American Rebel Holdings, Inc. (NASDAQ: AREB) Receives Nasdaq Panel Determination Confirming Compliance with Minimum Stockholders’ Equity Requirement

American Rebel Holdings (NASDAQ: AREB) received a written determination from a Nasdaq Hearings Panel on November 21, 2025 confirming the company meets Nasdaq Listing Rule 5550(b)(1) after filing its Q3 2025 Form 10-Q showing $3,378,257 in stockholders’ equity, above the $2.5 million requirement. The notice preserves AREB’s continued listing on The Nasdaq Capital Market and starts a mandatory one-year Panel monitoring period under Listing Rule 5815(d)(4)(B).

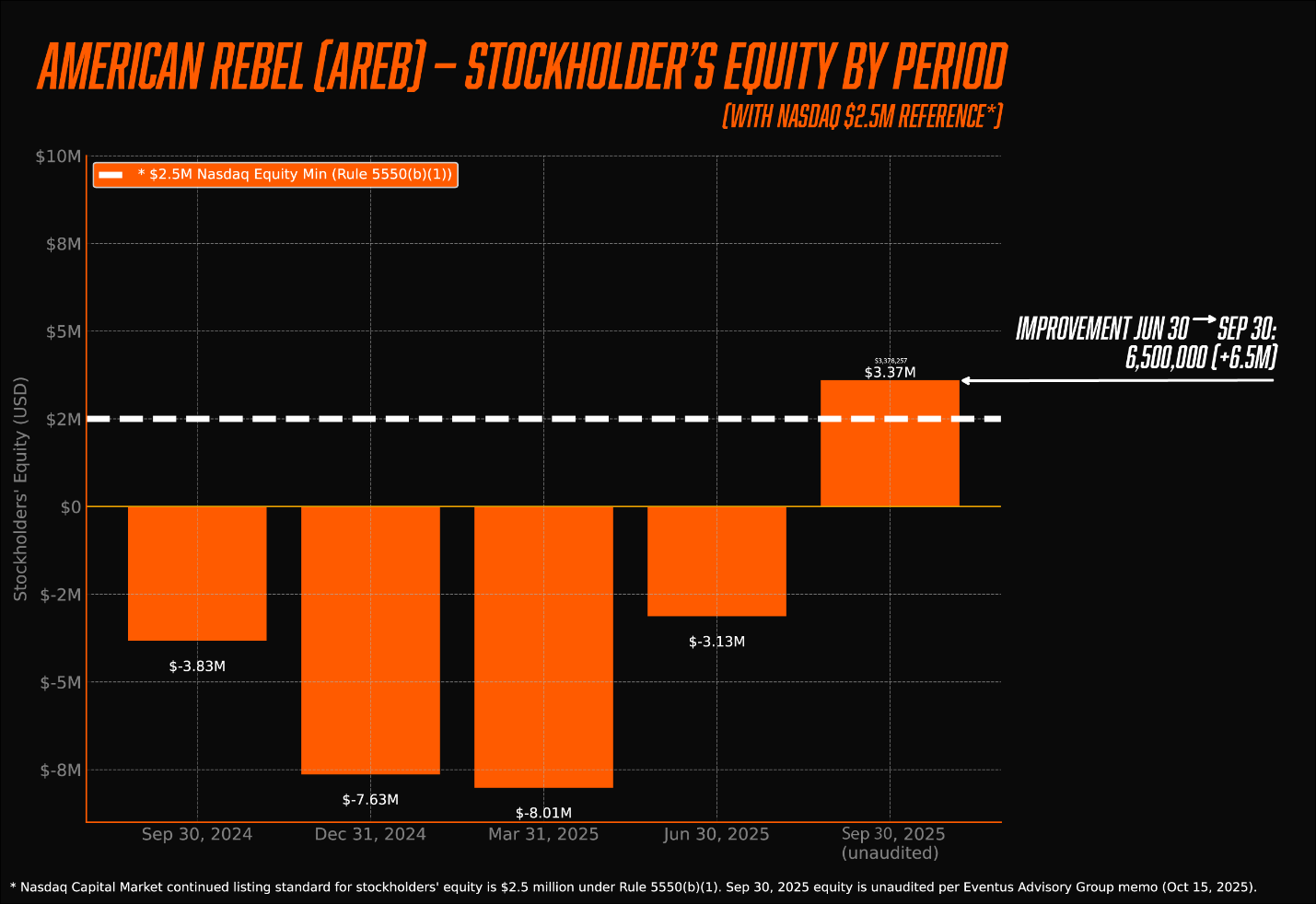

The filing documents a multi-quarter recovery from a stockholders’ deficit of approximately $8.0 million on March 31, 2025, to positive equity on September 30, 2025.

American Rebel Holdings (NASDAQ: AREB) ha ricevuto una determinazione scritta da un Nasdaq Hearings Panel il 21 novembre 2025 che conferma che la società soddisfa la Nasdaq Listing Rule 5550(b)(1) dopo la presentazione del Q3 2025 Form 10-Q che mostra $3,378,257 di patrimonio degli azionisti, superiore al requisito di 2,5 milioni. L'avviso preserva la continua quotazione di AREB sul Nasdaq Capital Market e avvia un periodo di monitoraggio dal Panel di un anno ai sensi della Listing Rule 5815(d)(4)(B).

La presentazione documenta una ripresa su più trimestri da un deficit degli azionisti di circa $8,0 milioni al 31 marzo 2025, a patrimonio positivo al 30 settembre 2025.

American Rebel Holdings (NASDAQ: AREB) recibió una determinación escrita de un Panel de Audiencias de Nasdaq el 21 de noviembre de 2025 que confirma que la empresa cumple con la Regla de Listado 5550(b)(1) de Nasdaq tras presentar su Form 10-Q del T3 2025 que muestra $3,378,257 en patrimonio de los accionistas, por encima del requisito de 2,5 millones. El aviso preserva la cotización continua de AREB en The Nasdaq Capital Market y inicia un periodo de monitoreo del Panel de un año bajo la Listing Rule 5815(d)(4)(B).

La presentación documenta una recuperación multicuatrimestral desde un déficit de accionistas de aproximadamente $8,0 millones al 31 de marzo de 2025, hasta un patrimonio positivo al 30 de septiembre de 2025.

American Rebel Holdings (NASDAQ: AREB)은 2025년 11월 21일에 나스닥 청문패널로부터 서면 판단을 받아 회사가 나스닥 상장 규칙 5550(b)(1)을 충족한다는 것을 확인받았으며, 2025년 3분기 Form 10-Q를 제출하여 $3,378,257의 주주자본을 나타내어 250만 달러 요건을 상회했습니다. 이 공지는 AREB의 The Nasdaq Capital Market 상장 유지를 보존하고 Listing Rule 5815(d)(4)(B)에 따라 1년 패널 모니터링 기간을 시작합니다.

제출 문서는 주주적자 약 $8.0 백만에서 2025년 3월 31일, 2025년 9월 30일에 양의 자본으로 회복된 다중 분기 회복을 기록합니다.

American Rebel Holdings (NASDAQ: AREB) a reçu une détermination écrite d'un Nasdaq Hearings Panel le 21 novembre 2025 confirmant que l'entreprise respecte la Nasdaq Listing Rule 5550(b)(1) après avoir déposé son Form 10-Q du T3 2025 montrant $3,378,257 d'equity des actionnaires, au-delà du requisitoire de 2,5 millions. L'avis préserve la cotation continue d'AREB sur The Nasdaq Capital Market et lance une période de surveillance du Panel d'un an en vertu de la Listing Rule 5815(d)(4)(B).

Le dépôt documente une reprise sur plusieurs trimestres d'un déficit des actionnaires d'approximativement $8,0 millions au 31 mars 2025, à un actif positif au 30 septembre 2025.

American Rebel Holdings (NASDAQ: AREB) erhielt von einem Nasdaq-Hörungsboard am 21. November 2025 eine schriftliche Feststellung, die bestätigt, dass das Unternehmen die Nasdaq Listing Rule 5550(b)(1) erfüllt, nachdem es seine Q3 2025 Form 10-Q eingereicht hat, die $3,378,257 Eigenkapital der Aktionäre ausweist, über der Anforderung von 2,5 Millionen. Die Mitteilung sichert AREB die Fortsetzung der Notierung am Nasdaq Capital Market und eröffnet eine einjährige Panel-Überwachungsperiode gemäß Listing Rule 5815(d)(4)(B).

Die Einreichung dokumentiert eine mehrquartalige Erholung von einem Aktionärsdefizit von ca. $8,0 Millionen zum 31. März 2025 auf positives Eigenkapital zum 30. September 2025.

American Rebel Holdings (NASDAQ: AREB) تلقّت تقريراً مكتوباً من لجنة الاستماع في ناسداك في 21 نوفمبر 2025 يؤكد أن الشركة تلتزم بقاعدة الإدراج 5550(b)(1) في ناسداك بعد تقديمها نموذج 10-Q للربع الثالث 2025 الذي يظهر $3,378,257 من حقوق المساهمين، وهو أعلى من شرط 2.5 مليون. الإشعار يحافظ على إدراج AREB المستمر في سوق ناسداك الرأسمال ويبدأ فترة مراقبة من قبل اللجنة لمدة سنة وفقاً لقاعدة الإدراج 5815(d)(4)(B).

تسجل وثائق التقديم تعافياً متعدد الأرباع من عجز المساهمين بنحو $8.0 مليون في 31 مارس 2025 إلى حقوق مالكية إيجابية في 30 سبتمبر 2025.

- Stockholders’ equity of $3,378,257 as of Sept 30, 2025

- Equity improved ~$11.4M from Mar 31, 2025 to Sept 30, 2025

- Nasdaq compliance determination preserves continued listing

- Subject to a mandatory one-year Panel monitoring period starting Nov 21, 2025

- Immediate delisting possible if Equity Rule noncompliance recurs during monitoring

Insights

Nasdaq confirms American Rebel met the $2.5M equity rule; listing continues with a one-year monitoring period.

American Rebel moved from a stockholders’ deficit of approximately

The Company now enters a mandatory one-year Panel monitoring period under Listing Rule 5815(d)(4)(B); if equity again drops below the threshold during that year, Nasdaq staff must issue an immediate delisting determination without another cure period (the Company may still request a hearing). The improvement reflects an aggregate swing in reported equity of roughly

Watchable items over the next 12 months include quarterly filings that preserve positive equity and the Panel monitoring end date (one year from the Panel’s

Nasdaq Hearings Panel Confirms American Rebel Holdings, Inc. Has Met

NASHVILLE, Tenn., Nov. 24, 2025 (GLOBE NEWSWIRE) -- American Rebel Holdings, Inc. (“American Rebel” or the “Company”) (NASDAQ: AREB) today announced that it received written notice on November 21, 2025 from the Nasdaq Hearings Panel (the “Panel”) stating that the Company is in compliance with Nasdaq Listing Rule 5550(b)(1) (the “Equity Rule”), which requires stockholders’ equity of at least

The Panel’s compliance determination follows the Company’s filing of its Quarterly Report on Form 10-Q for the period ended September 30, 2025, on November 10, 2025, which reported stockholders’ equity of

Andy Ross – CEO of American Rebel Holdings, Inc. Commentary

“The compliance notice from the Nasdaq Hearings Panel on Friday, November 21, 2025, is an important milestone for American Rebel and for all of our stockholders,” said Andy Ross, Chief Executive Officer of American Rebel Holdings, Inc. “We believe a Nasdaq listing is a critical asset for our Company—it supports liquidity, helps broaden our investor base, and reinforces the level of transparency and governance we strive to deliver. We are fully committed to taking whatever corporate actions are necessary to remain in compliance with Nasdaq’s standards because we believe it is in the best interests of both our current and future stockholders as we continue to build the next great American company, American Rebel Holdings, Inc.”

“We are deeply appreciative of the professionalism and patience shown by Nasdaq and the Panel throughout this process, and we are equally grateful to our strategic partners, strategic investors and loyal stockholders who continued to support us while we executed our plan,” Ross continued. “With our stockholders’ equity restored and our Nasdaq continued listing confirmed, we are energized as we look ahead to 2026 and beyond, focused on disciplined execution and long-term value creation.”

Nasdaq Panel Determination Confirming Compliance for Continued Listing for AREB

In its November 21, 2025, letter, the Panel advised that, based on the Nasdaq Listing Qualifications Staff’s compliance worksheet, American Rebel has satisfied the exception previously granted under the Equity Rule. Under Nasdaq Listing Rule 5815(d)(4)(B), the Company will be subject to a mandatory one-year Panel monitoring period beginning on the date of the letter.

During this monitoring period, if the Company again falls out of compliance with the Equity Rule, Nasdaq staff will be required to issue an immediate delisting determination without offering an additional cure or plan-of-compliance period, although the Company would retain the right to request a new hearing before a Nasdaq hearings panel.

American Rebel Holdings, Inc. Significant Improvement in Stockholders’ Equity

The Panel’s decision caps a multi-quarter effort by American Rebel to resolve its stockholders’ equity deficiency following Nasdaq’s February 19, 2025 notification that the Company did not meet the Equity Rule as of September 30, 2024. Over the course of 2025, American Rebel executed a series of strategic and corporate initiatives designed to strengthen its balance sheet and restore positive equity, which were reflected in its quarterly filings:

- As disclosed in its Q1 2025 Form 10-Q, the Company reported a stockholders’ deficit of approximately

$(8.0) million as of March 31, 2025. - By June 30, 2025, the deficit had narrowed to approximately

$(3.1) million , as disclosed in its Q2 2025 Form 10-Q. - As reported in the Q3 2025 Form 10-Q, stockholders’ equity improved to a positive

$3,378,257 as of September 30, 2025—an improvement of roughly$11.4 million from March 31, 2025, and approximately$6.5 million from June 30, 2025.

This progression from a material deficit to positive equity above the Nasdaq standard is also illustrated in the Company’s stockholder equity chart comparing the periods ended September 30, 2024, December 31, 2024, March 31, 2025, June 30, 2025, and September 30, 2025, demonstrating consistent quarter-over-quarter improvement through September 30, 2025.

About American Rebel Holdings, Inc. (NASDAQ: AREB)

American Rebel is a patriotic lifestyle brand that began as a designer and marketer of branded safes and personal security products. Over time, the Company has expanded into additional consumer categories—including American Rebel Light Beer, apparel and accessories—seeking to serve customers who identify with the American Rebel brand and its values. With the launch and ongoing rollout of American Rebel Light Beer in 2024, the Company is pursuing growth across the United States alongside experienced distribution partners in the premium light lager segment.

Watch the American Rebel Story as told by our CEO Andy Ross: The American Rebel Story.

Additional information, including the Company’s filings with the Securities and Exchange Commission, can be found on the investor relations section of American Rebel’s website.

Media:

Monica Brennan

Monica@NewtoTheStreet.com

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or the Company’s future financial or operating performance and can be identified by words such as “believe,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “estimate,” “may,” “could,” and similar expressions, or their negatives. These statements include, among others, statements regarding the Company’s expectations about its continued compliance with Nasdaq’s listing standards (including the Equity Rule and the one-year Panel monitoring period), its ability to maintain or enhance stockholders’ equity, its plans and strategies to create long-term stockholder value, and its growth and operating outlook for 2026 and beyond.

Forward-looking statements are based on current assumptions and involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. These risks and uncertainties include, but are not limited to, Nasdaq’s ongoing monitoring of the Company’s compliance with applicable listing requirements; the Company’s ability to execute operational, financial and strategic initiatives; market acceptance and performance of the Company’s products and brands; the performance and reliability of distribution partners and supply chains; competitive dynamics; general economic and industry conditions; the Company’s ability to obtain additional capital on acceptable terms, if needed; dilution arising from any financing or corporate actions; integration and performance of any acquisitions, partnerships or new product launches; regulatory and legal developments; and other factors described in the Company’s filings with the Securities and Exchange Commission.

Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of this release. American Rebel undertakes no obligation to update or revise any forward-looking statements to reflect subsequent events or circumstances, except as required by law.

Investor Contact

American Rebel Holdings, Inc.

Email: IR@americanrebel.com