Lode Gold Adds 5,000 Historical Channel Samples to Upgrade Mineral Resource Estimate at Fremont Gold Mine, California

Rhea-AI Summary

Lode Gold (OTCQB: LODFF) recovered more than 5,000 historical underground samples, increasing its validated sample database from 3,212 to 8,593 for the Fremont gold mine in Mariposa County, California.

The company recovered 5,728 underground samples and 665 daily assay reports (1936–1941), completed a new 3D stope model, and reports 42,717.3 m drilled, 23 km of underground workings and prior mining at 10.7 g/t Au. Lode Gold is validating and re‑testing legacy data that may support upgrading the 2025 MRE toward more Measured and Indicated classification.

Positive

- Validated sample database increased from 3,212 to 8,593

- 5,728 recovered underground samples available for re‑testing

- Recovered 665 historical daily assay reports (1936–1941)

- Completed new 3D model with actual stope locations for accuracy

- Multiple (2–6) independent datasets per zone to cross‑check grades

Negative

- Legacy samples are pending validation and re‑testing, results not yet confirmed

News Market Reaction

On the day this news was published, LODFF declined 3.73%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Key Figures

Market Reality Check

Peers on Argus

LODFF gained 3.31% while peers were mixed: CSRNF -25.74%, JORFF +2.35%, PRRSF -4.6%, GIGGF +5%, TMASF +1.2%, suggesting a stock-specific move rather than a sector-wide trend.

Historical Context

| Date | Event | Sentiment | Move | Catalyst |

|---|---|---|---|---|

| Dec 09 | LOI & funding plans | Positive | +3.3% | Exclusive LOI to advance Fremont and repay project-secured debt. |

| Dec 03 | Year-end project review | Positive | -3.7% | Outlined 2025 MRE, strong PEA economics and 2026–2028 development plans. |

| Nov 26 | Resource data expansion | Positive | -3.7% | Recovered 5,000+ historical samples to support MRE classification upgrades. |

| Oct 15 | Leadership & options | Neutral | -4.3% | Appointed Bill Fisher to technical role and granted stock options. |

| Oct 07 | Exploration results | Positive | -3.5% | Reported New Brunswick sampling and corporate financing steps at Gold Orogen. |

Recent news has often been operationally positive, yet price reactions have more frequently been negative, with only the LOI announcement showing a clearly aligned positive move.

Over the last few months, Lode Gold has focused on advancing the Fremont project. On Nov 26, it reported recovery of legacy samples and a larger database. A Dec 3 update detailed the 2025 MRE and strong PEA metrics, followed by a Dec 9 LOI aimed at advancing Fremont and repaying debt. Earlier, governance and exploration updates in October 2025 highlighted technical leadership and Gold Orogen exploration, but often saw weak share-price responses.

Market Pulse Summary

This announcement focuses on strengthening Fremont’s geological database by increasing validated samples to 8,593 and recovering 665 historical assay reports. The new 3D stope model and overlapping datasets may support upgrading parts of the 2025 MRE toward higher-confidence categories. In context of prior Fremont updates and development plans, key items to watch include future resource revisions, study milestones, and how these technical improvements influence project economics and development decisions.

Key Terms

mineral resource estimate technical

mre technical

measured and indicated resources technical

inferred resources technical

3d model technical

adits technical

underground workings technical

AI-generated analysis. Not financial advice.

Vancouver, British Columbia--(Newsfile Corp. - November 26, 2025) - Lode Gold Resources Inc (TSXV: LOD) (OTCQB: LODFF) (the "Company" or "Lode Gold") is pleased to announce that it has successfully recovered more than 5,000 historical underground samples from legacy geological maps and sections at its past-producing Fremont Gold mine in Mariposa County, California. It has initiated and is completing analysis on the additional data.

This significant milestone increases the Company's validated sample database from 3,212 to 8,593 records, substantially enhancing the geological understanding and exploration potential of the project.

This is a brownfield project with over 43,000 m drilled, 23 km of underground workings and 20 adits. The project has excellent infrastructure and is close to electricity, water, roads, railhead and port. Fremont was previously mined at 10.7 g/t Au. During gold mining prohibition in WWII, its mining license was suspended. Only

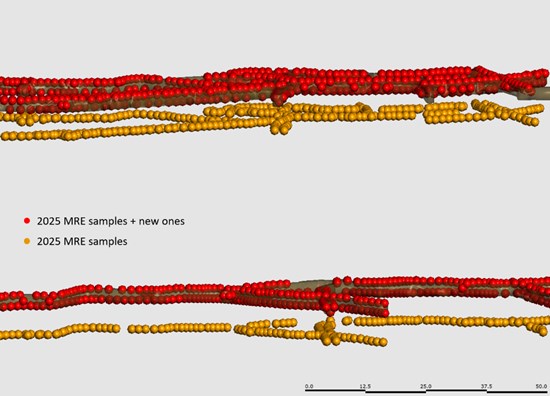

These 5,728 recovered underground samples (Figure 1) include transversal and longitudinal channel cuts, short drill holes (5 to 6 ft) from the wall rock, ribs channels in the wall rock and cars (diluted bulk sampling of every 5' blast in the drifts). These samples were taken from legacy level maps and consist of material collected from historical shafts and stopes, as well as channel and section samples completed in 1986 by the mine's owner at the time. Lode Gold is in process of validating and re-testing these samples.

A total of 665 daily assay reports from 1936 to 1941, covering both production and exploration, were recovered. These records can be utilized to trace historical samples and to more accurately quantify the grades of the exploited stopes.

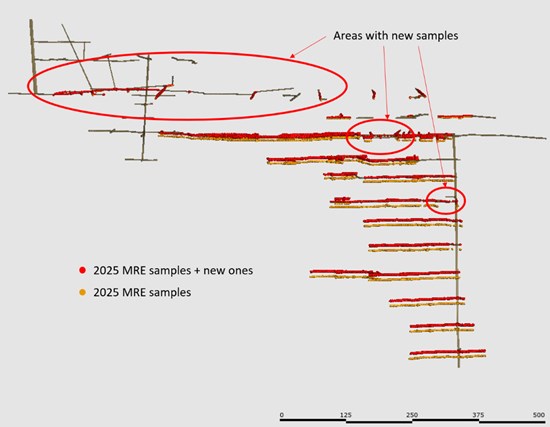

The newly recovered legacy samples include some areas where no prior data existed, though most overlap with samples that had already been collected (Figure 2). Lode Gold now has between two to six independent datasets for the same zones, allowing the Company to cross-check and compare underground data to confirm internal consistency in the analysis, and to validate these samples further with both previous reverse circulation and diamond drill holes.

That validation could allow Lode Gold to update the MRE with a higher proportion of Measured and Indicated Resources ratio over Inferred Resources.

A new 3D model has been completed with the actual location and size of the stopes for improved accuracy, whereas originally, mined out areas were idealized in a planar fashion, Stopes have been adjusted to the drifts shape and location using: level plant sections, cross sections and longitudinal sections and the intercepts from the drill-holes that were logged as voids or as barren fillings.

Jonathan Hill, Technical Chair of Lode Gold states, "Lode Gold has worked on achieving a better understanding of the historical data recovered for the Fremont gold mine and is now better positioned to upgrade the current Mineral Resource Estimation with increased certainty. (link)."

Figure 1 Detail of the project with old samples (orange) displaced as reference to show the new samples (red) added to the database.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4064/276018_04ff9676f403ea18_001full.jpg

Figure 2 Location of the areas with new samples

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4064/276018_04ff9676f403ea18_004full.jpg

Fremont Gold Mine (Fremont)

Fremont is an advanced exploration and early development brownfield project that was previously mined at 10.7 g/t Au. Gold production halted in 1942 during WW II when gold mining was prohibited.

It has been a mine since 1849 as one of the first project that started the California Gold Rush (1848 – 1855), and there has never been a change of use.

Fremont has 7 deposits on a 4km strike on the prolific 190 km Mother Lode Belt – only 2 of the 7 has seen exploitation. Of the MRE 2025, only

About Lode Gold

Lode Gold is an exploration and development company with projects in highly prospective and safe mining jurisdictions in Canada and the United States.

In Canada, Lode Gold holds exploration properties in the Yukon and New Brunswick. Lode Gold's Yukon assets are located on the southern portion of the prolific Tombstone Belt and cover approximately 99.5 km2 across a 27 km strike. Over 4,500 m have been drilled on the Yukon properties with confirmed gold endowment and economic drill intercepts over 50 metres. Four reduced-intrusive targets (RIRGS) and sedimentary-hosted orogenic gold mineralization have been identified on the Yukon properties.

In New Brunswick, Lode Gold, through its subsidiary 1475039 B.C. Ltd., has created one of the largest land packages in the province with its Acadian Gold joint venture Acadian Gold's holdings span 445 km2 with 44 km of identified strike. It has confirmed gold endowment with mineralized rhyolites.

In the United States, the Company is focused on its advanced exploration and development asset, the Fremont Mine in Mariposa, California. It has a recent 2025 NI 43-101 report and mineral resource estimate ("MRE") that can be accessed here https://lode-gold.com/project/fremont-gold-usa/.

The Fremont Mine operated until a gold mining prohibition was enacted during WWII, when its mining license was suspended. This asset has exploration upside and is open at depth (three step-out holes at 1,300 metres hit structure and were mineralized) and on strike. This is a brownfield project with over 43,000 metres drilled, 23 kilometres of underground workings and 20 adits. The project has excellent infrastructure with close access to electricity, water, state highways, railheads and port.

The Company recently completed an internal scoping study evaluating the potential to resume operations at Fremont based on

Qualified Person

The technical information contained in this press release was reviewed and approved by Gary Wong, P.Eng., Vice President Exploration of Lode Gold Resources Inc., designated as a Qualified Person under National Instrument 43-101.

ON BEHALF OF THE COMPANY

Wendy T. Chan

CEO & Director

+1 (604) -977-GOLD (4653)

Kevin Shum

Investor Relations

kevin@lode-gold.com

+1 (604) -977-GOLD (4653)

Cautionary Statement Regarding Forward-Looking Information

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release includes "forward-looking statements" and "forward-looking information" within the meaning of Canadian securities legislation. All statements included in this news release, other than statements of historical fact, are forward-looking statements including, without limitation, statements with respect to the use of proceeds, advancement and completion of resource calculation, feasibility studies, and exploration plans and targets. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as "anticipate", "believe", "plan", "estimate", "expect", "potential", "target", "budget" and "intend" and statements that an event or result "may", "will", "should", "could" or "might" occur or be achieved and other similar expressions and includes the negatives thereof.

Forward-looking statements are based on a number of assumptions and estimates that, while considered reasonable by management based on the business and markets in which the Company operates, are inherently subject to significant operational, economic, and competitive uncertainties, risks and contingencies. These include assumptions regarding, among other things: the status of community relations and the security situation on site; general business and economic conditions; the availability of additional exploration and mineral project financing; the supply and demand for, inventories of, and the level and volatility of the prices of metals; relationships with strategic partners; the timing and receipt of governmental permits and approvals; the timing and receipt of community and landowner approvals; changes in regulations; political factors; the accuracy of the Company's interpretation of drill results; the geology, grade and continuity of the Company's mineral deposits; the availability of equipment, skilled labour and services needed for the exploration and development of mineral properties; and currency fluctuations.

There can be no assurance that forward-looking statements will prove to be accurate and actual results, and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include a deterioration of security on site or actions by the local community that inhibits access and/or the ability to productively work on site, actual exploration results, interpretation of metallurgical characteristics of the mineralization, changes in project parameters as plans continue to be refined, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, delays or inability to receive required approvals, business disruptions, and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators, including those described under the heading "Risks and Uncertainties" in the Company's most recently filed MD&A. The Company does not undertake to update or revise any forward-looking statements, except in accordance with applicable law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/276018