveness with profitability as further disruption in the memory market threatens supply availability and drives up prices. Growth opportunities will be more selective, concentrated around premium and flagship model replacement cycles in developed markets alongside public-sector supported education demand in emerging markets.

On the product side, we expect a shift in how tablets are positioned and marketed, with vendors framing them as ecosystem-centric devices in a more controlled demand environment. This includes the introduction of cross-OS functionality and a focus on AI-driven experiences. Recent examples include Lenovo’s Qira, which operates across Windows and Android to deliver a more seamless user experience and reduce friction between AI assistants. In addition, the collaboration between Apple and Google to use Gemini for future Apple Intelligence features represents a positive step forward for the generative AI ecosystem across its device portfolio, including iPads.”

Worldwide tablet shipments (market share and annual growth) Omdia PC Market Pulse: Q4 2025 |

|||||

Vendor |

Q4 2025

|

Q4 2025

|

Q4 2024

|

Q4 2024

|

Annual

|

Apple |

19,630 |

|

16,852 |

|

|

Samsung |

6,444 |

|

7,096 |

|

- |

Lenovo |

3,865 |

|

2,837 |

|

|

Huawei |

3,029 |

|

2,639 |

|

|

Xiaomi |

2,797 |

|

2,542 |

|

|

Others |

8,000 |

|

7,896 |

|

|

Total |

43,765 |

|

39,862 |

|

|

|

|

|

|

|

|

Note: Unit shipments in thousands. Percentages may not add up to Source: Omdia PC Horizon Service (sell-in shipments), January 2026 |

|

||||

The global tablet market grew

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets grounded in real conversations with industry leaders and hundreds of thousands of data points, make our market intelligence our clients’ strategic advantage. From R&D to ROI, we identify the greatest opportunities and move the industry forward.

View source version on businesswire.com: https://www.businesswire.com/news/home/20260203774137/en/

Fasiha Khan: Fasiha.khan@omdia.com

Eric Thoo: eric.thoo@omdia.com

Source: Omdia