Omdia: YouTube TV on Track to Become the Largest US Pay-TV Operator by 2027

Key Terms

SVOD technical

UGC technical

goodwill impairment financial

restricted stock units financial

convertible notes financial

revolving credit facility financial

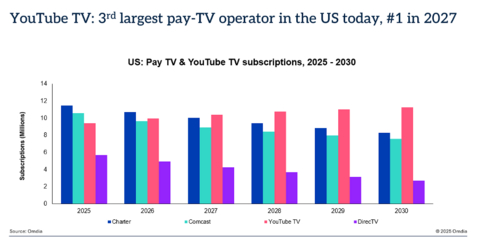

YouTube TV: 3rd largest pay-TV operator in the US today, #1 in 2027

Omdia’s latest analysis highlights the rapid growth trajectory of YouTube TV and its continued expansion into traditional pay-TV territory.

US Pay-TV Market Snapshot (End of 2025)

- Charter: 11.4 million subscribers

- Comcast: 10.6 million subscribers

- YouTube TV: 9.3 million subscribers

US Pay-TV Market Forecast (2027)

- YouTube TV: 10.4 million subscribers

- Charter: 10.0 million subscribers

- Comcast: 9.2 million subscribers

“For the first time in US television history, the largest pay-TV operator will be a virtual provider,” said Maria Rua Aguete, Head of Media and Entertainment at Omdia. “YouTube TV has evolved into a full pay-TV bundle, integrating linear channels, premium networks, and marquee sports properties such as NFL Sunday Ticket. This is not just another streaming service; it is the new face of US pay TV.”

YouTube’s Dual Strength: Global Video Giant and Rising Pay-TV Leader

Rua Aguete notes that YouTube’s influence extends far beyond its pay-TV platform. With nearly 3 billion global users, YouTube remains the largest video ecosystem in the world by a significant margin.

“Netflix may reach 300 million global subscribers, but alongside YouTube’s 3 billion users, it is not a dominant global player,” she said. “YouTube operates at a scale that no subscription service can match.”

This dual position, global video dominance plus rising pay-TV leadership, gives YouTube a unique strategic advantage in the media landscape.

US Streaming Market: Big, Fragmented, and Intensely Competitive

Omdia’s latest subscriber data highlights a highly fragmented US streaming market. Even as the largest single service, Netflix accounts for just

US Streaming Leaders in 2025 (Omdia forecast)

- Netflix: 88.7 million subscribers

- Amazon Prime Video: 64.7 million

- Disney+: 55.8 million

- Paramount+: 49.4 million

- HBO Max: 29.7 million

“The idea of Netflix as a dominant streaming service is a misconception,” Rua Aguete noted. “Audience attention and spend are spread across a wide array of platforms.”

Omdia’s research shows a clear shift toward hybrid services that blend linear TV, premium channels, live sports, UGC, and on-demand content. With YouTube TV on course to lead US pay-TV and YouTube already commanding the world’s biggest video audience, the company exemplifies where the industry is heading.

Rua Aguete also addressed consolidation pressures, noting strong interest in Warner assets.

“Paramount and Warner remain two of the most strategically valuable assets in Hollywood,” she said. “Interest from players such as Netflix or Paramount reflects the growing need for scale, premium IP, and global distribution.”

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

View source version on businesswire.com: https://www.businesswire.com/news/home/20251211953566/en/

Fasiha Khan: Fasiha.khan@omdia.com

Eric Thoo: eric.thoo@omdia.com

Source: Omdia