Omdia: OWS Crosses 10-Million-Unit Milestone as TWS Market Pivots to Value Creation

Key Terms

ai technical

sell-in shipments technical

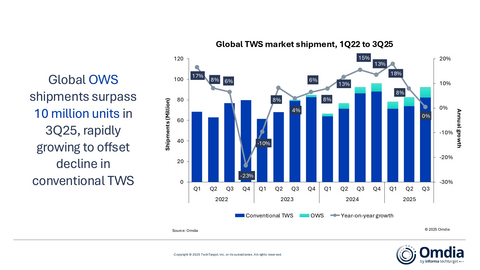

Global TWS market shipment, 1Q22 to 3Q25

"We're witnessing the democratization of ANC technology at sub-US

Apple remained the global revenue leader despite a

"OWS crossing the 10-million-unit quarterly shipment threshold represents more than a milestone - it validates OWS as a legitimate category that is reshaping how consumers think about hearable devices," noted Omdia Research Manager Cynthia Chen. “However, inherent sound quality limitations keep most OWS products concentrated in the

Leading vendors are actively pushing ASPs above

"Open form factor designs that do not enter the ear encounter sound quality limitations compared to conventional TWS, making long-term user retention dependent on delivering ongoing functional benefits beyond initial use," Chen explained. “As a dynamic category, OWS is positioned for rapid growth, particularly as the industry explores new avenues for enhanced features through strong integration with key user scenarios, such as during workouts or in office settings. Emphasizing long-term comfort and innovative AI-enabled features will be essential for sustaining momentum and meeting the evolving demands of consumers.”

The market's structural transformation extends beyond form factors to encompass regional dynamics and technological capabilities. Emerging markets continue to drive volume growth through aggressive pricing and feature democratization, while developed markets increasingly prioritize premium experiences and ecosystem integration. This bifurcation creates opportunities for vendors to pursue parallel strategies across different geographic segments and price tiers.

Omdia forecasts that OWS shipments will reach 40 million units in 2026, representing

Global TWS shipment and annual growth

|

|||||

Vendor |

3Q25

|

3Q25

|

3Q24

|

3Q24

|

Annual

|

Apple |

18.9 |

|

19.8 |

|

- |

Xiaomi |

8.6 |

|

6.9 |

|

+ |

Samsung |

7.0 |

|

8.3 |

|

- |

boat |

6.7 |

|

7.6 |

|

- |

Huawei |

5.0 |

|

3.7 |

|

+ |

Others |

46.4 |

|

46.0 |

|

+ |

Total |

92.6 |

|

92.3 |

|

+ |

|

|

|

|||

Note: Huawei excludes HONOR since 1Q21. OPPO includes OnePlus. vivo includes iQOO.

Percentages may not add up to Source: Omdia Smart Personal Audio Service (sell-in shipments), October 2025 |

|||||

Global OWS shipment and annual growth

|

|||||

Vendor |

3Q25

|

3Q25

|

3Q24

|

3Q24

|

Annual

|

Huawei |

0.9 |

|

0.4 |

|

+ |

Edifier |

0.8 |

|

0.2 |

|

+ |

Sanag |

0.7 |

|

0.6 |

|

+ |

Baseus |

0.7 |

|

0.1 |

|

+ |

Anker |

0.7 |

|

0.4 |

|

+ |

Others |

6.5 |

|

4.5 |

|

+ |

Total |

10.3 |

|

6.1 |

|

+ |

|

|

|

|||

Note: Huawei excludes HONOR since 1Q21. OPPO includes OnePlus. vivo includes iQOO.

Percentages may not add up to Source: Omdia Smart Personal Audio Service (sell-in shipments), October 2025 |

|||||

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets grounded in real conversations with industry leaders and hundreds of thousands of data points, make our market intelligence our clients’ strategic advantage. From R&D to ROI, we identify the greatest opportunities and move the industry forward.

View source version on businesswire.com: https://www.businesswire.com/news/home/20251209628026/en/

Fasiha Khan – fasiha.khan@omdia.com

Source: Omdia