Omdia: Global PC Shipments Grew 9% in 2025 but Memory and Storage Supply Issues Threaten 2026 Outlook

Key Terms

skus technical

sell-in shipments technical

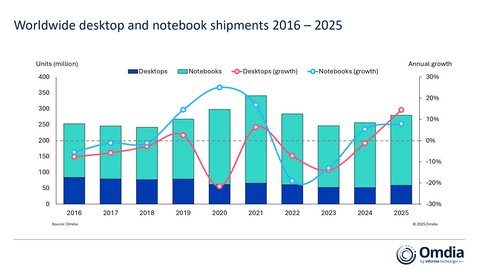

Worldwide desktop and notebook shipments 2016 – 2025

Although overall PC market performance in 2025 was healthy, memory and storage supply tightened, and the associated upward price pressure emerged from the middle of the year. In December 2025, PC vendors began signaling their expectations of price increases. Coupled with the inability to secure sufficient supply, this has already dampened forecasted shipment expectations for 2026. “Between Q1 to Q4 2025, mainstream PC memory and storage costs rose by

“In 2026, with device replacement demand not yet fully abated, supply-side pressures will be more pronounced and supply will not fully meet demand,” added Yeh. “Actual shipment performance will hinge on vendors’ memory and storage procurement and negotiating leverage; beyond scale, their track records and credibility with suppliers will be a decisive factor in determining their success in navigating this period of complexity.” A November 2025 Omdia poll of B2B channel partners that asked “How do you expect your PC business to perform in 2026 compared to 2025” revealed that

Worldwide desktop and notebook shipments (market share and annual growth) Omdia PC Market Pulse: Q4 2025 |

|||||

Vendor |

Q4 2025

|

Q4 2025

|

Q4 2024

|

Q4 2024

|

Annual

|

Lenovo |

19,313 |

|

16,880 |

|

|

HP |

15,387 |

|

13,724 |

|

|

Dell |

12,468 |

|

9,898 |

|

|

Apple |

7,023 |

|

6,893 |

|

|

Asus |

5,307 |

|

4,972 |

|

|

Others |

15,285 |

|

15,526 |

|

- |

Total |

74,783 |

|

67,893 |

|

|

|

|

|

|

|

|

Note: Unit shipments in thousands. Percentages may not add up to |

|||||

Source: Omdia PC Horizon Service (sell-in shipments), January 2026 |

|

||||

Worldwide desktop and notebook shipments (market share and annual growth) Omdia PC Market Pulse: 2025 |

|||||

Vendor |

2025

|

2025

|

2024

|

2024

|

Annual

|

Lenovo |

70,851 |

|

61,841 |

|

|

HP |

57,440 |

|

52,992 |

|

|

Dell |

41,894 |

|

39,096 |

|

|

Apple |

27,674 |

|

23,779 |

|

|

Asus |

20,067 |

|

18,329 |

|

|

Others |

61,526 |

|

59,910 |

|

|

Total |

279,452 |

|

255,947 |

|

|

|

|

|

|

|

|

Note: Unit shipments in thousands. Percentages may not add up to |

|||||

Source: Omdia PC Horizon Service (sell-in shipments), January 2026 |

|

||||

Lenovo led the PC market both sequentially and for the full year, delivering double-digit growth of

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets grounded in real conversations with industry leaders and hundreds of thousands of data points, make our market intelligence our clients’ strategic advantage. From R&D to ROI, we identify the greatest opportunities and move the industry forward.

View source version on businesswire.com: https://www.businesswire.com/news/home/20260111396892/en/

Fasiha Khan – fasiha.khan@omdia.com

Source: Omdia